This past Tuesday, I wrote “A Sellable Rally” in which I laid out the 4-reasons for a rally based on the psychological, fundamental, technical, and seasonal underpinnings. That rally came to fruition over the last few days.

For us, it has been the technical backdrop which remains the most compelling. To wit:

“Unlike the February lows, the recent sell-off fell 4-standard deviations below the 50-dma which is a rare event historically speaking. Such deviations do not last long as such an extreme move away from the average price tend to be corrected in fairly short order.“

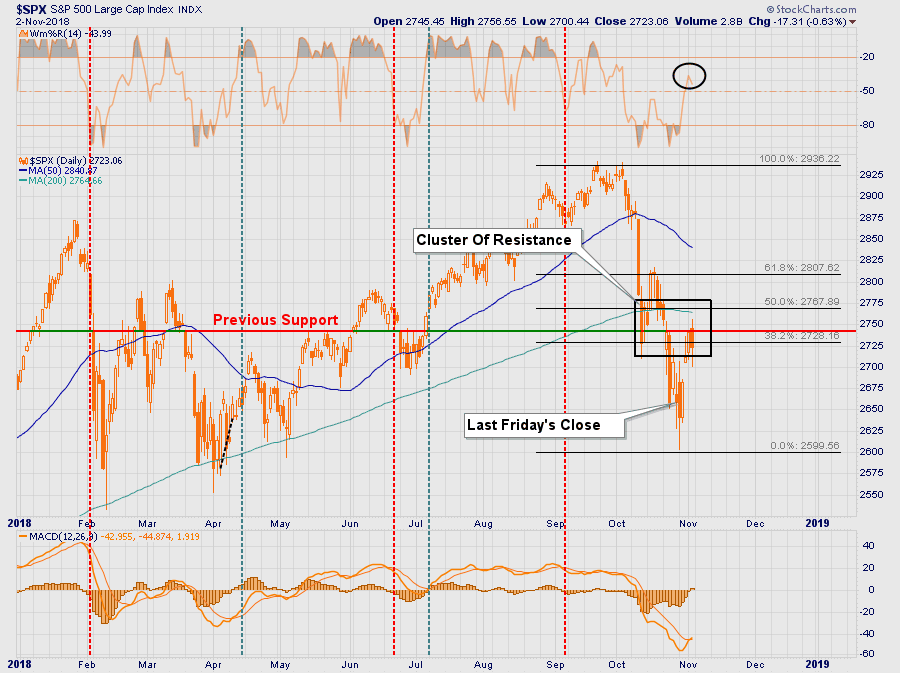

As shown, the combination of both the extreme oversold and deviated conditions contributed to a bounce which hit our “target neighborhood” of 2740-2750 on Friday morning.

In accordance with our portfolio management strategy, when the markets reached our target zone yesterday morning we executed sells of positions that have been under-performing both the market and other holdings within our portfolios. As we have stated many times previously, one of the primary tenants of portfolio management is to “sell losers.”

“Only losers, add to losers.” – Paul Tudor Jones

With portfolios reduced to 50% equity, we have a bit of breathing room to watch the elections next week. There is more than a decent chance the currently Republican controlled House of Representatives switches to Democratic control which would likely lead to further market volatility. However, Kevin Giddis from Raymond James laid out three likely scenarios last week.

“What could a potential change do for bonds and stocks? There are many possible scenarios, so the devil is in the details. I will lay out a couple of them for you:

1) The Republicans could lose the House, or the House and Senate. Either of these possibilities could derail the President’s agenda, leading us back to a period of gridlock that has plagued this country in the past. This would likely be good for bond prices and bad for equity prices.

2) The Republican majority remains intact, and the President pushes forward his plans of another tax cut, among other items as well. This would likely be good for stocks and bad for bond prices.

3) A complete rout that not only gives the majority of both the House and the Senate, it gives them the power and the votes to take on the President. If this happens, bonds could rally in price, the economy could lose its momentum, and the Fed would likely alter its monetary policy.

In the end, however this turns out, the markets are likely poised for some big changes come next Wednesday.”

He is right. More importantly, there are simply too many possible outcomes to head into the election without some extra cash on hand. That cash will either act as a hedge against a decline or will provide liquidity to add some discounted equity exposure where needed.

On a more bullish note, once we get past the election next week, we do start to deal with the “seasonal” bias that comes with the end of the year. As Stocktraders Almanac noted last week:

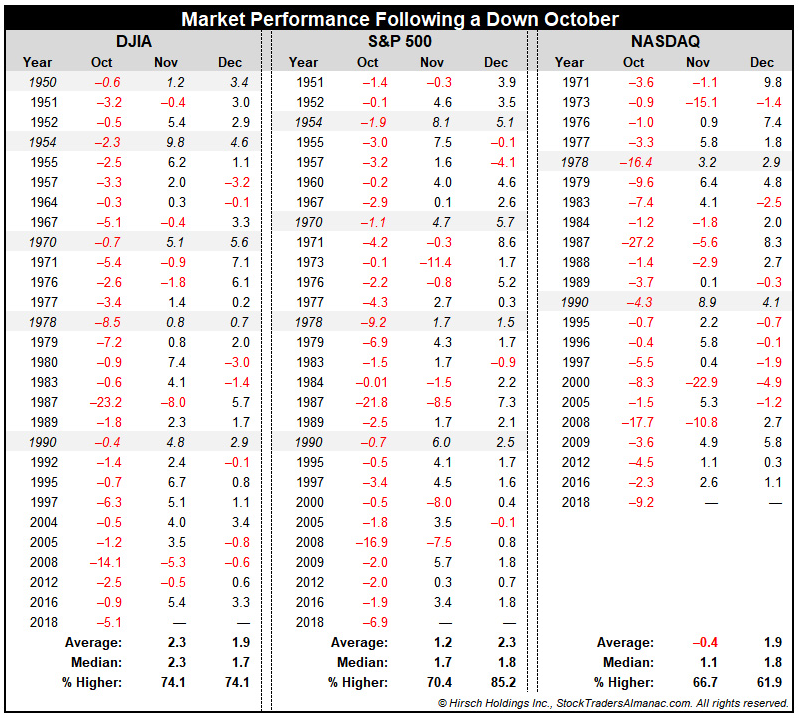

“This past midterm-year October that ended yesterday finished well below expectations and historical averages. DJIA declined 5.1%, S&P 500 dropped 6.9% and NASDAQ was off 9.2%. October’s losses were the seventh worst decline for DJIA since 1950, fourth worst for S&P 500 and fifth worst for NASDAQ since 1971. Historically, November and December market performance did hold up following a negative October.”

“The S&P 500 in November had a modestly weaker average performance following a down October, but December was notably stronger.”

Importantly, it should be noted that while the markets do tend to improve in November and December, following the 7% decline in October, an average gain of 3-3.5% does not get you back to even.

It is this seasonally positive bias that keeps us from a more restrictive equity allocation currently. However, it is our intention to use seasonal strength to reposition portfolios for a much weaker market environment going into 2019 as the bull market officially comes to its end.

Leave A Comment