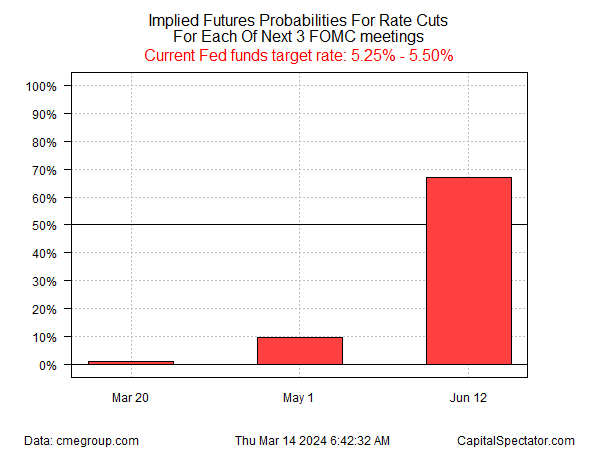

The mixed news on inflation earlier this week didn’t help, but neither did sticky inflation news derail expectations that the Federal Reserve will start cutting interest rates in June. Pixabay Yet uncertainty about the timing is creeping higher, as a confluence of factors muddy the outlook. Let’s start with Fed funds futures, which are currently pricing in a roughly 67% probability that the Fed will start to trim its current 5.25%-to-5.50% target rate at the June 12 FOMC meeting. That’s moderately lower vs. the 77% probability estimate from three weeks ago.

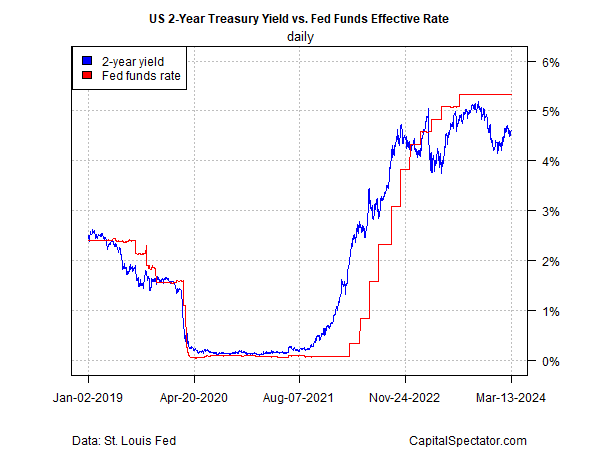

Pixabay Yet uncertainty about the timing is creeping higher, as a confluence of factors muddy the outlook. Let’s start with Fed funds futures, which are currently pricing in a roughly 67% probability that the Fed will start to trim its current 5.25%-to-5.50% target rate at the June 12 FOMC meeting. That’s moderately lower vs. the 77% probability estimate from three weeks ago. Meanwhile, the policy-sensitive 2-year Treasury yield continues to trade far below the Fed funds rate. That implies a strong expectation in the bond market that interest rates will be lower in the near term.

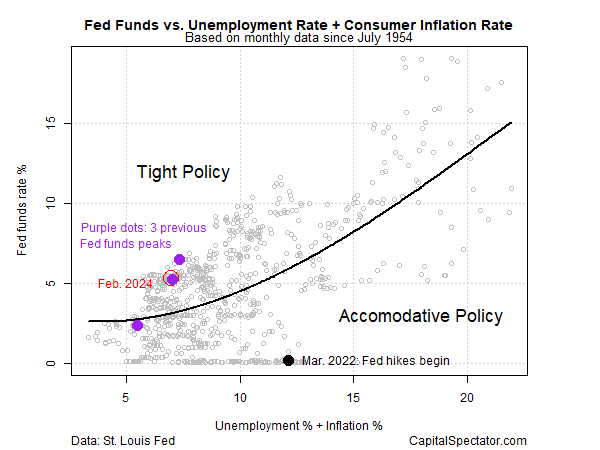

Meanwhile, the policy-sensitive 2-year Treasury yield continues to trade far below the Fed funds rate. That implies a strong expectation in the bond market that interest rates will be lower in the near term. There are also signs that current Fed policy is too tight relative to macro conditions. For example, a simple model that compares the Fed funds rate to unemployment and inflation suggests that there’s room to ease monetary policy.

There are also signs that current Fed policy is too tight relative to macro conditions. For example, a simple model that compares the Fed funds rate to unemployment and inflation suggests that there’s room to ease monetary policy. Several prominent economic voices have recently recommended patience for rate cuts. JP Morgan’s CEO Jamie Dimon, for example, this week advised: “If I were them, I would wait. You can always cut it quickly and dramatically. Their credibility is a little bit at stake here. I would even wait past June and let it all sort it out.”Sycamore Tree Capital Partners’ Mark Okada goes further and tells CNBC that “there’s a good chance they don’t cut at all this year.”Former Treasury Sec. Larry Summers recently opined that the neutral rate is higher than the Fed estimates, which suggests that the case for cutting interest rates is weak relative to current economic conditions. “The neutral interest rate is way above the 2.5% that the Fed likes to talk about,” he told Bloomberg last week. “When the Fed compares 5% with the 2.5% neutral rate it sees, and people say that monetary policy is substantially restrictive, that’s wrong. The neutral rate is much higher than that Neutral rates are closer to having a 4-handle than they are to having 2-handle.”But for those who adhere to the don’t-fight-the-Fed rule, the implied message is to listen to the central bankers. On that note, Fed Chairman Powell reaffirmed in testimony to Congress last week that rate cuts are nigh. “We believe that our policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly, as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”More By This Author:10-Year US Treasury Yield ‘Fair Value’ Estimate – Wednesday, March 13Small Cap And Value Stocks Lag In This Year’s RallyIs The US Labor Market As Strong As It Appears?

Several prominent economic voices have recently recommended patience for rate cuts. JP Morgan’s CEO Jamie Dimon, for example, this week advised: “If I were them, I would wait. You can always cut it quickly and dramatically. Their credibility is a little bit at stake here. I would even wait past June and let it all sort it out.”Sycamore Tree Capital Partners’ Mark Okada goes further and tells CNBC that “there’s a good chance they don’t cut at all this year.”Former Treasury Sec. Larry Summers recently opined that the neutral rate is higher than the Fed estimates, which suggests that the case for cutting interest rates is weak relative to current economic conditions. “The neutral interest rate is way above the 2.5% that the Fed likes to talk about,” he told Bloomberg last week. “When the Fed compares 5% with the 2.5% neutral rate it sees, and people say that monetary policy is substantially restrictive, that’s wrong. The neutral rate is much higher than that Neutral rates are closer to having a 4-handle than they are to having 2-handle.”But for those who adhere to the don’t-fight-the-Fed rule, the implied message is to listen to the central bankers. On that note, Fed Chairman Powell reaffirmed in testimony to Congress last week that rate cuts are nigh. “We believe that our policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly, as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”More By This Author:10-Year US Treasury Yield ‘Fair Value’ Estimate – Wednesday, March 13Small Cap And Value Stocks Lag In This Year’s RallyIs The US Labor Market As Strong As It Appears?

Leave A Comment