Investors eyeing the ongoing transformation of the telecom-media-technology (TMT) landscape are likely gearing up for Goldman Sachs’ annual Communacopia Conference later this week.

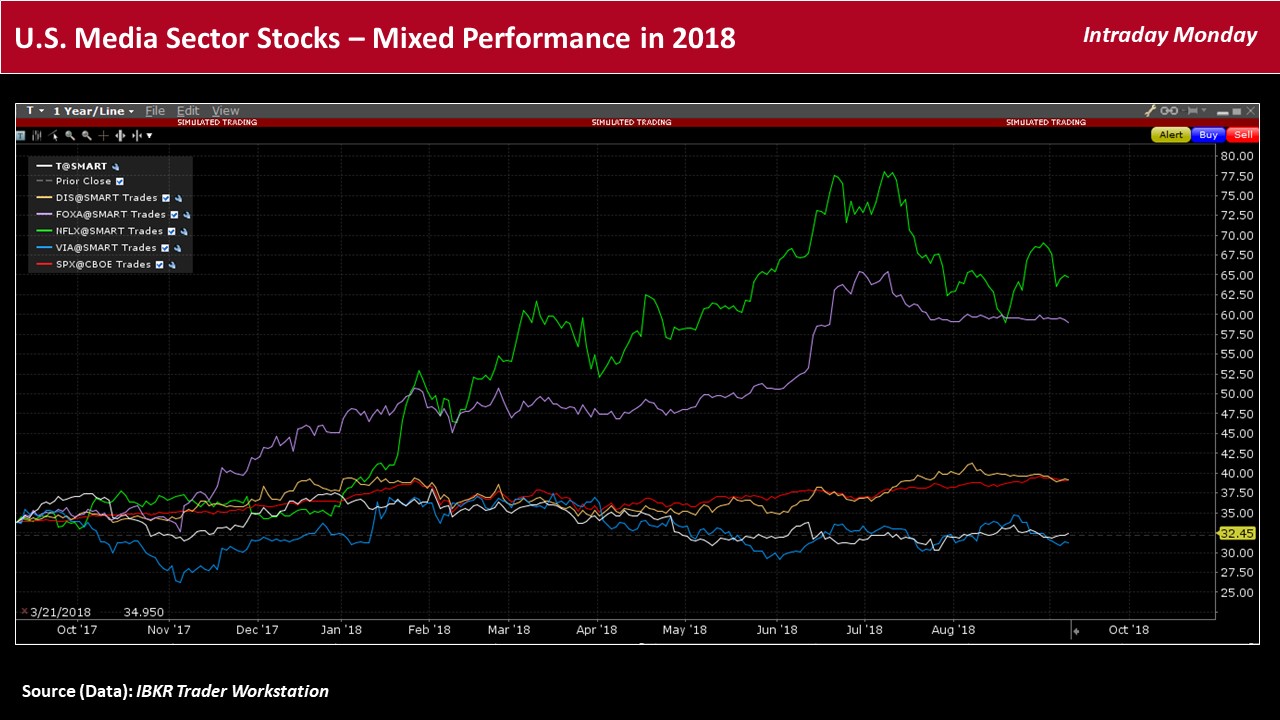

The TMT-focused event, which runs from September 12-14, falls against significant changes in the sector, including mega-mergers, such as AT&T’s (T) US$85.4bn purchase of Time Warner, as well as intensified competition between traditional media and streaming video services, including Netflix (NFLX) and Amazon Prime (AMZN).

Moreover, global trade concerns, notably between the U.S. and China, have spurred fears that further escalation may harm the Hollywood industry.

Uncertainties over whether China will decide to cease ongoing negotiations to increase the number of revenue-sharing foreign film imports as a retaliatory response against further U.S.-imposed tariffs, for example, has generally made Hollywood executives somewhat nervous.

Against this backdrop, while Viacom’s (VIA) Paramount Pictures’ domestic theatrical revenues grew 58% in the latest quarter, international theatrical revenues fell by an equal amount. Also, the studio’s filmed entertainment revenues declined by 9% in the quarter, driven mainly by a steep fall in international sales.

Gimme Credit analyst Dave Novosel recently noted that while Paramount’s film segment has produced positive operating income for the last two quarters, and may be profitable for the full year, the contribution will probably be quite meager to Viacom’s overall bottom line.

M&A burst as OTT threat intensifies

Meanwhile, consolidations across the TMT sector have ramped up recently, supported by intensified competition, the need for growth, as well as the still ultra-low cost of U.S. dollar-denominated debt financing.

T-TWX

Telco giant T, for example, priced a mammoth US$22.5bn bond in seven parts in late July 2017 to help fund its purchase of communications icon TWX.

Leave A Comment