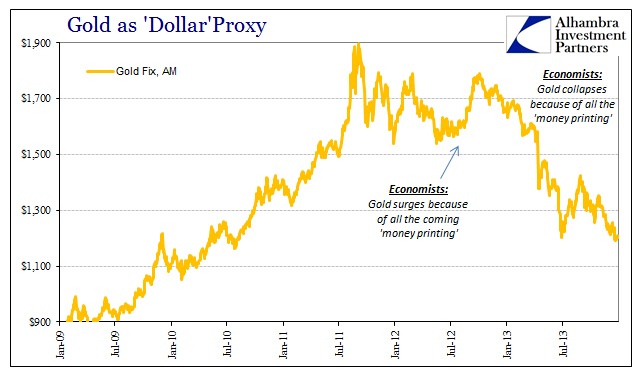

For many, it was just too good. In early 2013, gold prices were slammed – twice. Just after QE3 was announced, gold had moved back up to almost $1,800 per ounce as it “should” have, reflecting all that future “money printing.” Rather than keep going, however, gold started to drop and then drop some more so that by the time of the first slam gold was barely holding $1,600. After the second, the LBMA physical price was an incredible $1,200. In light of “money printing”, it didn’t make much sense.

To reconcile what “should” happen with what was actually taking place, economists rationalized this contradiction in gold as successful QE anyway. Rather than picking up coming inflation, they told themselves, gold investors were finally acknowledging that the Fed had been successful and that there was nothing left to fear – the recovery was finally at hand and even stubborn “gold bugs” were being forced to accept it.

I wrote last year that perhaps economists and their media should have been less giddy at the time given these basic contradictions. And they were giddy:

As a result, the falling price of gold is more important than simply being an opportunity for schadenfreude around the likes of Glenn Beck or John Paulson or Zero Hedge…

My hope is that the price of gold will continue to fall, that goldbugs will look increasingly silly, and that as a result Americans with savings will conclude that the best thing to do with those savings is to put them to work in a productive manner, rather than self-defeatingly trying to protect what they have.

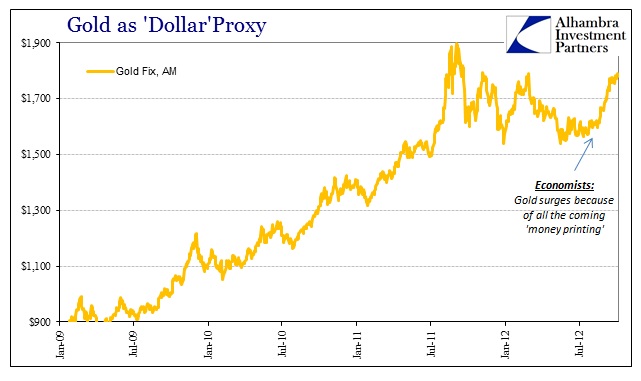

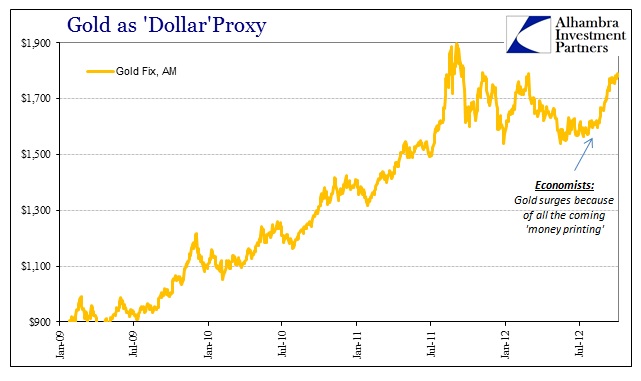

Gold prices rose to a high of $1,790 as of the AM fix on October 5, 2012, less than a week before the first MBS transactions of QE3 settled (meaning “money” actually “printed”). It was all downhill from there, both gold and what money really mattered – “dollars.”

The position of premature celebration in light of gold was one of pure emotion rather than evidence, and that weakness extended far beyond the realm of the one metal. Copper prices, for example, sold hard starting in February 2013 from a post-2011 rebound around $3.75 to as low as $3.08 by May 1 – before “taper.” Doctor Copper, as it is often called, was suggesting as gold “something” wrong with money; given the usage of copper and its relative importance in the confluence of finance with economy (especially China), the copper mini-crash should have been more prominent for those (few) economists who beyond emotion truly wanted to understand what was really going on in gold, commodities, and money.

Leave A Comment