Many consumer confidence surveys depend on how people feel about their own lives since it’s what they know best. If they are asked about the economy, their answer probably tells us about their job prospects more than anything. Confidence is really high before recessions because that’s when the labor market has the least slack, the most wage growth, and the least layoffs. Nothing brings confidence like little fear of being fired and the assurance that a worker can change jobs easily if he/she desires.

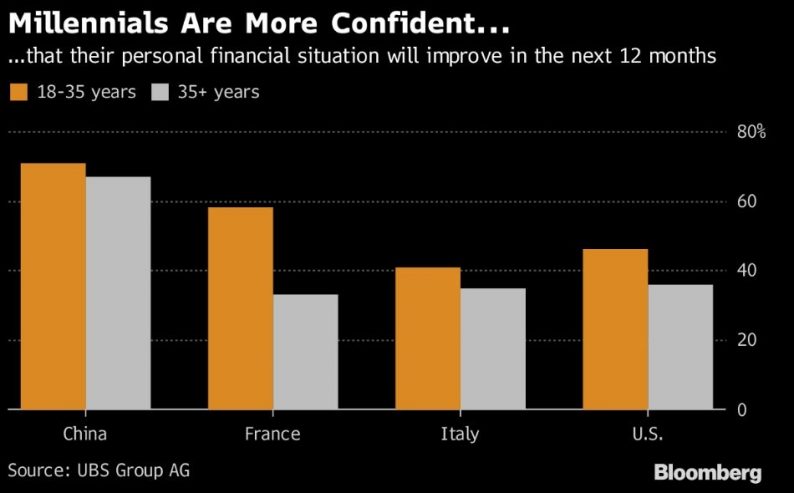

The chart below shows the percentage of respondents who think their financial situation will improve in the next 12 months.

Source: Bloomberg

This is a very similar question to asking how they are doing now because if someone isn’t doing well now because they don’t have a good job, they won’t be likely to expect good things in the future. Expectations aren’t leading indicators unless you look at the relationship with the current confidence.

This graph gives us an alternate vantage point as it breaks the results down by 4 countries and by 2 age groups. American, Italian, and French people above 35 all have about the same confidence rate; around 1/3rd think their financial situation will improve. Younger people will always expect financial improvement because as they gain education and experience, they will get paid more.

It’s disconcerting that less than half of young people in America think their finances will improve in the next year even though the economy is growing quickly and the quits rate is high, meaning people are confident in the labor market. Both young and old Chinese are optimistic because China is adding a great deal of people to the middle class. The long term question for China is how it transitions to a services economy. The next few quarters are critical because economic growth has been decelerating for the past few years.

Millennials Have A New (Worse) Balance Sheet

Leave A Comment