Mimecast (Nasdaq: MIME) is a SaaS/Cloud company focused on enterprise email security and archiving. The story is a little mixed up though. The company focuses on email but is positioned (at least by Gartner Group) as an information archiving company. There are also some misleading statements regarding market opportunity to take into consideration as well.

The vast majority (96%) of customers buy their email security add-on for Microsoft Exchange, Microsoft Office365 and Google Apps. Beyond that a good portion (2/3rds) add an “email continuity” service which keeps enterprise email running even when there are problems with the underlying email system (Exchange, Office365 or Google Apps).

Email security would probably be the best part of the “story” to go with but Mimecast is into backup and archiving as well. While this gives them some cross and up-sale opportunities with customers it broadens their exposure to focused competition and advances from the email platform providers Microsoft and Google.

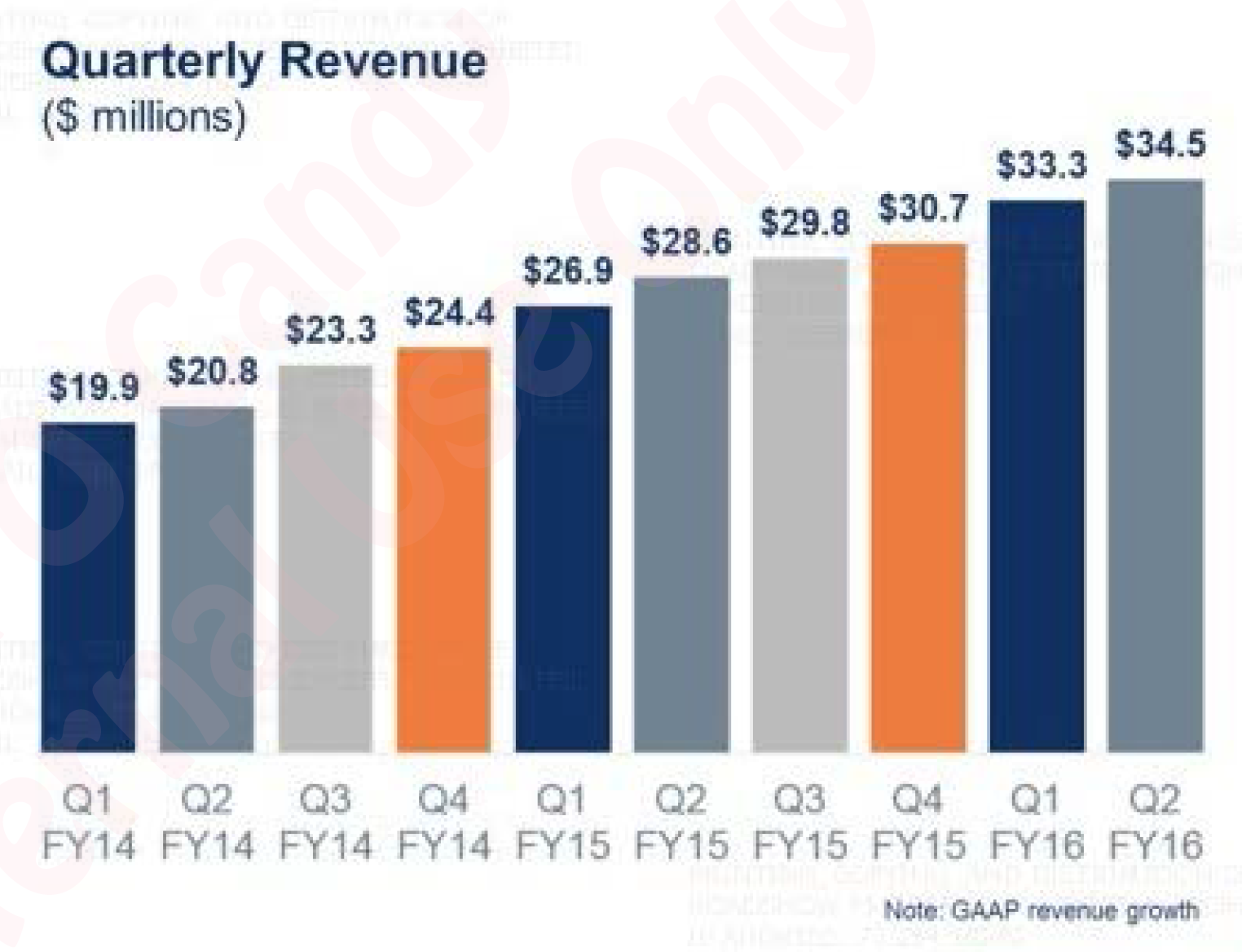

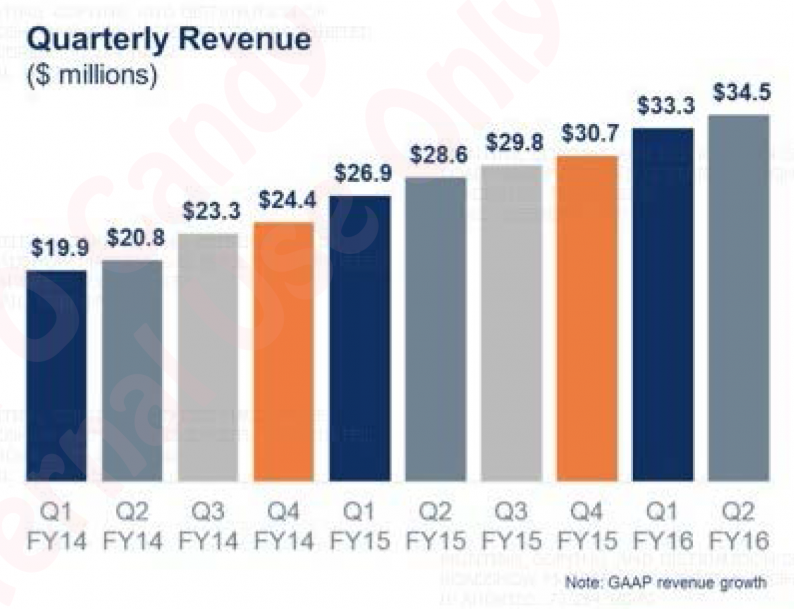

Looking at the vital stats Mimecast is doing well with $116M in FY15 (March) revenues growing just over 30%. Adjusted EBITDA margin is 15% and the company has a realistic target of 20-22%. Revenues are all SaaS/recurring so visibility is good and the quarterly growth has been very consistent.

At the $11 mid-point the market capitalization of MIME will be $600M or 4.5x sales which is reasonable for a company with their growth and profit margins

The “market opportunity” slide is a little misleading given the product set. As shown in the graph they include the entire backup and recovery market in the graph and it makes up the largest part of it. But Mimecast isn’t a backup and archiving company in the broad sense which would include other IT assets, operational data, etc.

In making some adjustments to reflect a more realistic market sizing we’d accept “secure email gateway” and “data loss prevention” and then take 10% of “E-discovery” and 10% of “back up and recovery software” to come up with a 2014 market size of $3B.Applying the same math to the 2017 forecast would get us to $3.5B.

Leave A Comment