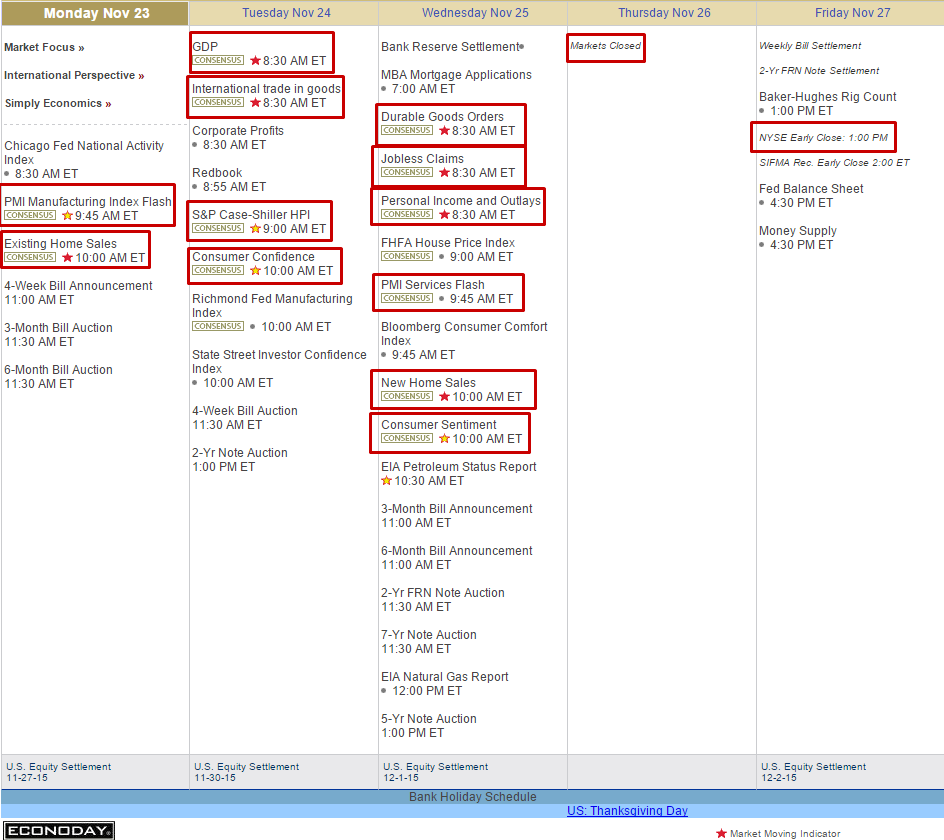

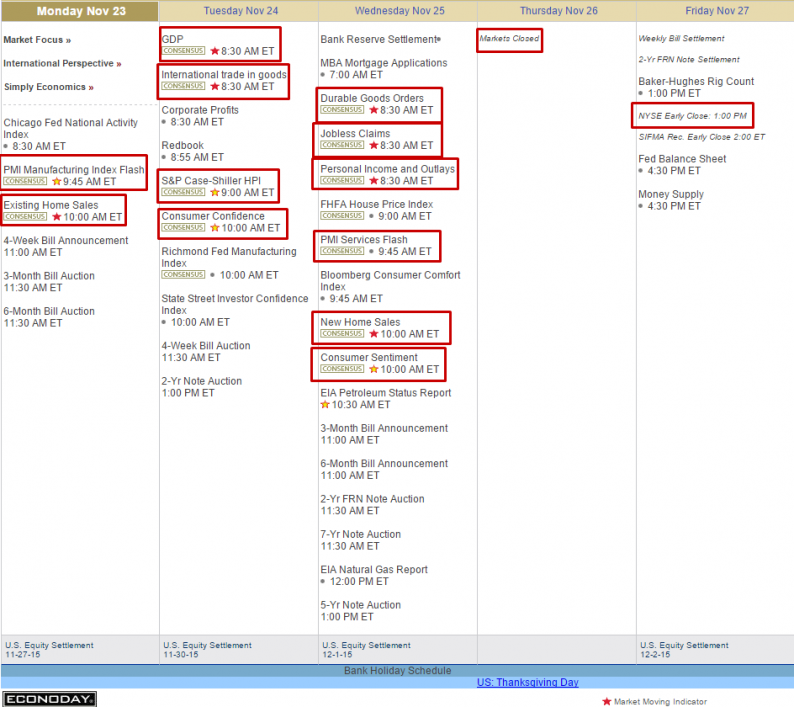

A Lot of data this week

We have, essentially, a 3-day week this week and don’t expect people to stick around on Wednesday either and Friday being a half-day is a joke as it’s dead as a doornail on Thanksgiving Fridays. Overall trading with be thin, which means all market action should be taken with a grain of salt and, unfortunately, we get revised GDP tomorrow morning – which is very important.

Our initial estimate of Q3 GDP was 1.5% and most Economorons think it will be revised up to 2% and why not – if GDP is so inexact that it can move up or down 33% in less than a month – what’s the difference what number they paint into a holiday weekend? It’s Personal Income and Outlays that really matter on Wednesday – as that’s a precursor to Christmas Shopping Season. Durable Goods (also Weds) were a disaster in September (-1.2%) so hard to be worse in October but run away if they are.

In faraway lands we’ll also get Eurozone PMI Reports, which are looking up so far but enjoy it while you can as tomorrow we get Germany’s GDP, which may make ours look good. The rest of the Eurozone reports their GDP Thursday and Friday – so that will be worth at least checking in for on Friday morning – especially if you are a Futures player looking for some fun!

Meanwhile, oil Futures look like this, so you’d have to be a maniac to play. We played on Friday,of course and our long plays on oil (/CL) and gasoline (/RB) each made over $1,000 per contract for our morning readers (you’re welcome). For those who could not play the Futures, we also had a long play on UGA options that popped 44% on the day (and will be cheap again this morning) so again, it’s not like we have to be heavily invested to make money every day – we can make a fortune with these quick in and out plays – over and over again.

Getting back to cash allows us to enjoy our Thanksgiving trips without worrying about what the market is doing while we’re on a plane. As noted in our October Portfolio Review, we pretty much just sat out all the madness in November as the S&P began the month over 2,100, dropped to 2,025 (3.5%) and is now back at 2,089, where we’re still more confident going short than going long at the moment:

Leave A Comment