by Gene D. Balas

What Worried Investors about China?

News on China’s economic slowdown – not to mention its plunging stock market – has rattled investors’ nerves worldwide. In data released January 4, China’s Caixin Manufacturing Purchasing Managers’ Index fell to 48.2 in December, from 48.6 in November, contracting for a tenth month in a row and coming in below a Reuters poll forecast for 49.0.

Levels below 50 indicate contraction. Details in the report showed both domestic and export demand for Chinese manufacturing goods was weak. Partly as a result of this latest news, Chinese shares plunged, touching off a sell-off in markets around the globe.

Signs of Manufacturing Contraction in the U.S.

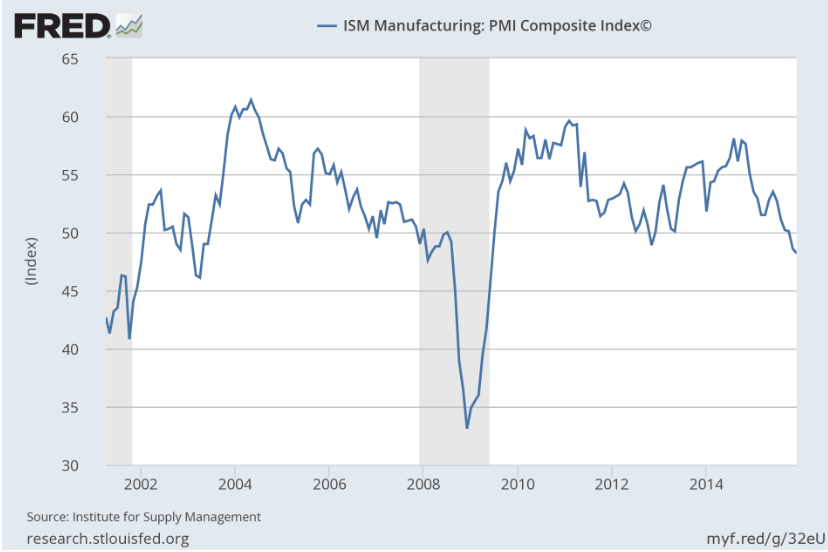

Rather than dissect the Chinese economy or the market’s reaction, we’ll instead direct our concern to why manufacturers are seeing fewer orders – and what it says about demand from economic health in the rest of the world, including the U.S. Indeed, the issue of falling manufacturing activity is not confined to China; we can see it here in the U.S. in the form of the Institute for Supply Management’s Manufacturing Purchasing Managers’ Index. The measure fell to 48.2 last month from 48.6 in November. A reading below 50 indicates the sector is contracting, and the ISM PMI is now at the lowest levels since 2009, when the country was in recession.

The Role of Inventories in Manufacturing Activity

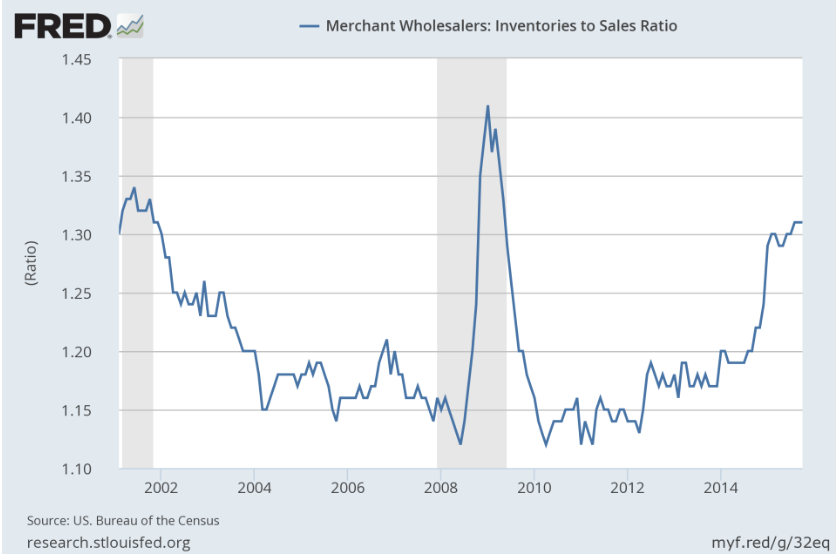

Is that reason to be alarmed? Well, perhaps not. There might be a likely explanation, and that relates to inventories. (Of course, the strong dollar denting exports while making imports more attractive plays a leading role as well.) Wholesalers in particular have increased their stockpiles of unsold goods. We can compare their inventories against their sales to see whether this inventory build could spell falling sales for their suppliers (i.e., manufacturers) at some point. And indeed, the inventory to sales ratio of wholesalers has risen quite a bit in the past year, as seen in the nearby graph, observing that wholesalers hold much more in inventories relative to sales than at any point since the Great Recession, and far more than at any other time besides the Great Recession, in the period since the Tech Wreck recession of the early 2000s.

Leave A Comment