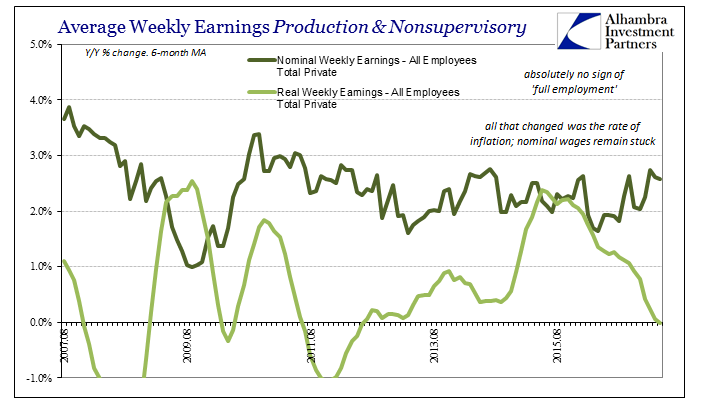

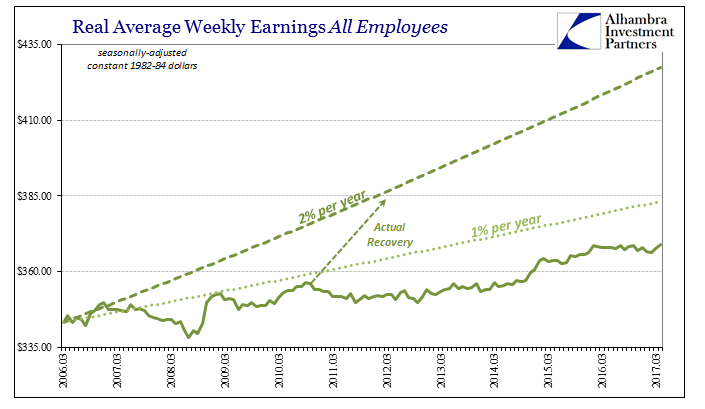

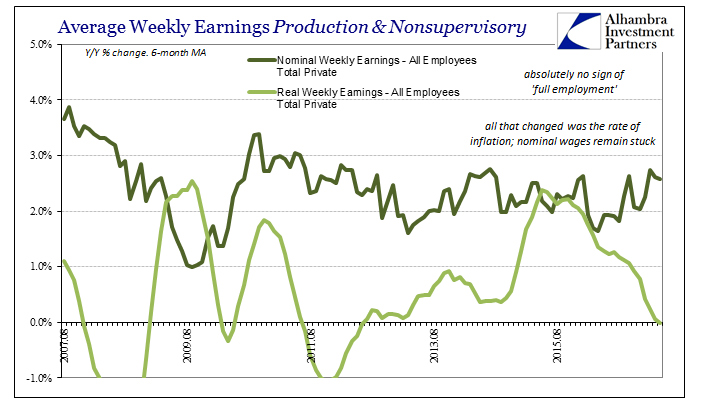

Despite a lower calculated inflation rate for April 2017, Real Average Weekly Earnings were only just positive for the month year-over-year. As the CPI had moved higher on the base effects of oil prices, real earnings were forced negative in each of the three prior months. The reason is, as always, no acceleration in nominal wages or earnings. None.

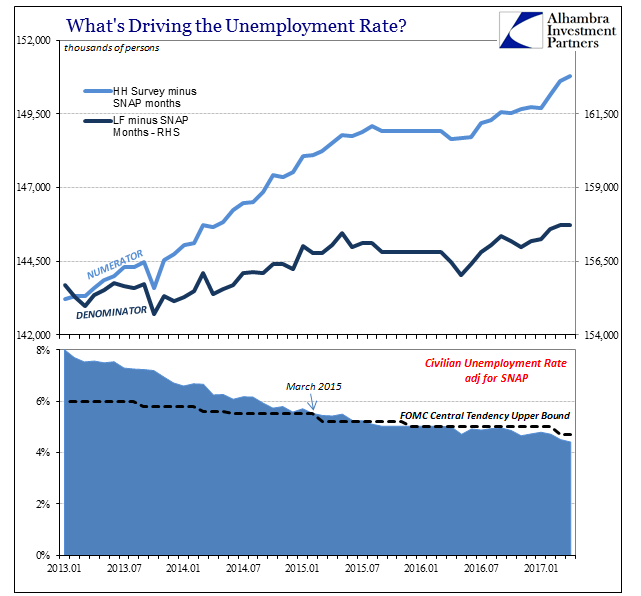

Given where the unemployment rate is, and how it has been this low for several years now, clearly “something” is missing. By that view of the labor market there is no longer any slack, as not only has the unemployment rate dropped to the full employment area it has gone so low so as to force economists to redefine full employment altogether. The reason is, again, because wage growth that should accompany this condition is totally absent.

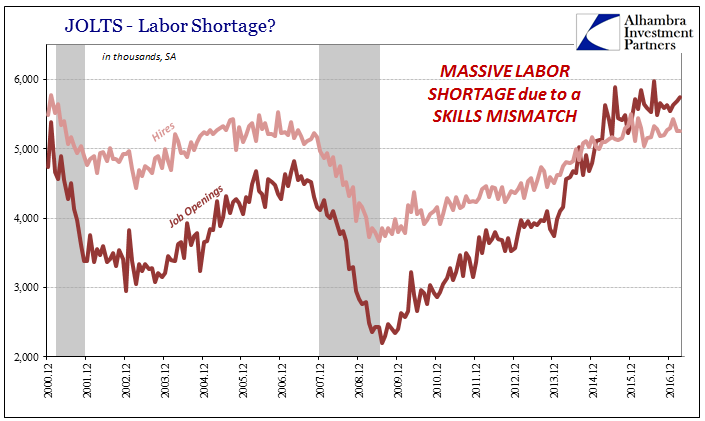

In many ways this is the flipside of the monetary policy argument made three years ago. In 2014, as convention posited a full economic recovery aided in no small part by QE3 (and 4), the rapid decline in the unemployment rate for a time made it appear as if the FOMC was in danger of being too slow toward the monetary policy exit. Quite a few economists and policymakers (“hawks”) started to worry that the economy was starting to grow too quickly, including a rapid increase in the demand for labor represented by JOLTS Job Openings, and that the Federal Reserve that was still purchasing UST’s and MBS at the time was not normalizing policy fast enough to head off what to these people was surefire inflation pressures.

To address this criticism, the “doves” began to describe weaknesses in the labor market statistics that suggested risks of economic “overheating.” Among them was Chicago Fed President Charles Evans, who in a speech given to the National Association of Business Economics in September 2014 suggested that the JOLTS Job Openings data wasn’t a complete enough view of the actual situation. Based in large part on that particular series as it moved very quickly higher throughout 2014 compared to the estimated rate of hiring, economists over the past few years have turned to the “skills mismatch” explanation for why the economy never did recover as expected after 2014 and further why QE then failed in every way.

Leave A Comment