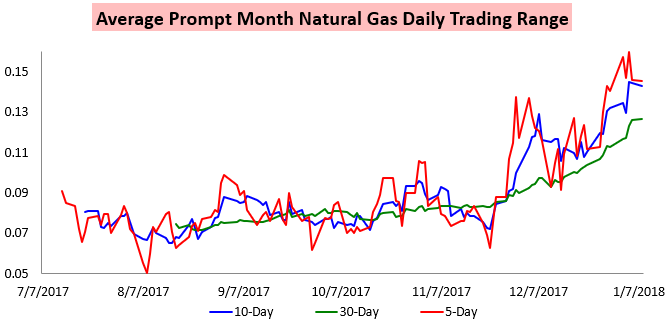

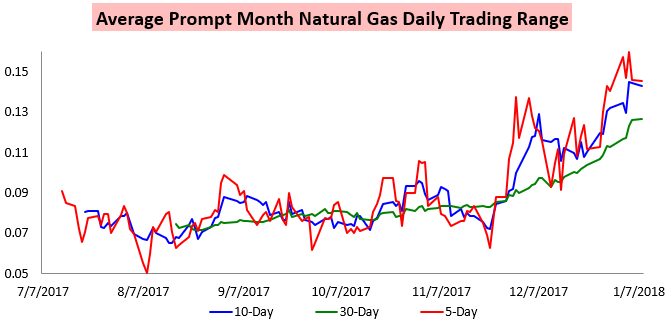

After a wild few weeks of trading, natural gas prices seemed to settle down a bit today. The February contract traded in an 8.5-cent range through the day today, which is the smallest intraday range for the prompt month natural gas contract since December 19th.

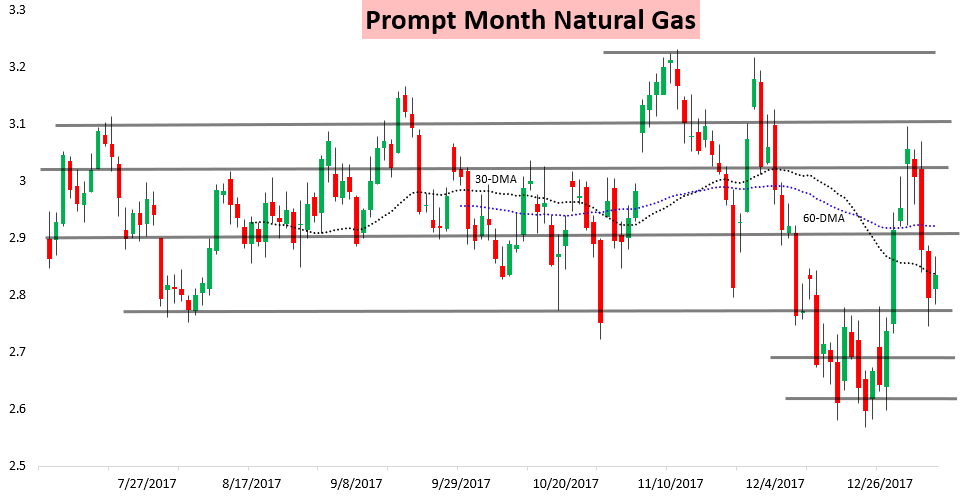

This came as prices gapped up weakly last night and settled right at the prompt month 30-DMA today.

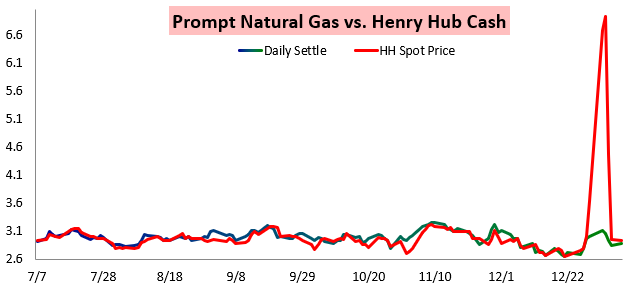

Cash prices ticked back a bit lower at Henry Hub again.

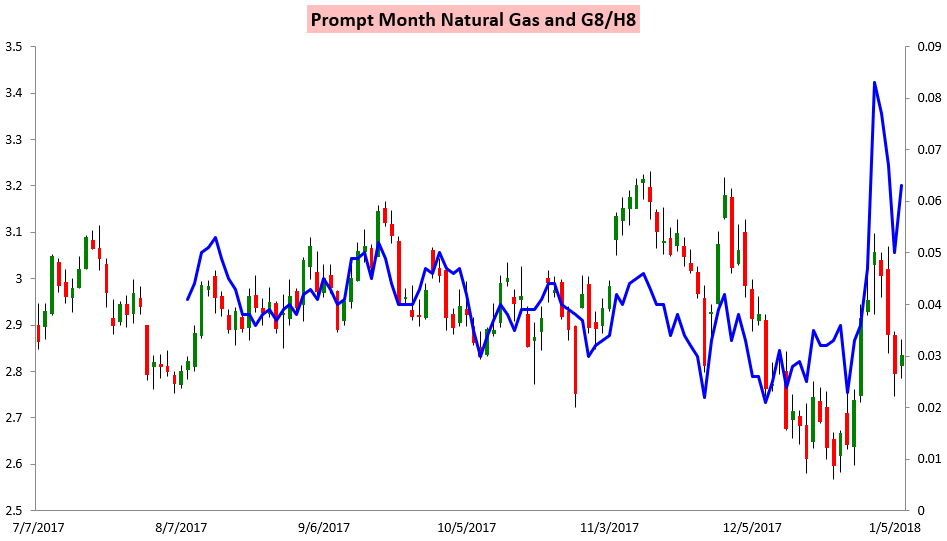

But you wouldn’t know it looking at the front of the natural gas strip, as G/H still widened rather significantly today given the relatively small move higher in flat price.

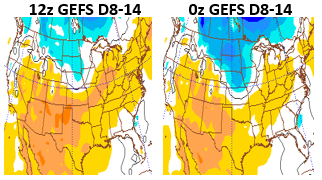

Meanwhile, the afternoon run of the GFS ensembles clearly trended warmer in the long-range, as seen below (images courtesy of the Penn State E-Wall).

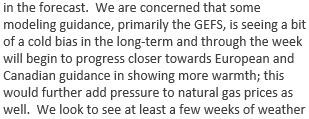

This helped pull natural gas prices lower intraday, when the February contract briefly dipped below the $2.8 level before recovering. In our flagship Weekly Natural Gas Report published today for subscribers, which covers all technical and fundamental aspects of the natural gas market, we highlighted exactly that risk as we expected GEFS guidance to trend back a bit warmer. Below is a small excerpt from the “Weather Trends” portion of the report, where we outline how forecasts and weather models are likely to trend through the week.

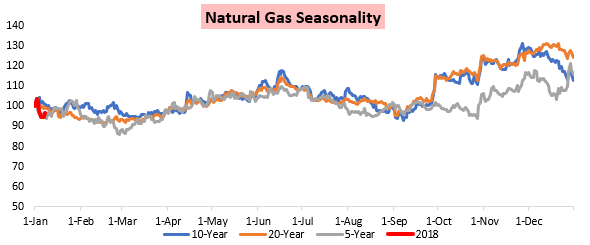

Included in the report is our new natural gas seasonality model as well, that runs 5, 10, and 20-year seasonality for natural gas.

Leave A Comment