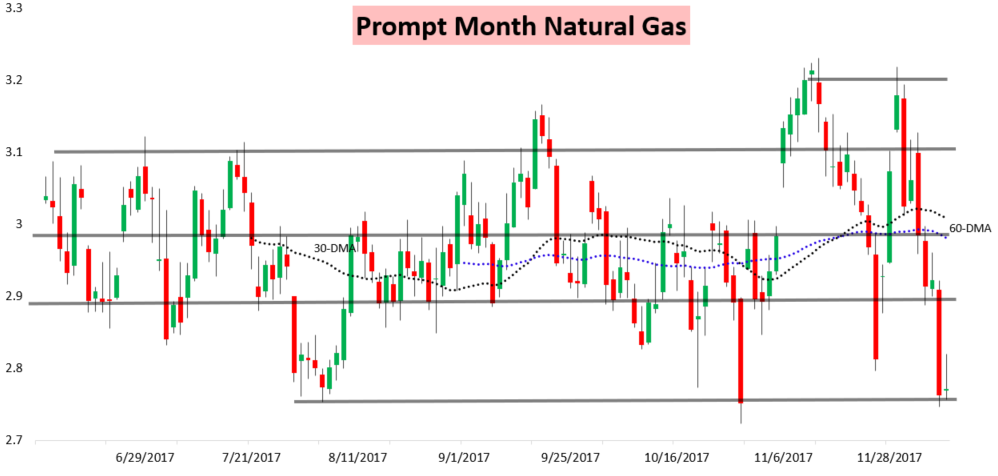

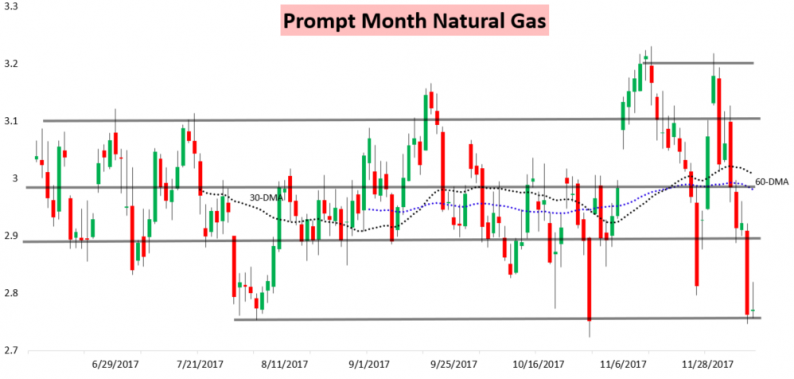

After such intense selling yesterday, natural gas bulls cannot be happy with the lackluster recovery in prices today. Though we did see some buying activity overnight, sellers came in through the day to keep prices below our first $2.82 resistance level, as prices were instead range-bound in a tight 6.3-cent daily range.

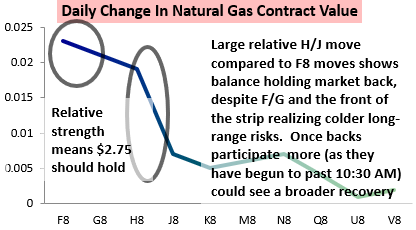

As can be seen, prices held just above the $2.75 support level. This is something we explained to clients in an intraday note was likely to hold given price action along the natural gas strip.

This came after we first identified $2.75 as a critical support level yesterday morning.

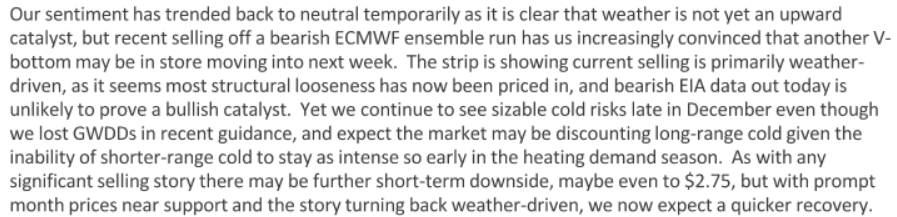

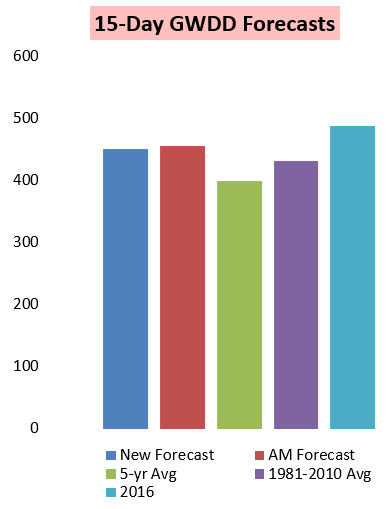

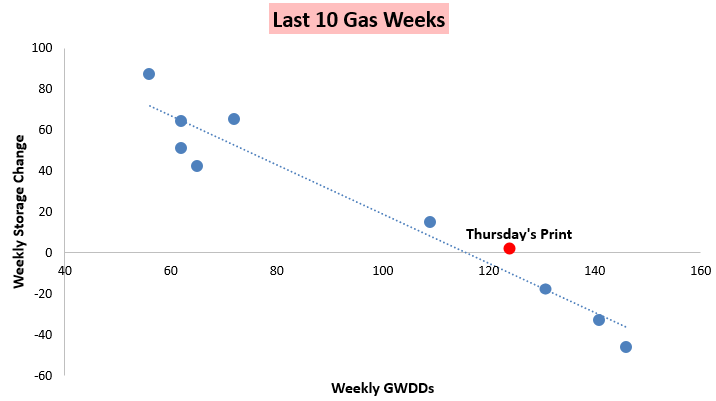

Admittedly, we had expected bulls to flex a bit more muscle in the face of some of the cold we have seen on guidance over the past week, as we still are forecasting above average GWDDs through the next 15 days (though we did shed a few this afternoon). This led us to hold sentiment that had a bit too bullish of a lean in a week where the front of the natural gas strip logged significant losses.

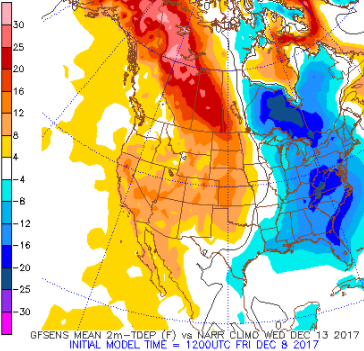

A significant portion of that elevated GWDD forecast is thanks to a strong eastern cold shot expected to be centered on December 13th, as seen on the afternoon 12z American GFS ensembles below (courtesy of the Penn State E-wall).

Yet it is also clear that forecasts in the medium-term have warmed, as seen in recent Climate Prediction Center forecasts.

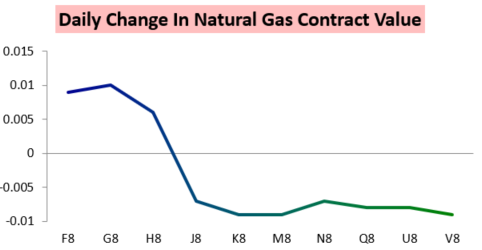

This appeared responsible for some of the selling yesterday, yet today it was the back of the natural gas strip that logged losses, as the front actually settled up a few ticks.

We actually did thus see weather support the front of the strip, and buyers did try and move us higher initially this morning. But balance concerns remain, as Thursday’s EIA print was quite bearish and indicated significant market loosening amidst record production levels.

All this sets up for a very interesting week of natural gas trading next week, where we expect both the latest production and weekend demand figures will be on the minds of traders as much as the latest weather expectations. We have noticed a tick up in weather forecast uncertainty recently as well, meaning we would expect that winter volatility is not going anywhere next week.

Leave A Comment