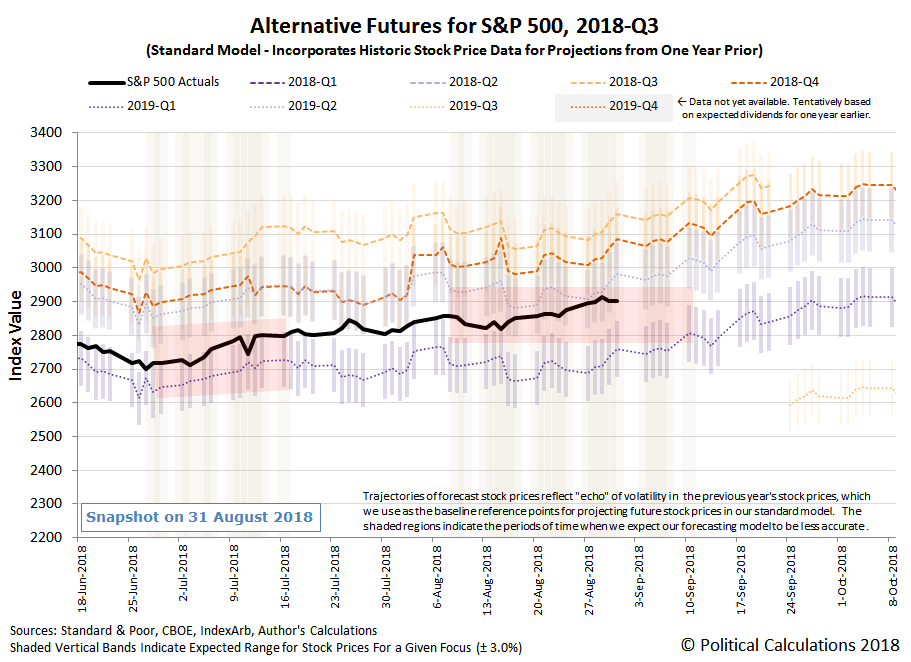

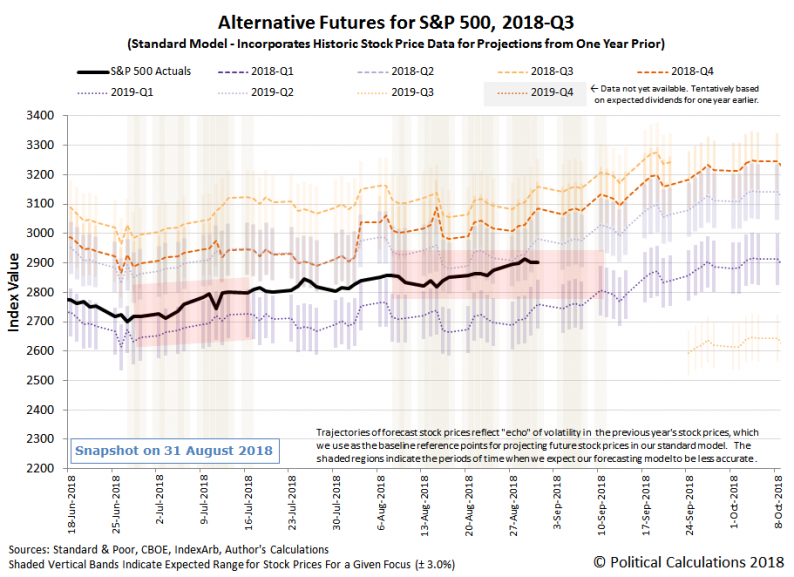

The S&P 500 (Index: SPX) continued setting new highs during the fifth and final week of August 2018, with its highest closing value to date set at 2,914.04 on Wednesday, 29 August 2018. The index went on to finish the week slightly lower at 2,901.52.

The recent uptrend in stock prices has lifted the trajectory of the S&P 500 toward the upper end of our red-zone forecast, which has just five trading days left to run. Overall, we think that investors are splitting their forward-looking focus between 2018-Q4 and 2019-Q1 in setting today’s stock prices, which we think will continue in the absence of news that might more definitively focus their attention on one of these points of time in the future.

As for what news might be behind the market’s recent upward momentum, here are the headlines that we weighted more heavily for their effect upon investor outlook in Week 5 of August 2018.

Monday, 27 August 2018

Tuesday, 28 August 2018

Wednesday, 29 August 2018

Thursday, 30 August 2018

Friday, 31 August 2018

Leave A Comment