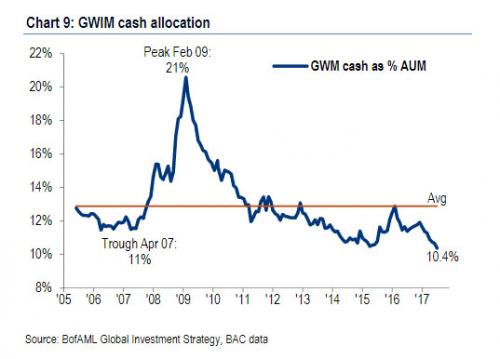

One can finally put all references to “cash on the sidelines” in the trash can, not only for purely logistical reasons (when someone buys a stock, the seller ends up with the cash), but also from a purely cash allocation basis. According to the latest BofA flow show report, Michael Hartnett writes that as of the latest week, private client cash – i.e., high net worth individuals, or those who still allocate capital to single-stocks and ETFs on a discretionary basis (unlike the broader US public which has long ago given up on the stock market), is now at a record low, taking out the cash levels observed in the period just prior to the last market peak in 2007: “GWIM cash allocation % AUM falls to all-time low of 10.4%.”

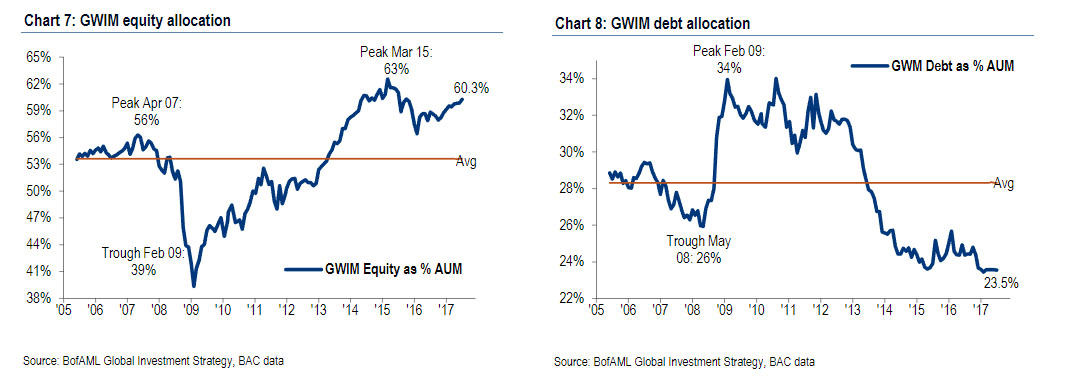

Furthermore, for all the talk about climbing a wall of worry, the same investor group has now allocated 60.3% of its AUM to equities, just why of the recent peak in March 2015 (63%) and far above the pre-crisis peak of 56% in April 2007. At the same time, private clients have reduced their allocation to debt to the lowest on record, or just above 23%.

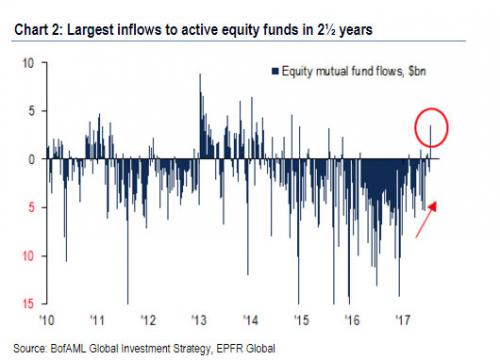

Against this backdrop of euphoria among investors, it is hardly a surprise that in the last week EPFR reported that there was a whopping $9.9bn inflow into equities and $10.7bn into bonds (nearly all corporate bonds), as global stock markets and credit indexes hit all-time highs. And while the bulk of the equity allocation was, as usual, into passive vehicles, last week saw an unexpected comeback for active equity funds which saw the largest weekly inflow of $3.5 billion, in two and a half years.

Where is all this new money going? For those following EM and Europe moves in recent weeks, it will come as no surprise, that of the $24BN in outflows from US stocks in the past 3 months, $19BN have gone into European stocks & $20BN into EM stocks, driven by more attractive rates & EPS outlook.

For now, all those rushing into the “hottest” new thing have been rewarded: annualized YTD returns for some of the biggest uses of cash include tech stocks at 55%, EM stocks 50%, biotech 36%, EAFE stocks 33%, European HY 27%, banks 27%, US stocks 18%, and US CCC HY 16%.

Leave A Comment