If there is any doubt as to the confusion inside the FOMC, one needs only to examine its models. The latest updated projections make a full mockery of both monetary policy and the theory that guides it. Ferbusand the rest don’t buy the labor market story, either, which is why the Fed can only be hesitant at best about “normalization.” Coming from the (neo or not) Keynesian persuasion, what is showing up should never happen.

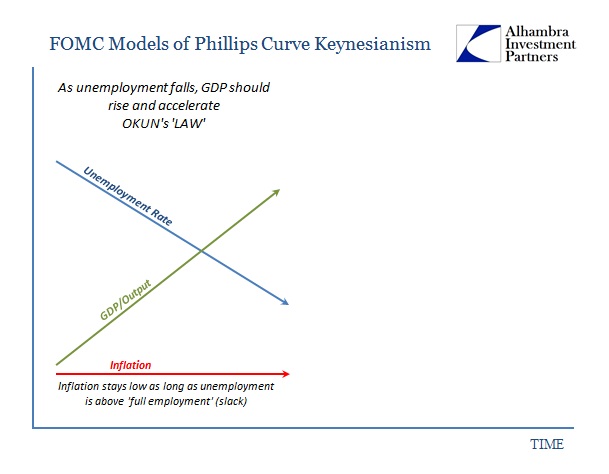

The theoretical notion of recovery is very straightforward in orthodox economics. In recession, the economy starts with high unemployment and therefore low inflation. Using the Phillips Curve as a short-term guide, orthodox models assume that as levels of unemployment begin to normalize, output (GDP) will rise. That will occur first without any uptick in inflation as the “slack” produced by the recession keeps price pressures to a minimum.

In Stage 1 everything is easy, so long as you can gain forward momentum in unemployment or output (which is what the QE’s were supposed to accomplish with regard to theoretical notions of hysteresis). Stage 2 gets slightly more complicated as the economy nears or reaches “full employment.” At that point, inflation should start to rise which will moderate output growth. If it progresses too far, that means the economy has reached “overheating” whereby inflation gets out of control and actively suppresses output, even reversing employment gains.

By the simple act of communicating a rate hike in December (though not actually carrying it out in meaningful fashion), the FOMC proclaimed closeness to overheating. But there is a huge problem with not just observed conditions but also projected economic conditions for the immediate future. If the economy and recovery has progressed sufficiently through Stage 2 to demand policy action before overheating, we should see a concurrent rise in inflation as well as output. The FOMC estimates show no such thing; worse, they estimate the opposite for especially inflation, as modeled GDP projections continue to muddle. That was true for not just CY 2015 as it was completed in full disappointment, but now encompassing CY 2016 as well.

Leave A Comment