The US Dollar took a dangerous tumble through the first quarter, throwing into doubt the currency’s ambitions after more than four years of advance. The extreme contrast between the Greenback and its global counterparts has notably moderated over the past months and that in turn has cooled the bullish fervor for the currency. In fact, the benchmark’s fundamental supremacy started to falter around March of 2015 when forecasts for growth, revenues and rates started to fall short of the overzealous speculative projections. As the economy cooled, corporate profits ebbed and the Federal Reserve cut its rate forecasts; the inflated Dollar premium started to evaporate.

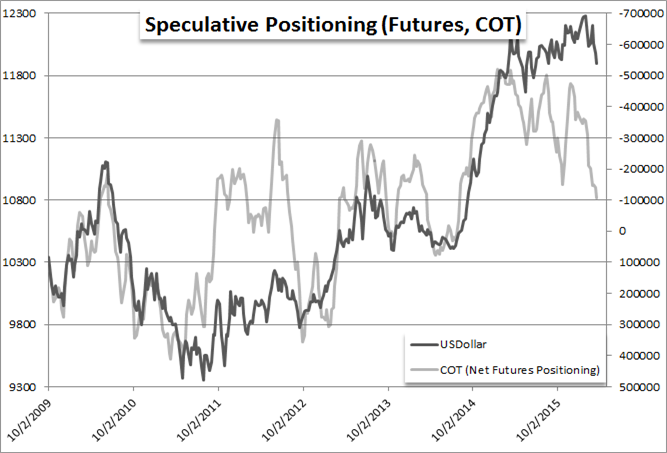

In turn, the speculative chase for long-Dollar exposure cooled – as can be seen in the net speculative futures positioning below. Heading into the second quarter, the perceived advantage to the world’s largest currency and economy will likely remain under pressure. However, where the USD tempo may ease; its fundamental advantage is unlikely to falter. This will intensify the importance of and reaction to key event risk, bolster volatility and likely sabotage efforts to sustain major trends.

Chart prepared by John Kicklighter. Data Source: Bloomberg, FXCM.

Will the Fed Cut Its Forecasts Again, Further Vindicating Rate Skeptics?

While the Dollar has maintained its bullish course, momentum started to flag approximately a year ago. Following a record-breaking 9 consecutive month climb for the ICE Dollar Index, the currency stalled and corrected through April and May. A key source of this slip was a souring of the market’s rate forecasts. In an effort to acclimate the market and temper the impact normalization would have on the markets, the Federal Reserve committed to a communications plan that emphasized forward guidance as an active tool. Yet, as their tone softened and the first rate hike (‘liftoff’) was expected to be pushed further back; the market applied the brakes to the Dollar’s advance.

Leave A Comment