This week, I just want to review a couple of things as we begin to wrap up 2017.

Earlier this week, I wrote a piece called “This Is Nuts.” If you haven’t had a chance to read it, I suggest you do. It outlines my view on the current market extension in the short-term and the potential for a mean-reverting correction at some point in the future. To wit:

“More importantly, a decline of such magnitude will threaten to trigger ‘margin calls’ which, as discussed previously, is the ‘time bomb’ waiting to happen.

Here is the point. The ‘excuses’ driving the rally are just that. The election of President Trump has had no material effect on the market outside of the liquidity injections which have exceeded $2 Trillion.

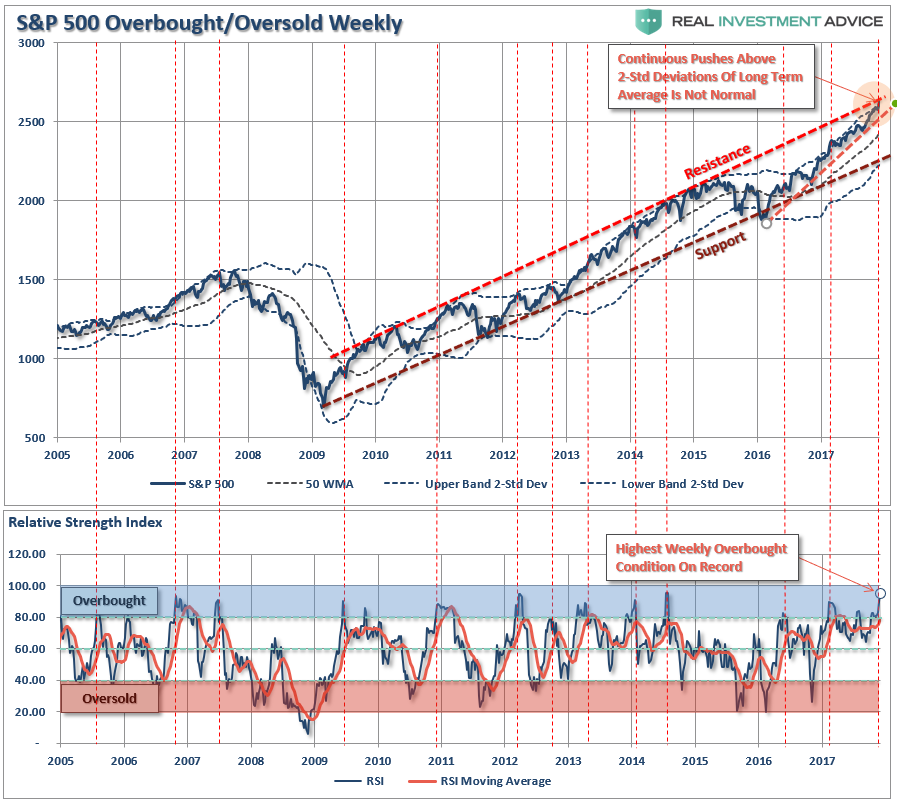

Importantly, on a weekly basis, the market has pushed into the highest level of overbought conditions on record since 2005. I have marked on the chart below each previous peak above 80 which has correlated to a subsequent decline in the near future.”

As I noted, the problem for investors is not being able to tell whether the next correction will be just a “correction” within an ongoing bull market advance, or something materially worse. Unfortunately, by the time most investors figure it out – it is generally far too late to do anything meaningful about it.

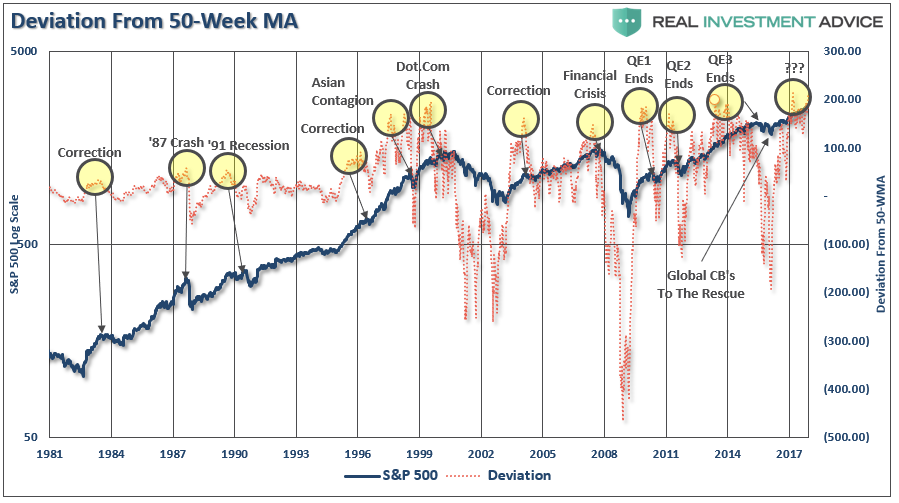

“As shown below, price deviations from the 50-week moving average has been important markers for the sustainability of an advance historically. Prices can only deviate so far from their underlying moving average before a reversion will eventually occur. (You can’t have an ‘average’ unless price trades above and below the average during a given time frame.)”

“Notice that price deviations became much more augmented heading into 2000 as electronic trading came online and Wall Street turned the markets into a ‘casino’ for Main Street. At each major deviation of price from the 50-week moving average, there has either been a significant correction, or something materially worse.”

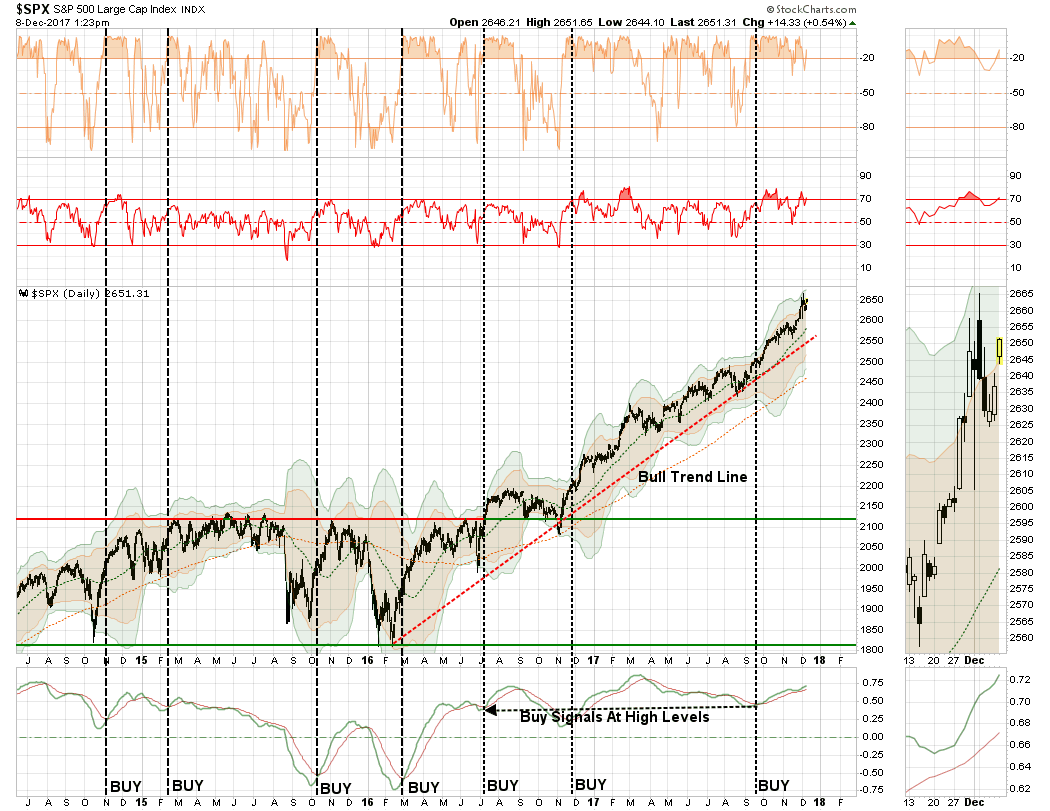

However, in the short-term, the market trends are CLEARLY bullish, very overbought, but nonetheless bullish.

As such, our portfolios remain “long” on the equity side of the ledger…for now.

I am still somewhat suspicious of the markets going into 2018. As I laid out over the last couple of weeks, I believe the risk of “tax-related” selling is a strong possibility at the beginning of the year as portfolios lock in gains without having to pay taxes until 2019. While the risk to the overall market trend remains small, a correction of 3-5% is possible. I am still looking for the right “setup” by the end of the month to add a small “short S&P 500” position to portfolios and increase longer-duration bond exposure to hedge off some of the potential risks. I will keep you apprised.

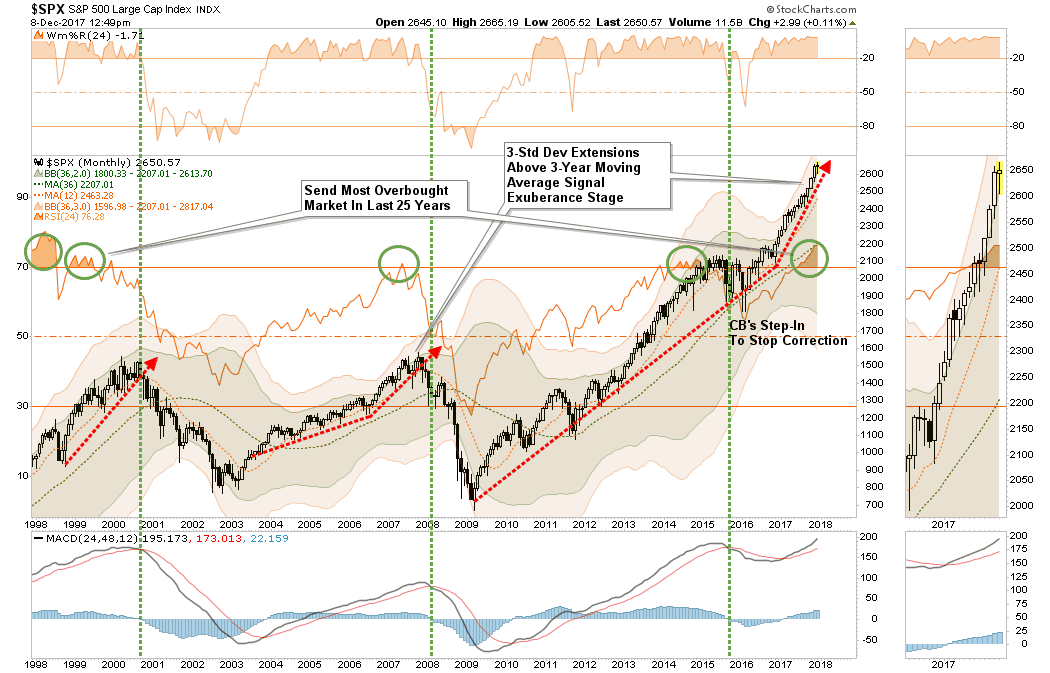

Importantly, while the short-term backdrop is clearly bullish, and as noted above, the longer-term overbought condition remains worrisome. The monthly chart below shows the current market extension is at levels rarely seen in market history. With the market trading into 3-standard deviations above the 3-year moving average, RSI pushing well above 70, and the MACD line hitting the highest level since 2000, the risk of a market reversion has risen.

While there is plenty of discussion of the support of Central Banks keeping markets afloat indefinitely into the future, it should be remembered that at the peak of every major market throughout history, it was always believed to be “different this time.”

But in the end, it wasn’t, and this time is unlikely to be different as well.

No Risk Of A Recession?

I have discussed, along with Doug Kass, several different “meme’s” running around as of late trying to justify the current market extension. To wit:

“The advance has had two main storylines to support the bullish narrative.

- It’s an earnings recovery story, and;

- It’s all about tax cuts.”

We can add to that list “economic growth” given the strength of the rebound over the last two-quarters which followed two quarters of exceptionally weak growth in Q4 of 2016 and Q1 of 2017. While the growth has certainly gotten everyone excited as of late, it is quite possible we have seen the peak of the “restocking cycle” for now.

Under the guise of these “meme’s” it is currently believed that a “recession” is nowhere to be found and therefore it should be “clear sailing” for investors as we head into 2018 and beyond.

Leave A Comment