Of the three principal US indices, it is once again the Nasdaq 100 and the NQ emini that are leading equity markets away from the lows of the last two weeks and slowly, but surely, regaining the levels last seen in late January prior to the arrival of the latest market shakedown.

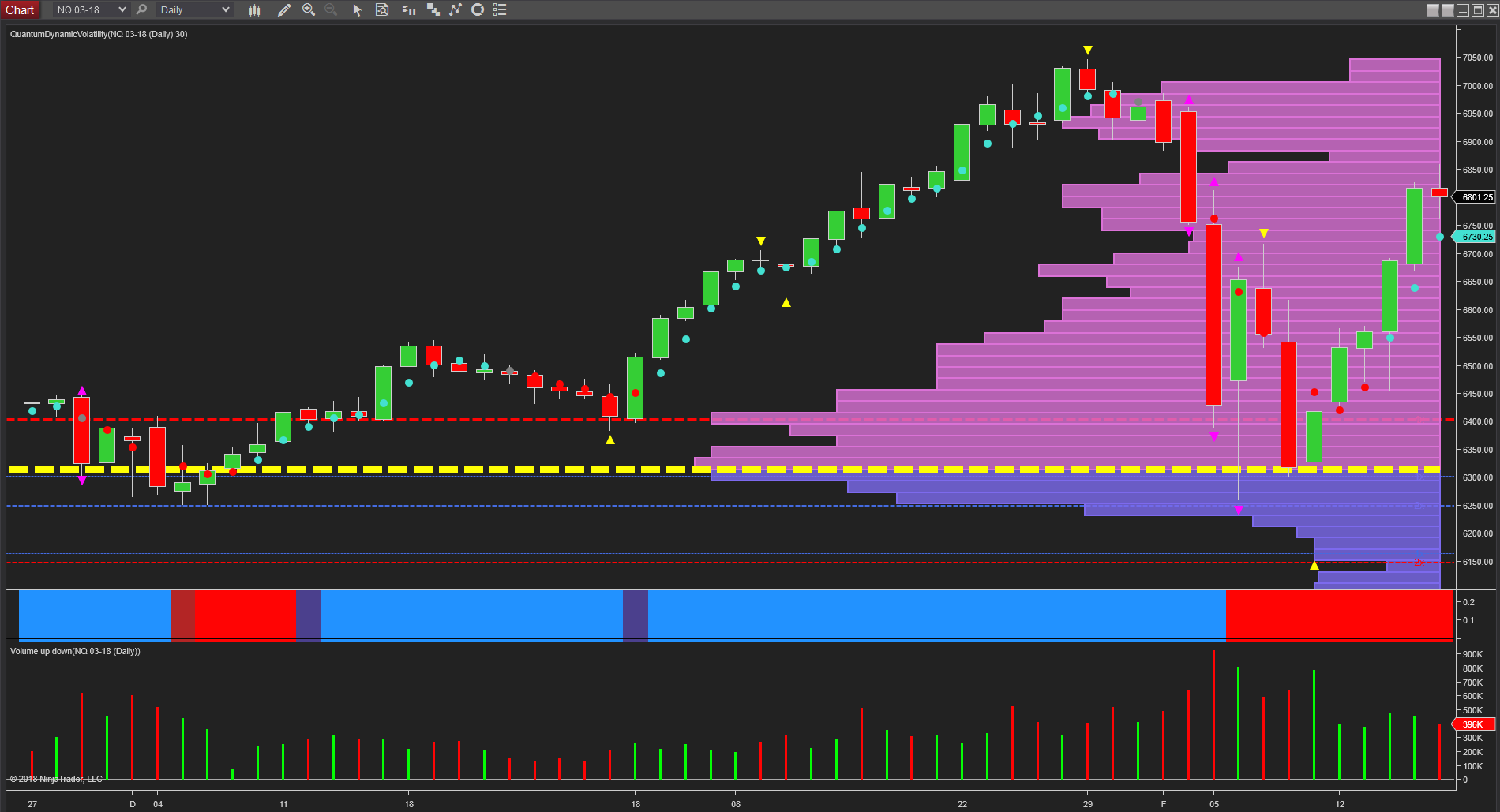

Volume as always, describes both the current price action and the anticipated future price action perfectly, and it is the candles and associated volume of the 6th and 9th which were pivotal in the reversal higher, where we have strong accumulation in preparation for the subsequent rally. This is a classic market maker campaign – short and vicious and designed to shake the tree – triggering panic selling which is then duly absorbed. This was the case on the 6th and denoted with ultra high volume and the very deep wick to the lower body of the candle. What was also clear was that after such a dramatic move lower, further heavy selling was inevitable and this arrived on the 8th, before further accumulation on the 9th repeated the price action of the 6th with equivalent volume once more.

Since then, we have seen the NQ rally higher over five consecutive days, with Friday’s price action on lower volume reflecting lower participation levels ahead of Monday’s Presidents’ Day holiday , and with a low volume node now immediately ahead in the 6870 region, we should expect a test of resistance in the 6950 area into the early part of next week. Breaching this region will require further effort, but if volumes continue to rise, and the VIX continues to fall, we should expect to see equity markets regain their poise as the waves of volatility gradually ebb away.

Leave A Comment