Key Points:

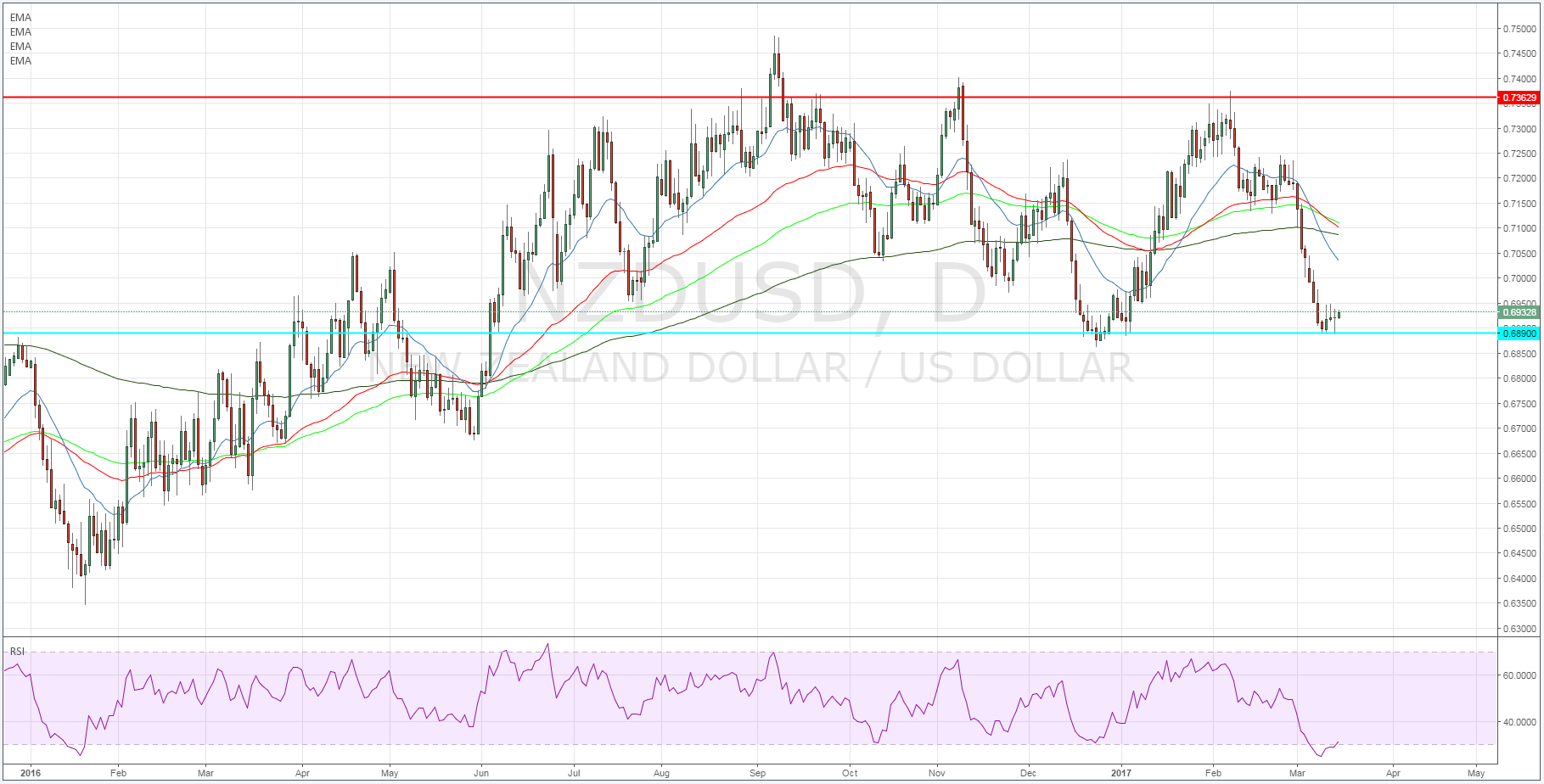

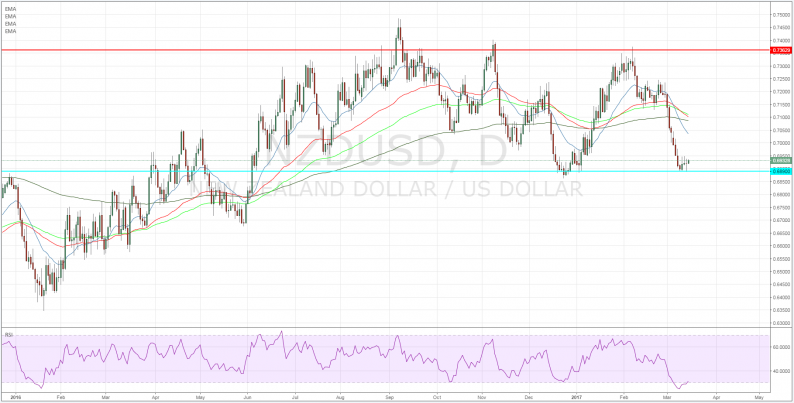

The New Zealand Dollar is bracing itself ahead of the U.S. Fed’s FOMC decision but the pair currently remains on a recovery trajectory. In particular, the daily pivot point has proved decisive in containing any further declines and price action has subsequently held around the 0.6931 mark. However, despite a solid NZ current account result of -2.335bn, the pair is still at risk from potential FOMC volatility.

The looming Fed interest rate decision poses a sharp risk event to the embattled Kiwi Dollar given the current level of uncertainty over the central bank’s medium-term direction. Most of the economic forecasts that are floating around seem to suggest that the central bank will hold rates steady at 0.75% during tomorrow’s meeting. However, this stands in stark contrast to Bloomberg’s survey showing that out of 83 professional economists, only 3 believe that the Fed will hold steady.

Subsequently, there has been a steady pricing in of the risk of a 25bps rate hike, especially given the veritable public relations assault that various FOMC members have been undertaking recently. The central bank has literally done all they can to alter expectations for a rate hike in the lead up to this event. This primarily suggests that Dollar longs will be looking for, not just a rate hike, but some strong signals of a cycle of tightening.

However, given the Fed’s predilection for caution, the likely scenario is a 25bps rate hike to the FFR and then a subsequent return to the central bank’s key mantra of remaining data dependant. This is unlikely to be enough to satiate the bulls given the current spread of long positions in play. Subsequently, there is a very real risk of market disappointment despite the likely decision to announce a 25bps hike. So don’t at all be surprised if the various cross pairs actually rise against the greenback on the day.

Leave A Comment