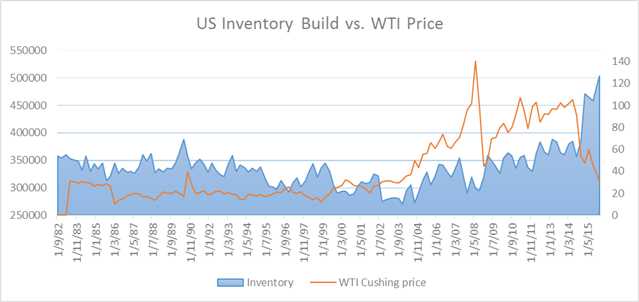

Oil price steadied above 30.28 support level, after a forceful retreat overnight over enormous US inventories. The U.S. Department of Energy published data of crude stocks reaching an 86-year high of 504.1 million barrels. As WTI price moves inversely to US inventories, the recent fast pace of stock build spells deep trouble to oil.

Chart created using data from DoE & Bloomberg

The department’s Energy Information Agency also reported that production in the Gulf of Mexico would reach a record high in 2017 regardless of current low price.

Outside the US, OPEC’s third largest producer Iran reportedly rejected the oil pact while Saudi foreign minister spoke of a discord to restrain output. Saudi’s excessive production to fund its eroding budget and Iran’s need to regain market share have been sources of the recent deadlocks.

Price of safe haven gold jumped nearly 2 percent today in response to the oil slip and a retreat in regional shares. It only stopped short of 1240, as yen also strengthened, while Asian shares pared yesterday’s gains. It would be good news to gold investors if European and U.S. equities follow suit tonight.

Copper price bounced up during Asian session to linger near this week’s high of 2.0840 as market stacked the metal before the new week. This level also capped prices during the last week of January, before February’s tumultuous rally and slump. Hence a break above this will be important to any upside resumption in copper.

GOLD TECHNICAL ANALYSIS – On weekly chart, gold price nearly pared last week’s gains, notwithstanding a late recovery today. The support trend line is well below current price band so there is no hindrance for gold to move in either direction next week. Wild swings could occur as a result.

Weekly Chart – Created Using FXCM Marketscope

COPPER TECHNICAL ANALYSIS – Copper price traded subdued below the previous support trend line, which may hold out into next week. On the downside, support level at 2.0020 held firmly. The metal seems pretty much trapped in a range, until upside progression may resume.

Leave A Comment