The short-term trend continues to be impressive. Oil prices firmed up and the entire stock market is happy about it.

The Medium-Term

The weekly chart of the S&P Equal Weight is pointed higher, and the momentum indicator is encouraging.

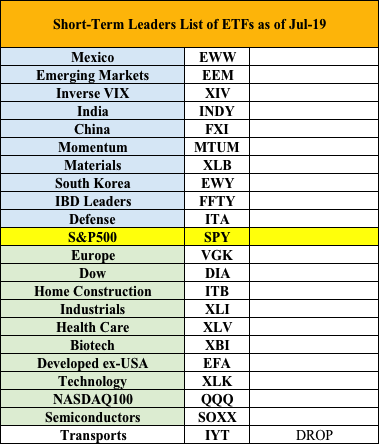

The Leader List

This has turned into a broad based stock market rally. Almost all of the ETF charts that I monitor are looking bullish or promising.

The Technology stocks are back in the leader list. You knew they would be.

Strong: Health Care, Technology, Energy, Bonds, Small Caps. Weak: Transports, Financials.

Health Care is pushing against the top of its range. This looks like it could be getting ready to break out.

Japan may be close to breaking out.

Energy finally broke above its 50-day. Do we have an Energy rally?

The Energy weekly chart still has some work to do.

Outlook

John Murphy has pointed out that it has been a year since the market has experienced a 5% correction so it is overdue for a pullback. He also mentioned that we are entering the risky time of the year for market corrections.

The long-term outlook is positive.

The medium-term trend is up.

The short-term trend is up as of July-12.

Leave A Comment