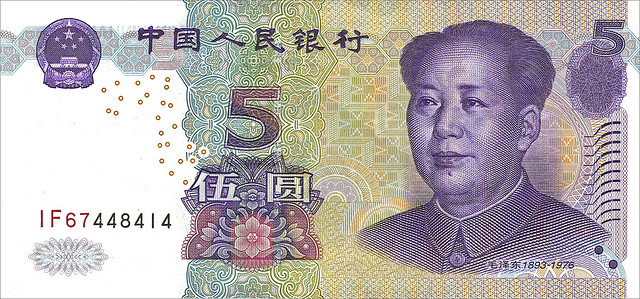

Photo Credit: Jason Wesley Upton || Of course this isn’t China…

I know this is redacted, but it is advice to a reader in a really remote area of the world. You might find it interesting.

I am currently with the XXX team in XXX.We are taking about trying to budget the [project] with the inflation of the past months being 50%. And September being 91%. I think XXX would appreciate your thoughts on the likely economic and inflation situation. They are trying to decide whether to move to working on dollars. And how to budget if they stay in the [local currency].

Dear [Friend],

One question that may not matter so much… is the inflation rate 50-91%/year, or 50-91%/month?The reason I ask this is if that is the rate per month, then you should try to do as much business as you can in dollars, and/or treat the local currency like a hot potato… don’t hold onto it long – it is not a store of value.It is normal in such a situation for another currency to become the practical currency when inflation gets that high… even if it is illegal.

If the rate is 50-91%/year, that’s not great to work with, but prices are still moving slow enough for you to have some degree of a planning horizon in the local currency.Still, any big transactions should be done in dollars, unless you are certain that you are getting a favorable rate in the local currency.

As for budgeting, it could be useful to do the budget in both currencies.This will help to raise the natural question of what happens if you don’t have the right currency.Here’s what I mean: ask what currencies you would naturally use to transact to accomplish your goals – look at both revenues and expenses.If you find your expenses are mainly in dollars or euros, but revenues are in the local currency, you will need to do one of two things.Either a) try to charge in hard currency terms, or raise revenue rates regularly, or b) build in a significant pad in local currency terms for the things you would typically buy in a hard currency.

Leave A Comment