A market crash can be viewed as a monumental tragedy or a splendid opportunity depending on what side of the fence you sit on. If you decide to pour all your money into the market close, then it would be viewed as a tragic event. If on the other hand, you got in early and as the market trended higher, you banked some of your profits then it would be viewed as a splendid opportunity.

Our overall motto as long as the trend is up (bullish) is to jump for joy when there is blood in the streets, and panic when the crowd is euphoric. This simple picture will explain why all strong corrections or crashes or whatever the naysayers would have you believe are nothing but buying opportunities. That is really what crisis investing is all about, seeing opportunity where others see a disaster.

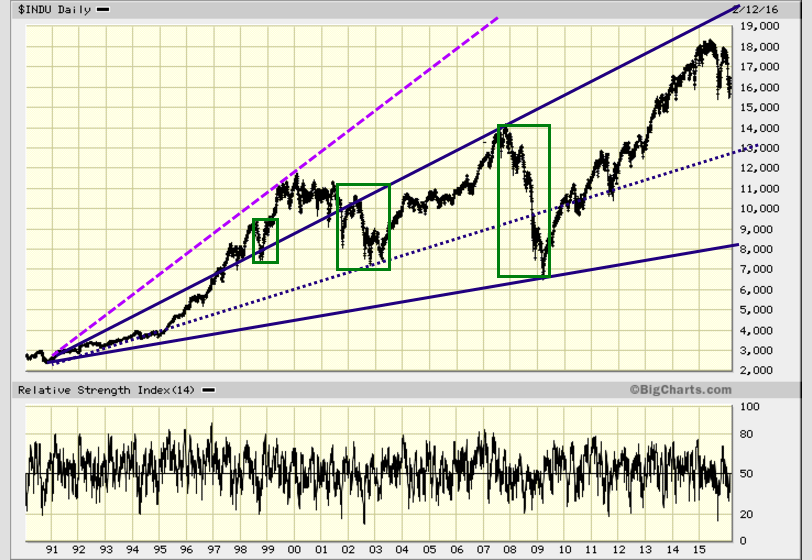

This chart dates back to 1990. What do you see? Well, we will tell you what we see? There is no such thing as a crash? A market crash is a matter of perspective, and the masses always examine the situation with fear as their guide and foolishness is their master. It is a crash only if one is silly enough to wait until the top to commit all one’s funds, which the masses are famous for doing and if one is equally silly enough to trade without any stops in place. If you were playing the trend all the way up, then it’s a correction to a pullback because hopefully you were prudent enough to take some money of the table as the markets soared higher. All corrections are should be viewed as bullish developments; the stronger the deviation from the mean the better the buying opportunity, illustrated by the green boxes.

Look at the chart above; who won from 1990-2016, the bears or the bulls? Even the terrible and devastating crash of 1987 turned out to be buying opportunity, and not a disaster as the naysayers and doctors of doom were advocating.

Game plan

Do not deploy all your funds into the market when the bull is mature. Wait for a strong pullback before getting in. Crowd psychology states that you should be wary when the masses are happy and vice versa. You have to have stops in place, just in case the trade does not work out. As the profits start to roll in, take some money of the table and put it aside for future opportunities; for example, purchasing stock after a strong correction.

Leave A Comment