As is customary virtually every time the Chinese central bank commences some form of tightening, overnight the PBOC injected “hundreds of billions of yuan into the financial system after some smaller lenders failed to repay borrowings in the interbank market”, according to people familiar with the matter.

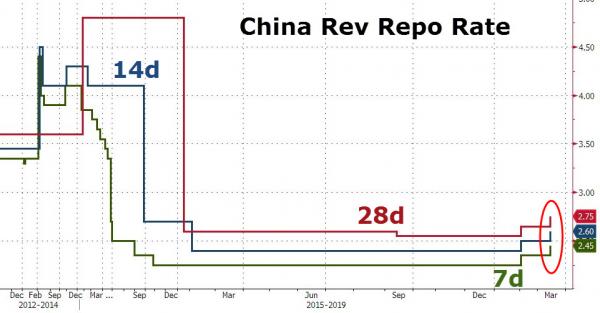

According to a brief note by Bloomberg, Tuesday’s injections followed missed interbank payments on Monday, anonymous sources said; the matter is not made public over concerns of bank deposit flight risk. The institutions that missed payments included rural commercial banks. One of Bloomberg’s trader sources said a borrower failed to repay an overnight repo of less than 50 million yuan ($7.3 million). China’s smaller lenders have been squeezed by a rise in money market rates this week, with the benchmark seven-day repurchase rate jumping to the highest level since April 2015 on Tuesday. As we described last Wednesday, the PBOC for the second time in a month engaged in tightening by hiking the rate on reverse repos as well as various liquidity conduit operations such as the MLS.

While the tightening of liquidity reflects factors including quarter-end regulatory checks and a wall of maturing certificates of deposit, BBVA said the People’s Bank of China may also be sending a message to over-leveraged firms to rein in borrowing.

“The PBOC wants to warn the smaller lenders not to play the leverage game excessively,” said Xia Le, chief economist at BBVA in Hong Kong. “It’s a tug of war between the central bank and the financial institutions.”

And while some smaller banks were on the verge of failure, overnight virtually everyone felt the surge in the 7-day repo fixing to the highest since 2014, driven by China’s liquidity squeeze amid policy tightening and continued high leverage

As Goldman’s MK Tan explains, China’s 7-day repo fixing interest rate rose to 5.5% on Tuesday, the highest level since late 2014. This followed PBOC’s statement last Thursday signaling a deviation from the previous framework of regarding interbank rates as de facto “policy rates”. Reflecting the prospective quarter-end MPA (macro-prudential assessment) examination and continued tightening bias from the PBOC, interbank rates may remain fairly volatile in the coming days, although most analysts do not expect such elevated rates to be sustained, especially since the PBOC will promptly have to bail out any banks suffering a liquidity squeeze.

Leave A Comment