Axel Merk, President & CIO, Merk Investments LLC, pinged me on March 16 with his thoughts regarding “Peak Dollar“.

He is not referring to the number of dollars, but rather, the intermediate-term value of the dollar compared to other currencies.

Merk’s comments are online at “Dollar Outlook: Peak Dollar?“. Let’s take a look.

In guest post format, with a few of my own comments interspersed, please consider these snips from …

Dollar Outlook: Peak Dollar by Axel Merk

Is the dollar’s seemingly relentless rise in recent years coming to an end? What are the implications not only for the greenback, but other currencies and markets around the world?

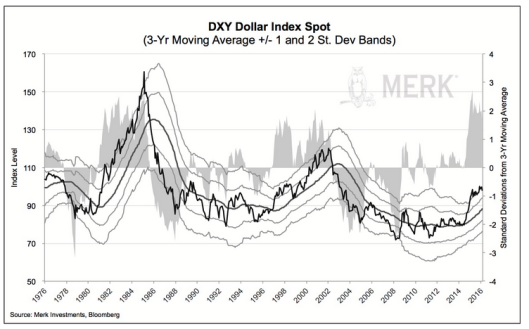

The chart below shows the U.S. dollar index over the past 40 years together with its longer term moving average, as well as 1 and 2 standard deviation bands. To some the chart may suggest that exchange rates are mean reverting; some will see a longer-term declining trend in the dollar; others will point to what may be considered an extreme valuation given that the dollar index has been around 2 standard deviations above its moving average. To us, the fact that the dollar has moved so far from its moving average, gives rise to the question whether the dollar rally may be over. Let’s consider some arguments for and against ‘peak dollar’:

U.S. Rate Hikes?

It’s widely anticipated that the Fed will continue to raise interest rates. So why would the dollar not rise? It turns out that we have been told for years now that the Fed will ‘exit’ from its extraordinarily accommodative policy. In our analysis, the U.S. dollar historically appreciates in anticipation of a hiking cycle, but not necessarily as rates actually move higher.

Mish Comments: Steen Jakobsen, CIO of Saxo bank also recently commented along the lines of … by the time the Fed starts hiking, the dollar appreciation is over. In this case, it is debatable if the Fed hikes any more at all. I expected mid-last-year the US and global economies were weakening far more than most thought, especially the Fed. I wondered if the Fed would get in any hikes. They did get in one, with near-promises of four more. Now it’s two more. The dollar and gold both reacted as many of us thought.

Rate Differentials

What about rate differentials? The European Central Bank (ECB) just lowered rates again. While all else equal, a high interest rate differential may benefit the higher yielding currency, all else is rarely equal. Betting on such rate differentials is also referred to as a ‘carry trade’ strategy. In our analysis, carry trade strategies tend to perform well in ‘risk on’ environments, i.e. in environments when equities and other ‘risk assets’ do well. Let’s pause to reflect that the U.S. dollar historically is considered a ‘safe haven’ when there is a ‘flight to quality.’ Remember 2008, when the dollar was widely considered the ‘only safe place in town’? Well, the yen substantially outperformed the greenback that year, but, yes, the dollar – and notably U.S. Treasuries – were two of the few places where investors found refuge.

Leave A Comment