And so the final quarter of 2015 is in the history books and we can officially accuse the US Bureau of Economic Analysis of “peddling fiction” about the US recovery, because at a growth rate of 0.69%, the annualized rate of economic growth was the lowest since the first quarter of 2015 when it grew an almost identical 0.64% which was blamed on the harsh weather. This time however, there is no easy scapegoat.

The breakdown was as follows:

In other news, core PCE rose 1.2% in 4Q after rising 1.4% prior quarter, while the clearest confirmation of the rapidly slowing US economy was final sales to private domestic purchasers which rose just 1.8% in 4Q after rising 3.2% the prior quarter.

But what some may be most interested by is that the Q3 implicit price deflator was +0.8%, begging the question: just what would the real GDP print be if it wasn’t propped up by CPI gimmicks.

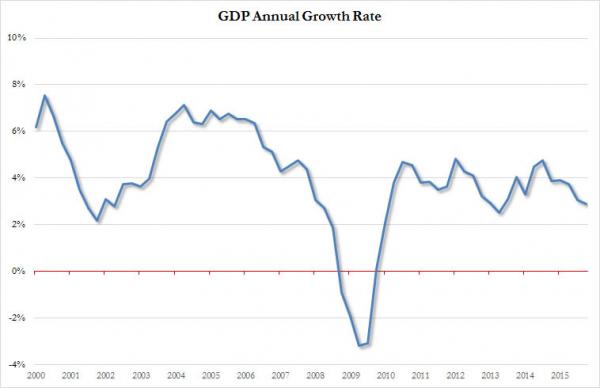

Here is a chart of US GDP by quarter:

And a full breakdown:

The punchline: annual GDP growth has just dropped to 2.9%, below the 3.1% in Q3, and the lowest in three years, since the 2.5% recorded in Q2 2013.

Most importantly, the inventory hangover remains strong as ever, because if anyone can spot the “inventory liquidation” in Q4, they win a Zero Hedge hat.

Leave A Comment