Let me make a few comments on the report on personal income and spending. Well, actually, just the spending part for now.

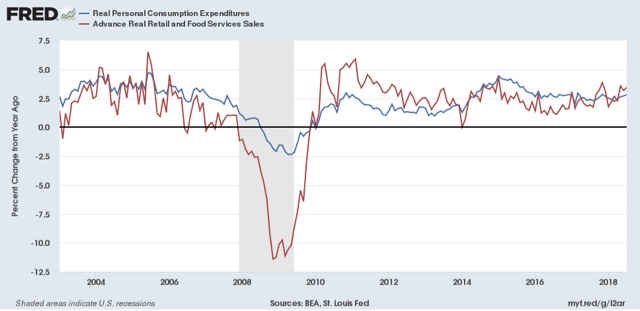

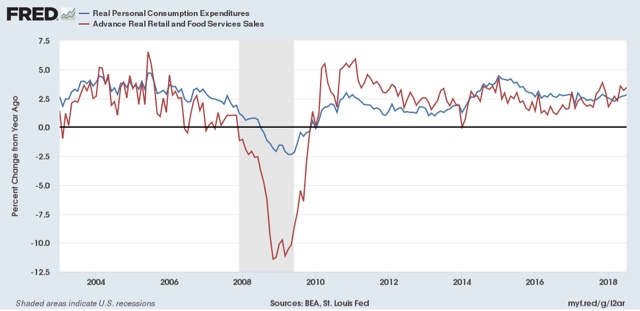

First, there is a long-time relationship going back 60 years in the data whereby the YoY% growth in retail sales is higher in the first part of an economic expansion, and lower in the latter part, compared with wider measures of spending, such as personal consumption expenditures (PCE’s). In fact, it is so reliable it is one of my “mid-cycle” indicators.

Well, it hasn’t been that way for the past year. Here’s the graph:

YoY retail sales have been higher than PCE’s in the past year — and the YoY growth has been rising. So has the economic cycle been rejuvenated?

Probably not, although the tax cut that took effect in January probably is having an effect.

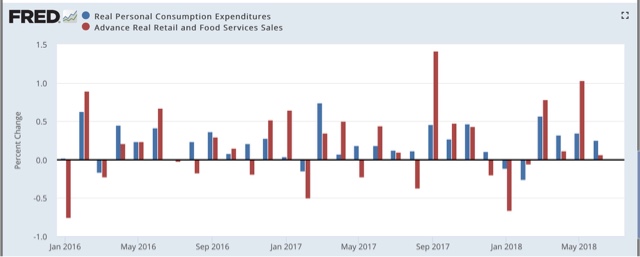

It all seems to boil down to an anomalously huge monthly surge in retail sales, even after adjusting for inflation, last September. It is easily seen in this next graph, which shows the monthly change in real retail sales (red) vs. real PCE’s (blue):

That’s a 1.4% real, inflation-adjusted increase in retail sales in just one month!

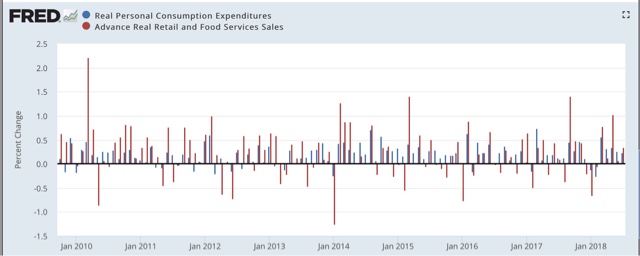

How anomalous? Well, here’s the same graph expanded back to October 2009:

Only three other months are comparable (1.0% or above), and only one of them, at the beginning of the expansion, is significantly larger.

The suspicion has been that the spike in spending was due to the hurricanes along the Gulf Coast and perhaps also the California wildfires. If that’s true, then in two months we’ll see that spike drop out of the YoY comparisons, and the normal long-term relationship between retail sales and PCE’s should assert itself. We’ll see.

A second point I want to make is about the Fed’s asymmetric 2% inflation “target.” In practice, it is actually a ceiling. We had a report by the Fed staff earlier this week warning that if they don’t move to increase rates now, inflation could get out of control.

Leave A Comment