One of Warren Buffett’s best pieces of investment advice is that “it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

This is why each quarter, when Berkshire Hathaway reveals its portfolio via regulatory filings, investors eagerly look to see what companies have the Oracle of Omaha’s quality and valuation stamp of approval.

Investors can read analysis of all of Warren Buffett’s dividend-paying stocks here.

Starting in 2016, Berkshire began making big acquisitions of refining giant Phillips 66 (PSX) and has continued to add shares over the past year. Today, Buffett’s company owns 80.7 million shares of Phillips, worth $7.5 billion and representing 15.9% of the company.

Of course, it’s never a good idea to just blindly follow along with any large institutional investor no matter how amazing his or her historical performance has been.

So let’s take a closer look at Phillips 66 so see why Buffett is such a fan, and more importantly, whether or not this industry leader deserves a spot in a diversified dividend growth portfolio.

Business Description

Phillips 66’s roots go back all the way to 1875, though as a company it was spun off from ConocoPhillips in 2012. It’s the nation’s second largest independent refiner with 13 refineries in the U.S. and in Europe. However, Phillips 66 is also a highly diversified petrochemical company with a total of four business segments:

Marketing & Specialties (44% of 2016 segment income): sells refined products through its 7,850 Phillips 66, Conoco, and 76 branded gas stations in the U.S., and 1,306 JET and COOP stations in Europe.

Chemicals (29% of 2016 segment income): a 50% stake in Chevron Phillips Chemical Company LLC (CPChem), whose 32 global facilities and two R&D centers produce specialty petrochemicals that serve the solvents, catalysts, drilling chemicals, and mining chemicals industries.

Refining (19% of 2016 segment income): refines crude oil into gasoline, diesel, and jet fuel.

Midstream (8% of 2016’s segment income): gathers, processes, transports, and markets natural gas, and transports, fractionates and markets natural gas liquids in the U.S. This segment has a 50% stake in general partnership of DCP Midstream Partners (DCP), and a 59% stake in Phillips 66 Midstream Partners (PSXP), whose infrastructure services parent company’s oil transportation and storage needs.

Business Analysis

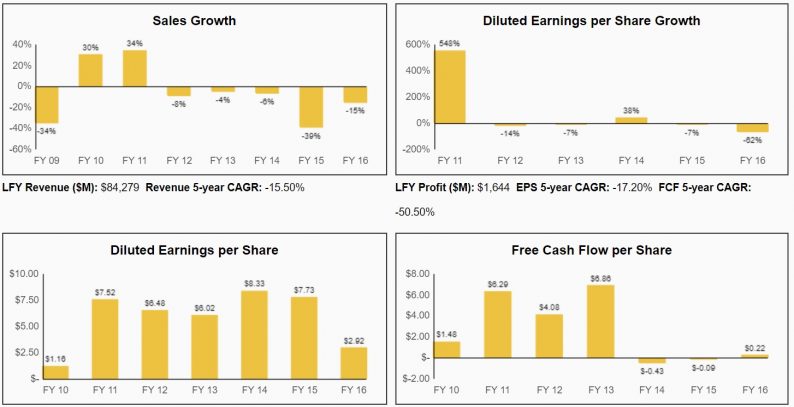

Management says that “Phillips 66 is committed to paying a regular dividend that is secure, has a competitive yield and increases annually.” Now that may come as a surprise since refining is hardly an ideal industry for safe and consistent dividend growth.

That’s because it’s highly capital intensive and very cyclical, with sales, earnings, and cash flow at the mercy of volatile commodity prices.

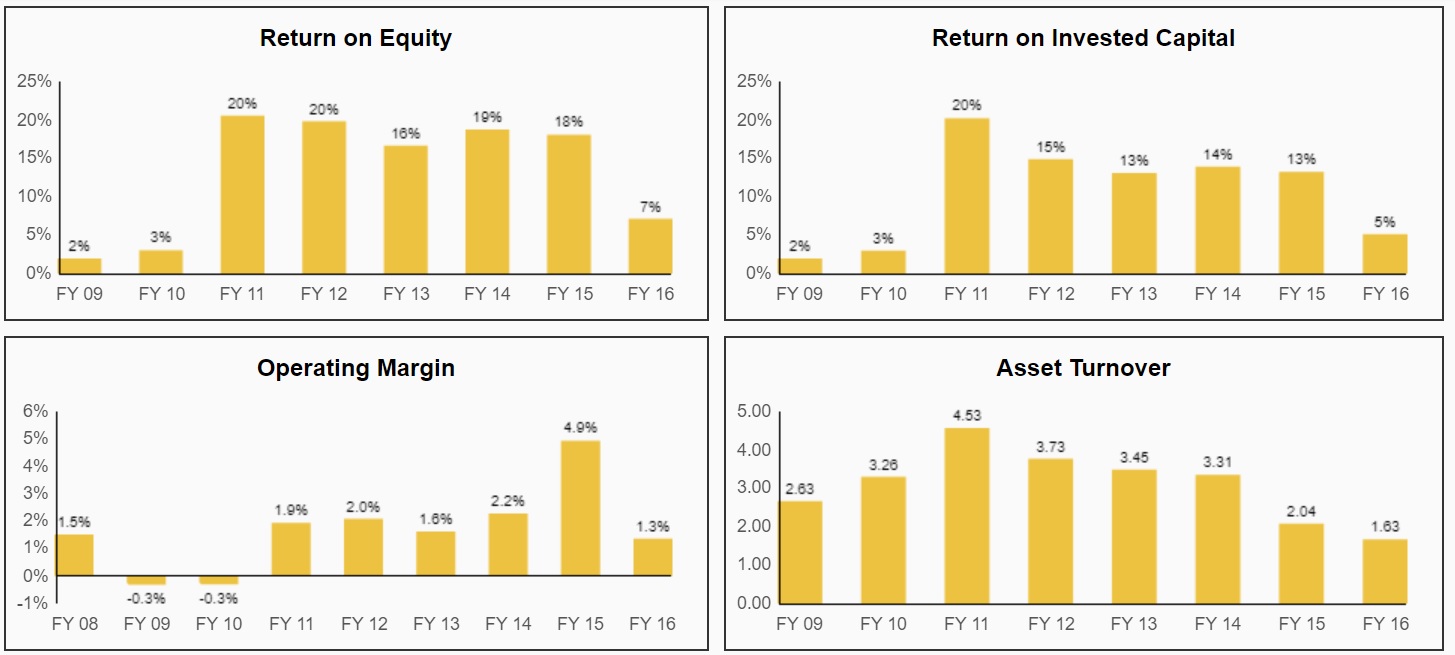

Source: Simply Safe Dividends

In addition, the high fixed costs of maintaining its assets (about $1 billion in projected 2017 maintenance costs) mean that profitability and returns on shareholder capital are equally volatile.

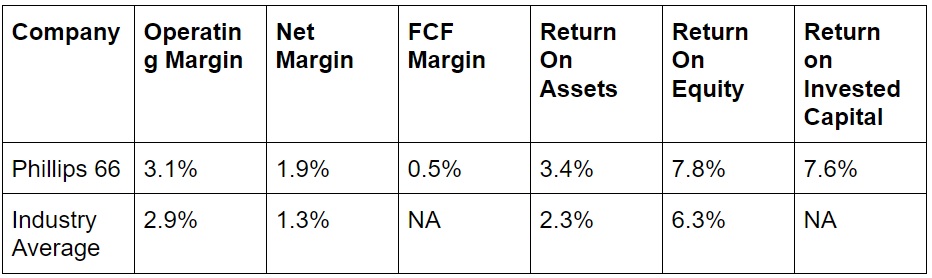

The industry is also famous for its low margins, and even with Phillips 66’s great economies of scale, which allows for better-than-average profitability, the company is hardly swimming in profits.

Phillips 66 Trailing 12-Month Profitability

Sources: Morningstar, Gururfocus

So what exactly about this company has attracted Buffett’s attention and caused him to take such a large position? Well, despite the challenges of the industry, there is actually a lot to like about Phillips 66.

For one, thing the company’s vast nationwide infrastructure is tapped into all of the U.S.’s largest shale oil formations, resulting in an ability to source discounted crude for its refineries and achieve higher profitability than many of its smaller, more regional peers.

Source: Phillips 66 Investor Presentation

Another benefit Phillips 66 has, courtesy of its significant geographic diversity, is the ability to tap into America’s fast-growing oil and petrochemical export market.

The prolific production growth of U.S. oil over the years, thanks to the shale fracking revolution, has resulted in much lower input costs for U.S. refiners, giving American petrochemical companies a big competitive advantage over rivals in other countries.

Leave A Comment