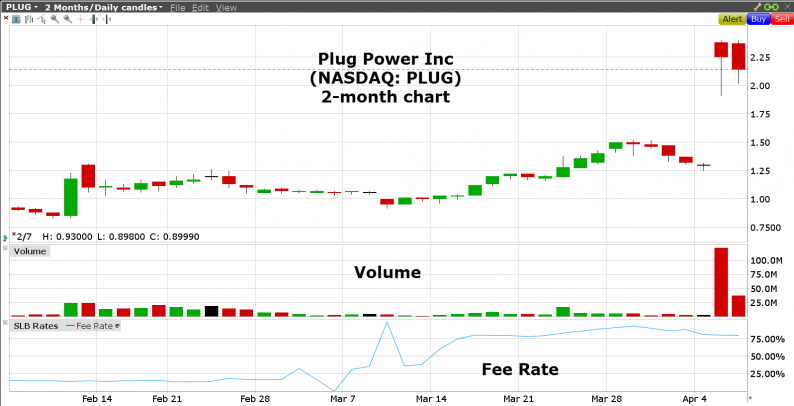

Plug Power (NASDAQ: PLUG) develops fuel cells for electric lift trucks and materials handling equipment. The company went public in 1999 at $15, rising to $1,200 in 2000 and cratering to under $100 in 2001. The share price meandered to 80 cents by February of 2017, but shot up to a $2-handle this week after reporting that Amazon will utilize Plug’s hydrogen-powered forklifts. Amazon also acquired rights to buy a stake in the company. PLUG’s revenue in FY 2016 was $85 Million, with FY 2017 revenue being estimated at $150 Million. The company has not had a profitable year since its IPO.

PLUG is becoming more popular among short sellers, with the Short Interest as percentage of float rising from 6% in 2012 to 35% in 2014, settling at 19% currently. With a market capitalization of $400 million, shares are very tough to find. It seems like most Securities Lending desks are looking for PLUG: large banks, trading firms and retail brokers. Daily inventory shows are unstable as traders cover or short more with utilization nearing 100% most days. The borrow fee rose from 10% to 80% within the last two months. Borrow Fees many times track volatility, so it’s no surprise that the fee jumped with 10-day vol spiking from 75 to 300 this week. ATM May options are trading at over 100% Implied Volatility, suggesting that the borrow cost may continue to be relatively high for some time.

Leave A Comment