Our intraday outlook is bearish, and our short-term outlook is bearish. Our medium-term outlook remains neutral, following S&P 500 index breakout above last year’s all-time high:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

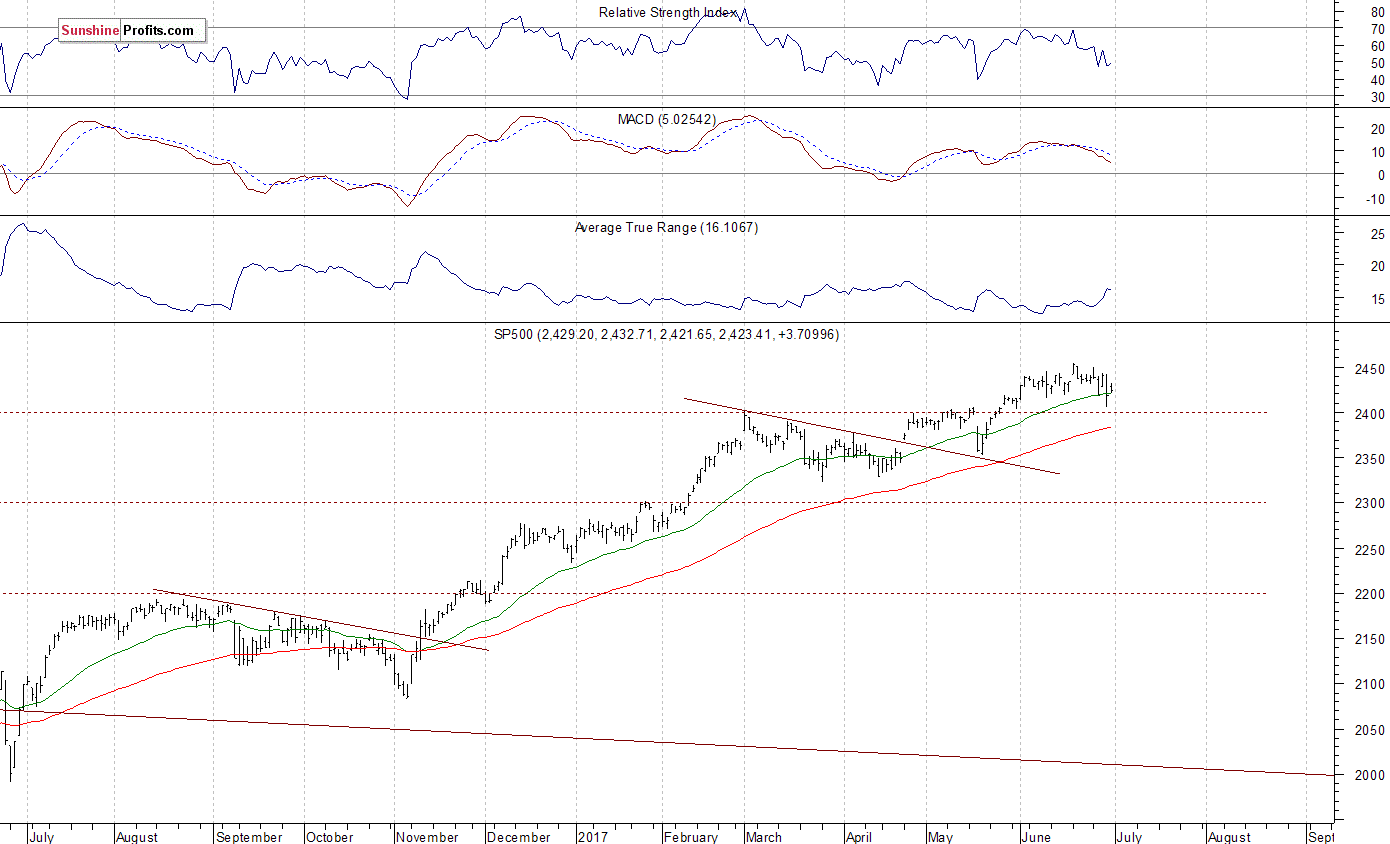

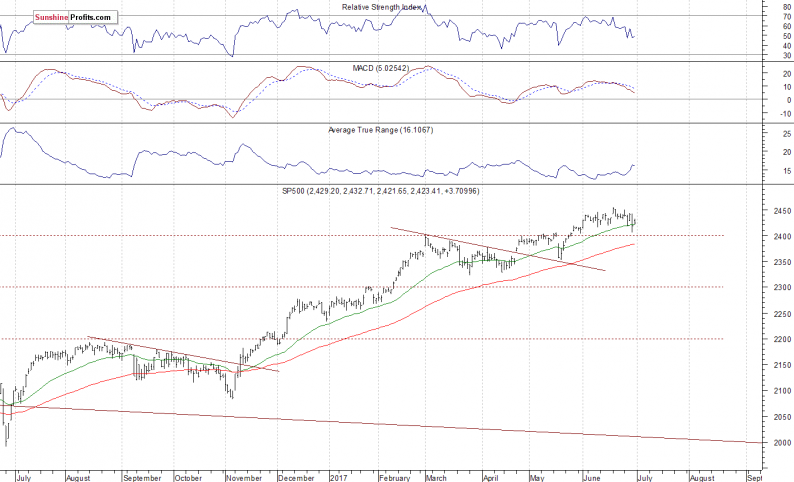

The U.S. stock market indexes were mixed between -0.1% and +0.3% on Friday, as investors hesitated following Thursday’s move down. The S&P 500 index fell the lowest since end of May on Thursday, as it got closer to support level of 2,400. It is now trading 1.2% below its June 19 all-time high of 2,453.82. It has reached new record high after a breakout above short-term consolidation along the level of 2,420-2,440. Stocks have rebounded sharply following their mid-May quick two-session sell-off and continued over eight-year-long bull market off 2009 lows. The Dow Jones Industrial Average was relatively stronger on Friday, as it gained 0.3%. It has managed to stay above the level of 21,300. The technology Nasdaq Composite was relatively weaker than the broad stock market, as it lost 0.1% following Thursday’s move down. The nearest important support level of the S&P 500 index is at around 2,415-2,420, marked by some recent local lows. The next support level is at 2,400-2,410, marked by the May 25 daily gap up of 2,405.58-2,408.01, among others. On the other hand, level of resistance is at 2,425-2,430, marked by some recent fluctuations. The next resistance level remains at 2,450-2,455, marked by all-time high. There have been no confirmed negative signals so far. However, we can see overbought conditions and negative technical divergences. The S&P 500 index is trading within its three-week-long consolidation, as we can see on the daily chart:

New Uptrend?

Expectations before the opening of today’s trading session are positive, with index futures currently up 0.2-0.3% vs. their Friday’s closing prices. The cash market will close at 1:00 p.m. today, ahead of tomorrow’s holiday pause. The European stock market indexes have gained 0.4-1.0% so far. Investors will now wait for some economic data announcements: Construction Spending, ISM Index at 10:00 a.m. The market expects that Construction Spending grew 0.3% in May, and the ISM Index was at 55.0 in June. The S&P 500 futures contract trades within an intraday uptrend, as it retraces its Friday’s late-session decline. The nearest important level of resistance is at around 2,435-2,440, marked by local highs. The next resistance level is at 2,445-2,450, marked by record high. On the other hand, support level is at 2,420, marked by an intraday consolidation, and the next support level is at 2,400-2,410, marked by Thursday’s local low. Will uptrend continue? Or is this an upward correction within a new downtrend?

Leave A Comment