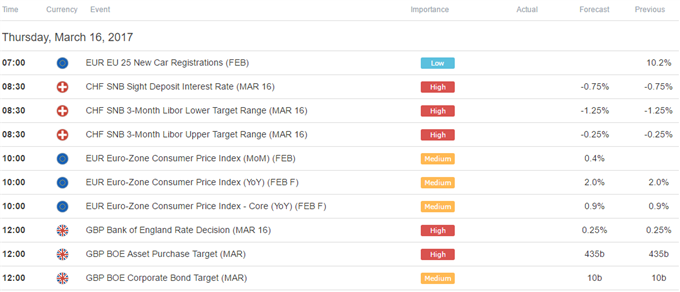

A Bank of England monetary policy announcement tops the calendar in European trading hours. Governor Mark Carney and company seem firmly locked in wait-and-see mode however, meaning the outcome may not offer a lasting lead to the British Pound. The UK economy looks relatively well-supported despite a run of softer data over the past month but Brexit-related worries are keeping policymakers on edge.

A rate decision from the Swiss National Bank may also be a non-event. A cautious improvement in the tone of economic news flow in recent months and the highest inflation rate since mid-2011 probably mean that expanded stimulus is not on the horizon. Tightening policy is likewise a hard sell however. Core price growth is negative and shaky EU politics may yet amplify EURCHF selling, erasing headline CPI gains.

Later in the day, US President Trump will make his formal 2018 budget request to Congress. Fiscal policy is a critical consideration but an already-available outline of what the administration will ask for makes clear that investors will not get answers to their most pressing questions. Details on tax cuts, infrastructure spending and entitlements won’t come until May, meaning this exercise will likely pass with little fanfare.

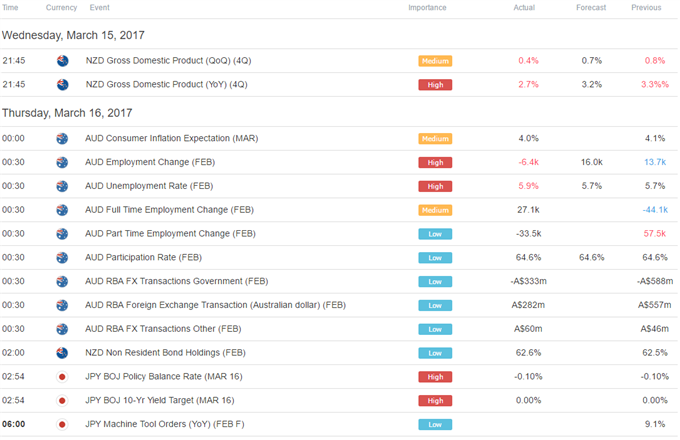

The Australian and New Zealand Dollars underperformed in otherwise quiet Asian trade. Both currencies suffered at the hands of disappointing economic data. The Aussie took a hit after the revelation that net employment fell last month while the Kiwi was weighed down by an unexpectedly sluggish fourth-quarter GDP growth reading.

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

Leave A Comment