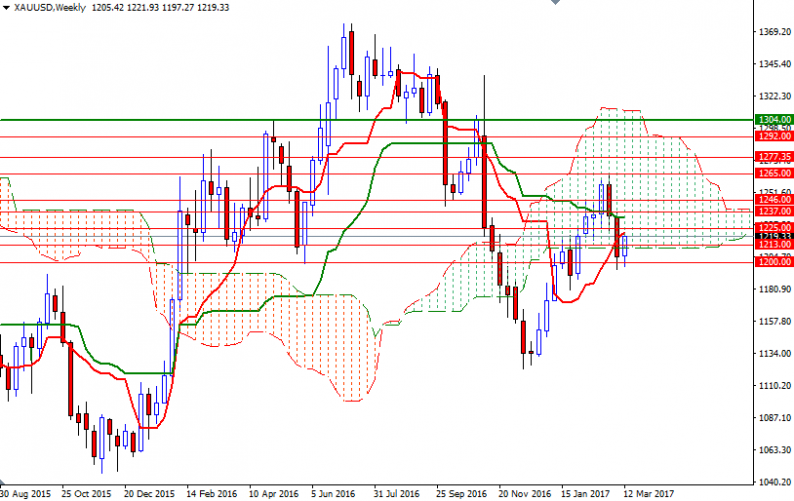

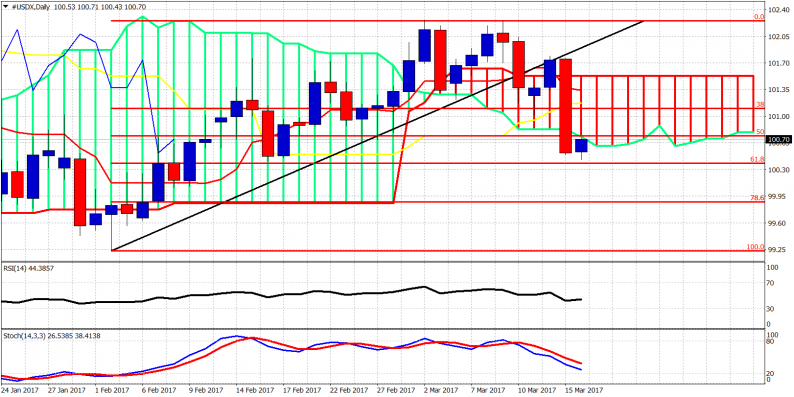

The US dollar remained under pressure in Asia following the disappointment that the FOMC did not signal a more aggressive stance, even though its delivered the nearly universally expected 25 bp rate hike. News that the populist-nationalist Freedom Party did

March 16, 2017