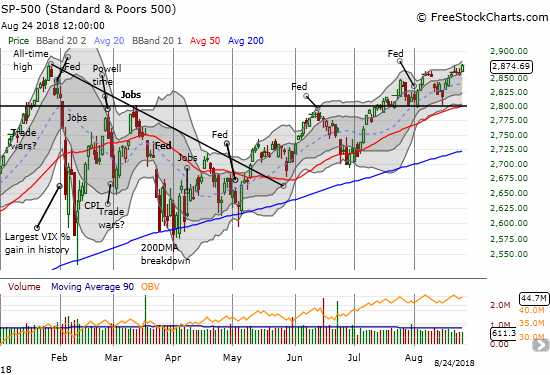

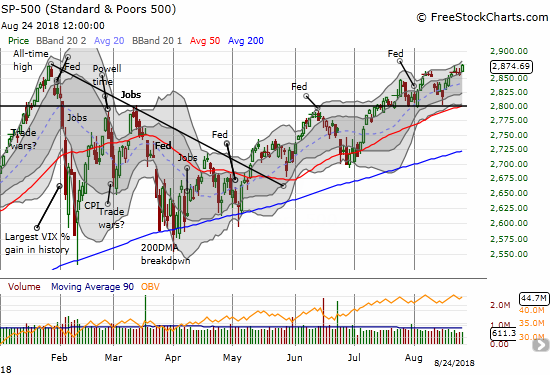

Federal Reserve Chair Jerome Powell delivered a speech at Jackson Hole, Wyoming last Friday that seemed to reassure financial markets. The S&P 500 (SPY) finally closed at a new all-time high, and the U.S. dollar cooled off a bit again.

It took 7 months, but the S&P 500 (SPY) FINALLY closed at a new (marginal) all-time high.

Source: FreeStockCharts.com

The U.S. dollar index bounced away from 50DMA support only to return to this important uptrending support the very next day.

Source: TradingView.com

Fundamentally, the speech contained no new news, but it did reaffirm the Fed’s gradual path of rate normalization within an environment where runaway inflation is not a concern. In other words, while the Fed will keep hiking rates, the path upward will stay slow and likely plateau sooner than later. Moreover, Powell reassured markets that the Fed is well aware of the risks of leaving rates too low and hiking rates too high. Powell expressed the dilemma in two questions:

“…two opposing questions that regularly arise in discussions of monetary policy both inside and outside the Fed:

1. With the unemployment rate well below estimates of its longer-term normal level, why isn’t the FOMC tightening monetary policy more sharply to head off overheating and inflation?

2. With no clear sign of an inflation problem, why is the FOMC tightening policy at all, at the risk of choking off job growth and continued expansion?”

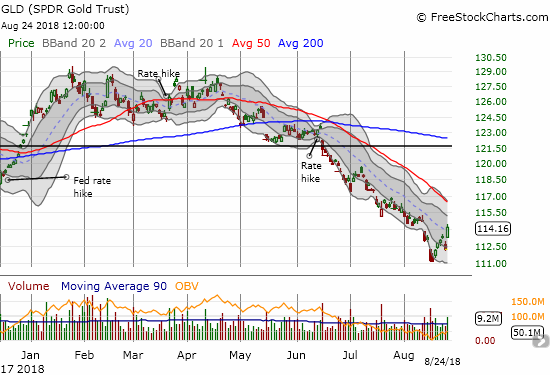

With Powell’s soothing answers bringing the U.S. dollar index back down to uptrending support at its 50-day moving average (DMA), gold and silver jumped higher. The SPDR Gold Shares (GLD) in particular confirmed its recent signs of a bottoming process. It looks like the dollar will not stand in the way of a more extended rally for gold and, hopefully, silver.

The SPDR Gold Shares (GLD) jumped 1.8% in a move the sharply departed from the previous pullback. The downtrending 50DMA resistance looks like it is in play.

While the iShares Silver Trust (SLV) gained 2.0%, it was only able to return to the recent highs of price churn. SLV even faded off its intraday high.

Source: FreeStockCharts.com

The divergence in performance between GLD and iShares Silver Trust (SLV) remains striking even as SLV actually gained more than GLD on Friday. While it seems I chose the wrong directions for my pairs trade, I am going to stick to plan and soon pair fresh GLD puts to my stacks of SLV calls.

Leave A Comment