Online survey provider SurveyMonkey (SVMK) will IPO on Wednesday, September 26. At a price range of $9-$11 per share, the company plans to raise up to $171 million with an expected market cap of ~$1.2 billion. At the midpoint of the IPO price range, SVMK currently earns our Very Unattractive rating.

SVMK looks different from many recent IPO’s in both positive and negative ways. On the positive side, its losses are lower and it doesn’t have a dual class share structure that prevents investors from having a vote on corporate governance matters. On the negative side, its high debt and slow growth make it hard to believe SVMK can justify its lofty valuation.

This report aims to help investors sort through SurveyMonkey’s financial filings to understand the fundamentals and valuation of this IPO.

Losses Are Worse Than Reported

SVMK earns revenues by charging monthly/annual fees for premium plans that offer unlimited surveys and questions along with customizable features and customer support. The company has over 16 million active users, but only 600 thousand (4%) are paying users. The company earned $121 million in revenue from these users through the first six months of 2018, up 14% year over year.

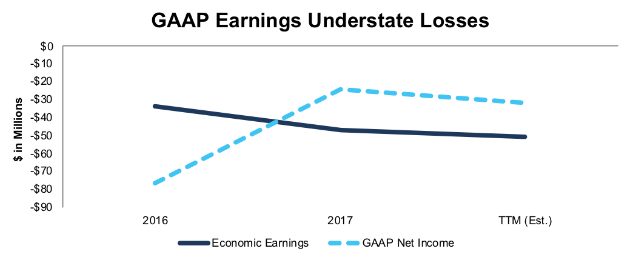

At first glance, SVMK’s GAAP losses narrowed from -$76 million in 2016 to -$32 million over the trailing twelve months (TTM). However, Figure 1 shows that economic earnings, the true cash flows of the business, declined over that period. The company’s economic losses increased from -$34 million in 2016 to -$47 million in 2017 and an estimated -$51 million TTM.[1]

Figure 1: SVMK GAAP Net Income and Economic Earnings Since 2016

Sources: New Constructs, LLC and company filings

Non-operating items overstated SVMK’s GAAP losses in 2016 and understated its losses in 2017. Adjusting to remove these non-operating items reveals the company’s growing losses.

The most notable non-operating expense in 2016 was $25 million (12% of revenue) in restructuring expense.

The most notable non-operating income in 2017 was a $12 million (6% of revenue) tax benefit due to tax reform.

Price Increase Can’t Drive Profitability

SVMK’s user growth has been minimal over the past year, but it has grown revenue by raising prices on existing users. The company increased its average revenue per user (ARPU) from $351 in the first six months of 2017 to $400 in the first six months of 2018, a 14% increase. According to the S-1, this increase was:

Leave A Comment