Preferred stocks offer the distinction of being unique hybrid instruments with qualities of both stocks and bonds.In that manner, they offer healthy dividend yields alongside a favored position in the capital structure of many companies that issue these securities.

The reason company’s issue preferred shares are to raise capital from investors that are seeking an attractive yield without adding traditional debt (bonds) that carry strict maturity dates and covenants.Preferred stocks can also be “callable” from the issuer, who has the right to redeem them at a certain price or time at their discretion.

Sometimes the prices of preferred stock indexes follow the path of the stock market and other times they follow a closer inverse relationship to interest rates, like bonds.The result is an alternative income producing asset class with distinctive risk and reward dynamics that must be carefully considered before adding them to your portfolio.

The largest exchange-traded fund in this space is the iShares U.S. Preferred Stock ETF (PFF).This well-known index-based ETF invests in a basket of nearly 300 preferred stock issues of primarily publicly traded U.S. companies.Think companies like Wells Fargo & Co (WFC), HSBC Holdings PLC (HSBC), and GMAC Capital (ALLY).

The sector makeup of PFF is overwhelmingly dominated by banking, financial, insurance, and real estate stocks.Currently this ETF offers a 30-day SEC yield of 5.28% and charges an expense ratio of 0.47% annually as well.

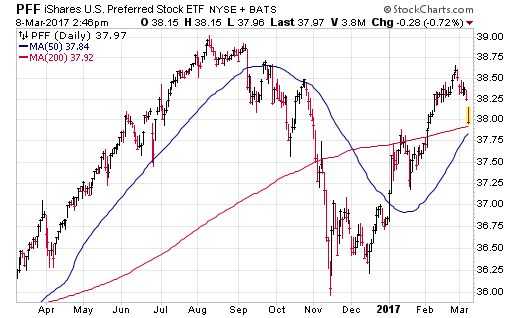

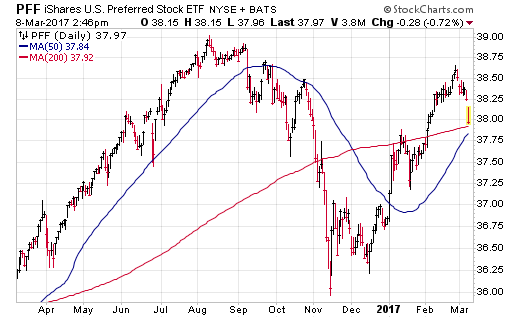

Examining recent one-year chart below, it’s notable that PFF peaked near the bottom in interest rates in mid-2016 and has been slowly trying to reclaim that prior high.This fund has once again come under fire as signals of more frequent Federal Reserve rate hikes spook interest rates back to the top of their recent range.

The next big test for PFF is whether it will be able to hold its long-term 200-day moving average or if it gets sucked down once again by sharply rising Treasury yields.It appears that once again this index is taking its cues from bond holders in terms of its recent price action.

Leave A Comment