There really is no reason for the Fed to hold off on rates hikes.

I’ve been saying it for months now, when they start raising, we see economic activity increase as bank lending , which is overly restrictive now, will improve.

“Davidson” submits:

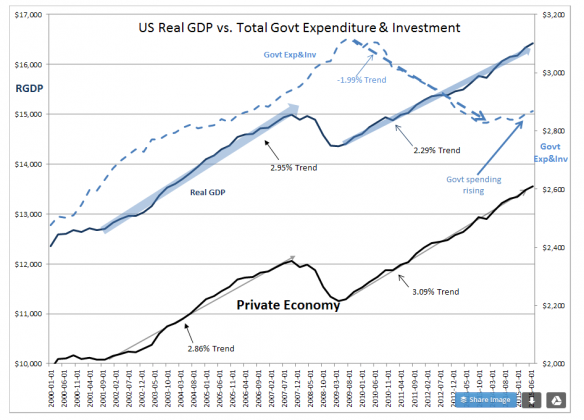

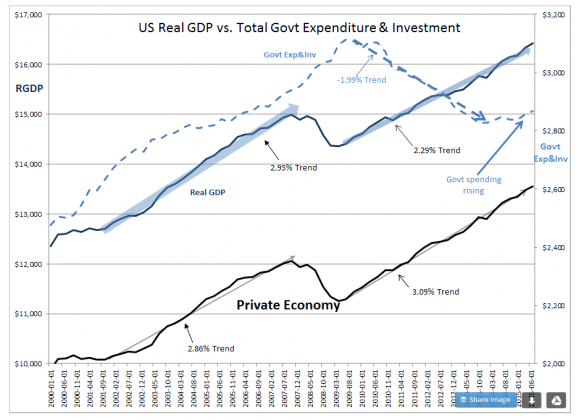

US Gross Domestic Product was reported higher than expected and past numbers were revised higher. With new data the trends can be calculated a little more accurately.

The current economic cycle has differed from the past only in the contributions from government spending. US Real GDP had roughly a 3%(2.95%) growth rate from Oct 2001 thru July 2007-see the DARK BLUE LINE in the chart. The current cycle has been closer to 2.3%(2.29%). The reason for this change has been the drop off in Govt Expenditure & Investment. In other notes it has been shown that slowing Govt Expenditure has been the reason for low inflation as government reduces historically inflationary military expenditures. It appears that Govt Expenditures may now be turning higher which historically has pushed inflation higher.

A better understanding of our economy comes when we look at the Private Economy. The Private Economy which is calculated by subtracting Govt Expenditure & Investment from US Real GDP and shown by the BLACK LINE is running at a pace near 3%(3.09%). The Oct 2001 thru Jul 2007 Private Economy grew at a similar ~3% (2.86%). Considering that several years from today we will see revisions in these reported values when doing ‘economic math’ using statistical methods both recoveries appear to have the same trajectory.

It should be clear that the often expressed view that there is nothing supporting stock prices but low interest rates has ignored the economic strength of the Private Economy.

The recent rise in Govt Expenditure & Investment is likely to push inflation higher which the Fed’s rate regime was unable to accomplish. Many will likely see higher inflation as ‘victory’ and praise the Fed for doing its job finally. Frankly, I think the Fed is misguided. We do better with low inflation in my opinion. But, consensus is consensus even if it is misguided. The new perception of inflation is likely to see funds flow from Fixed Income to Equities as investors adjust. Such a shift portends much higher equity prices including prices of Natural Resource companies.

My recommendation remains that investors favor Equities ($SPY) over Fixed Income.

Leave A Comment