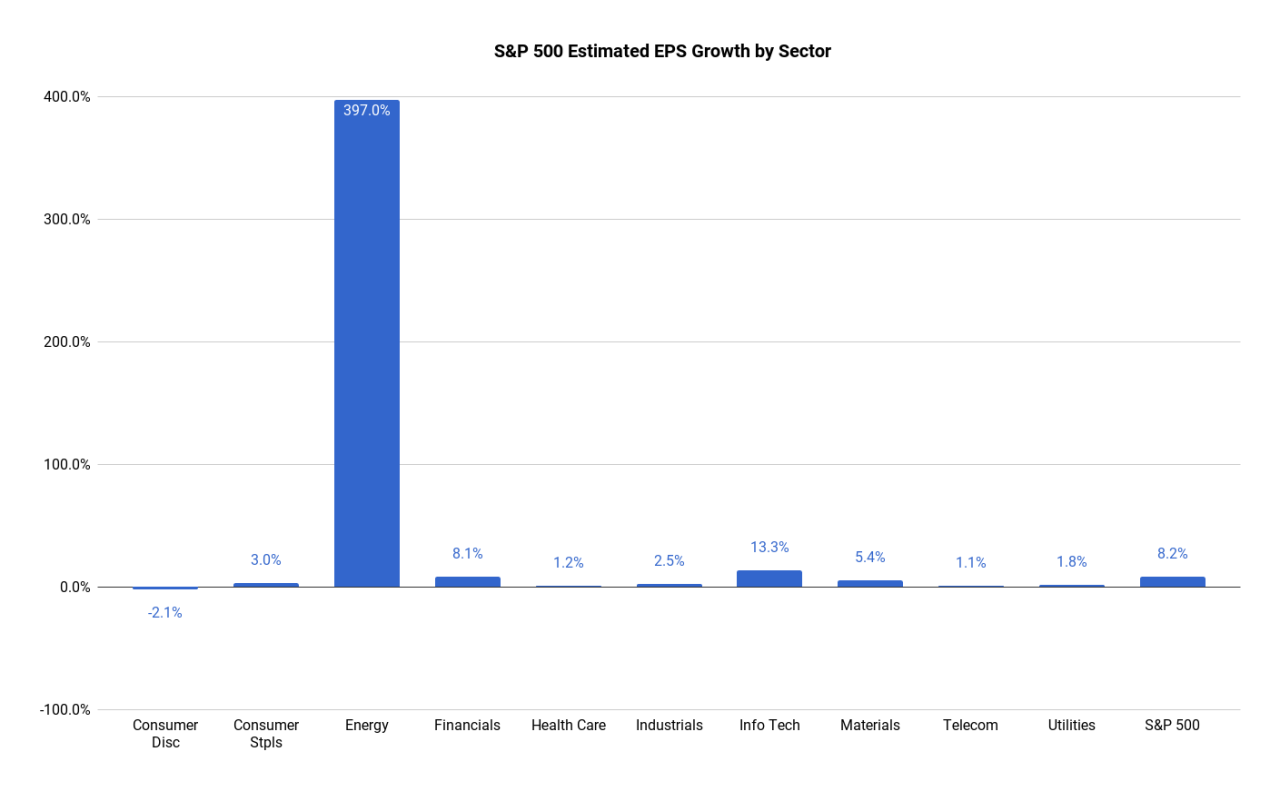

The big banks (JPM, C, WFC, GS, BAC) kicked off earnings season on a high note when they reported on Friday, all beating on the bottom-line, and only Wells Fargo missing on the top-line. Overall the Estimize community is expecting another strong earnings season, but a pull back from Q1. S&P 500 EPS is anticipated to grow 8.2% from the year ago quarter, a deceleration from last quarter’s 14%. Revenues are expected to grow 5%, down from 7% in Q1.

In 2017 we’re seeing a flip in winning/losing sectors, with energy and IT at the top, and health care and consumer discretionary lagging after putting up the best numbers for many of the quarters in 2015 and 2016. Energy is leading the pack right now with expected growth of almost 400% due to easier year-over-year comparisons. If you remove energy, index growth is almost cut in half to 4%, just around the 20 year historical average. The question then becomes, is 4% growth enough to justify a market that is trading at nearly 18x. Investors may be wishing for stronger fundamentals at these prices.

Following energy, technology is expected to see the second highest growth rate of all the sectors with profit growth of 13% and revenue growth of 8%. All 10 industries within the sector are estimated to record positive numbers this quarter, but none more than semiconductors which are currently anticipated to increase earnings by 50% YoY. Micron Technology is driving the semiconductors and is the largest contributor to sector growth. The company posted EPS of $1.62 on June 29 vs. the year ago result of -$0.08, an increase of 2125%. Optimism around Micron’s stock is due to favorable pricing of DRAM and NAND chips, MU’s main businesses. Gartner recently reported that worldwide PC shipments were down 4.3% in Q2, the 11th consecutive quarter of declines, due to supply shortages for memory chips which in turn has driven up prices and pushed down demand. This trend is expected to benefit MU again in Q3 with growth expected to come in even higher at 3600%.

Leave A Comment