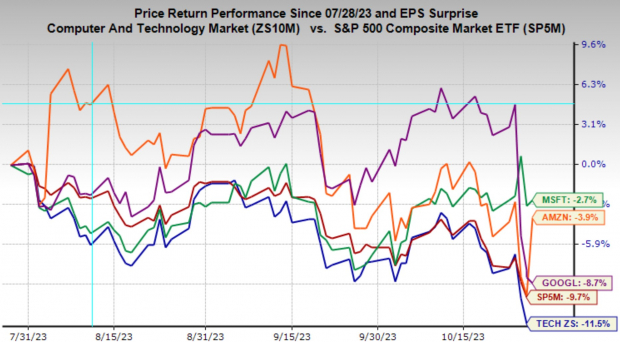

Image Source: Zacks Investment ResearchAs you can see here, the Zacks Tech sector (blue line at the bottom; down – 11.5%) has lagged the broader market (red line, second from the bottom, down -9.7%), with Microsoft (green line, down -2.7%), Amazon (orange line, down -3.9%) and Alphabet (purple line, down -8.7%) doing better.The relative outperformance of Microsoft and Amazon is a reflection of these mega-cap companies’ earnings power that was reconfirmed in their quarterly results. Alphabet’s results were no less impressive, but the market is putting a premium on momentum in cloud and AI. Alphabet appears to be fumbling a bit on that front.The ‘Big 7 Tech Players’ group that includes Apple (AAPL), Meta (META), Tesla (TSLA), and Nvidia (NVDA), in addition to Amazon, Microsoft, and Alphabet, is on track to achieve +49% earnings growth in 2023 Q3 on +12.2% higher revenues, as the chart below shows.

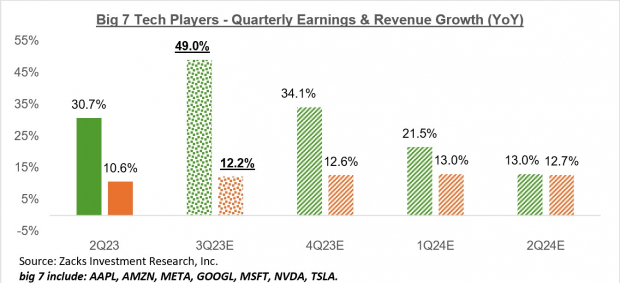

Image Source: Zacks Investment ResearchAs you can see here, the Zacks Tech sector (blue line at the bottom; down – 11.5%) has lagged the broader market (red line, second from the bottom, down -9.7%), with Microsoft (green line, down -2.7%), Amazon (orange line, down -3.9%) and Alphabet (purple line, down -8.7%) doing better.The relative outperformance of Microsoft and Amazon is a reflection of these mega-cap companies’ earnings power that was reconfirmed in their quarterly results. Alphabet’s results were no less impressive, but the market is putting a premium on momentum in cloud and AI. Alphabet appears to be fumbling a bit on that front.The ‘Big 7 Tech Players’ group that includes Apple (AAPL), Meta (META), Tesla (TSLA), and Nvidia (NVDA), in addition to Amazon, Microsoft, and Alphabet, is on track to achieve +49% earnings growth in 2023 Q3 on +12.2% higher revenues, as the chart below shows. Image Source: Zacks Investment ResearchStrong Q3 results from these mega-cap Tech players, of which only Apple and Nvidia have yet to report results at this stage, are a big reason why the aggregate Q3 earnings growth rate for the S&P 500 index has turned positive in recent days.Q3 earnings for the S&P 500 index on a blended basis, meaning combining the actual earnings that have come out with estimates for the still-to-come companies, is now expected to increase +1.2% from the same period last year, with equal growth (+1.2%) expected in revenues. If we exclude the contribution from these ‘Big 7 Tech Players’, Q3 earnings for the remainder of the index would be down -5.7% from the same period last year. The chart below shows the group’s earnings and revenue growth on an annual basis.

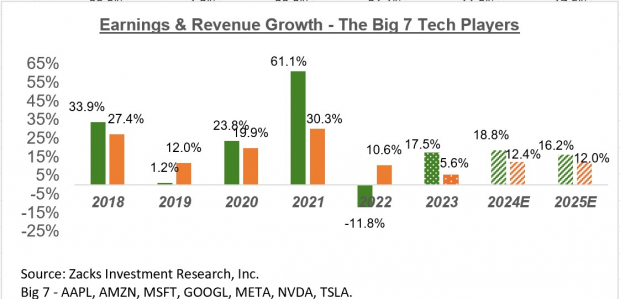

Image Source: Zacks Investment ResearchStrong Q3 results from these mega-cap Tech players, of which only Apple and Nvidia have yet to report results at this stage, are a big reason why the aggregate Q3 earnings growth rate for the S&P 500 index has turned positive in recent days.Q3 earnings for the S&P 500 index on a blended basis, meaning combining the actual earnings that have come out with estimates for the still-to-come companies, is now expected to increase +1.2% from the same period last year, with equal growth (+1.2%) expected in revenues. If we exclude the contribution from these ‘Big 7 Tech Players’, Q3 earnings for the remainder of the index would be down -5.7% from the same period last year. The chart below shows the group’s earnings and revenue growth on an annual basis. Image Source: Zacks Investment ResearchAs we all know by now, the group’s phenomenal boost in 2021 partly reflected pulled forward demand from future periods that was in the process of getting adjusted last year and this year. As you can see above, the expectation is for the group to resume ‘regular/normal’ growth next year, but a lot of that is contingent on how the macroeconomic picture unfolds.Beyond these mega-cap players, total Q3 earnings for the Technology sector as a whole are expected to be up +18.6% from the same period last year on +4% higher revenues.The chart below shows the sector’s Q3 earnings and revenue growth expectations in the context of where growth has been in the preceding two quarters and what is expected in the coming three periods.

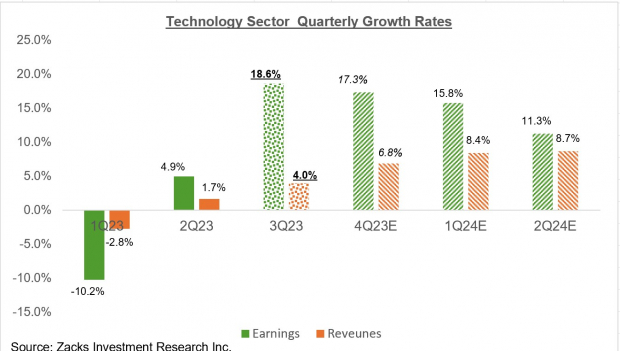

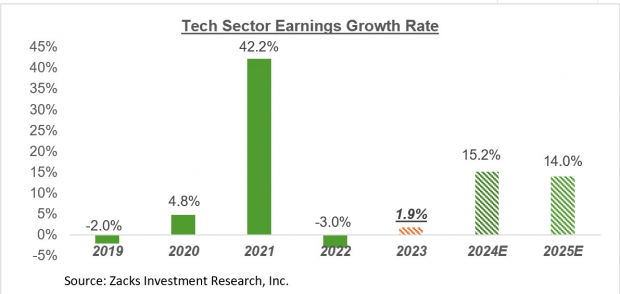

Image Source: Zacks Investment ResearchAs we all know by now, the group’s phenomenal boost in 2021 partly reflected pulled forward demand from future periods that was in the process of getting adjusted last year and this year. As you can see above, the expectation is for the group to resume ‘regular/normal’ growth next year, but a lot of that is contingent on how the macroeconomic picture unfolds.Beyond these mega-cap players, total Q3 earnings for the Technology sector as a whole are expected to be up +18.6% from the same period last year on +4% higher revenues.The chart below shows the sector’s Q3 earnings and revenue growth expectations in the context of where growth has been in the preceding two quarters and what is expected in the coming three periods. Image Source: Zacks Investment ResearchAs was the case with the ‘Big 7 Tech Players’, the overall Tech sector has been dealing with the pulled forward revenues and earnings during Covid over the last many quarters. In fact, earnings growth for the Zacks Tech sector turned positive only in the preceding quarter (2023 Q2) after remaining in negative territory during the four quarters prior to that.This big-picture view of the ‘Big 7 players’ and the sector as a whole shows that the worst of the growth challenge is shifting into the rearview mirror.You can see this clearly in the chart below.

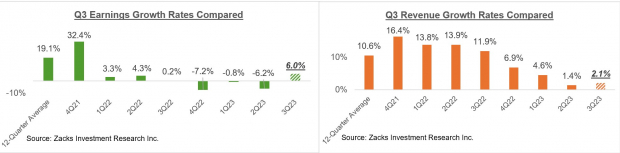

Image Source: Zacks Investment ResearchAs was the case with the ‘Big 7 Tech Players’, the overall Tech sector has been dealing with the pulled forward revenues and earnings during Covid over the last many quarters. In fact, earnings growth for the Zacks Tech sector turned positive only in the preceding quarter (2023 Q2) after remaining in negative territory during the four quarters prior to that.This big-picture view of the ‘Big 7 players’ and the sector as a whole shows that the worst of the growth challenge is shifting into the rearview mirror.You can see this clearly in the chart below. Image Source: Zacks Investment ResearchThe Q3 Earnings Season ScorecardIncluding all the earnings reports through Friday, October 27th, we now have Q3 results from 246 S&P 500 members, or 49.2% of the index’s total membership. Total Q3 earnings for these companies are up +6% from the same period last year on +2.1% higher revenues, with 79.3% beating EPS estimates and 64.2% beating revenue estimates.We have another super busy reporting docket this week with more than 1100 companies reporting Q3 results, including 159 S&P 500 members. In addition to the aforementioned Apple, which reports after the market’s close on Thursday, we have many other notable companies reporting results this week, including Airbnb (ABNB), Shopify (SHOP), Qualcomm (QCOM), and others.The comparison charts below put the Q3 earnings and revenue growth rates at this very stage in a historical context.

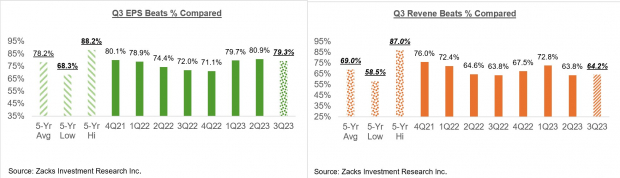

Image Source: Zacks Investment ResearchThe Q3 Earnings Season ScorecardIncluding all the earnings reports through Friday, October 27th, we now have Q3 results from 246 S&P 500 members, or 49.2% of the index’s total membership. Total Q3 earnings for these companies are up +6% from the same period last year on +2.1% higher revenues, with 79.3% beating EPS estimates and 64.2% beating revenue estimates.We have another super busy reporting docket this week with more than 1100 companies reporting Q3 results, including 159 S&P 500 members. In addition to the aforementioned Apple, which reports after the market’s close on Thursday, we have many other notable companies reporting results this week, including Airbnb (ABNB), Shopify (SHOP), Qualcomm (QCOM), and others.The comparison charts below put the Q3 earnings and revenue growth rates at this very stage in a historical context. Image Source: Zacks Investment ResearchThe comparison charts below put the Q3 EPS and revenue beats percentages in a historical context.

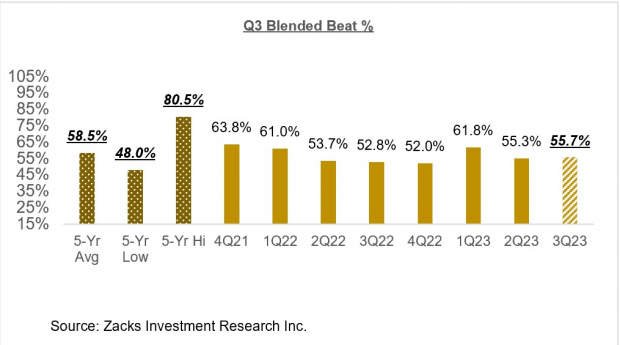

Image Source: Zacks Investment ResearchThe comparison charts below put the Q3 EPS and revenue beats percentages in a historical context. Image Source: Zacks Investment ResearchAs you can see here, companies are comfortably beating consensus EPS estimates but coming up a bit short on the revenue beats percentages. This becomes clearer when we look at the ‘blended’ beats percentage for Q3, which shows the proportion of these 246 index members that have beaten both EPS and revenue estimates.

Image Source: Zacks Investment ResearchAs you can see here, companies are comfortably beating consensus EPS estimates but coming up a bit short on the revenue beats percentages. This becomes clearer when we look at the ‘blended’ beats percentage for Q3, which shows the proportion of these 246 index members that have beaten both EPS and revenue estimates. Image Source: Zacks Investment ResearchThe Earnings Big PictureLooking at 2023 Q3 as a whole, the expectation currently is of S&P 500 earnings growing by +1.2% from the same period last year on +1.2% higher revenues. This would follow the -7.1% decline on +1.1% higher revenues in 2023 Q2. Please note that earnings growth has turned positive for the first time after staying in negative territory for three back-to-back quarters.The chart below highlights the year-over-year Q3 earnings and revenue growth in the context of where growth has been in recent quarters and what is expected in the next few periods.

Image Source: Zacks Investment ResearchThe Earnings Big PictureLooking at 2023 Q3 as a whole, the expectation currently is of S&P 500 earnings growing by +1.2% from the same period last year on +1.2% higher revenues. This would follow the -7.1% decline on +1.1% higher revenues in 2023 Q2. Please note that earnings growth has turned positive for the first time after staying in negative territory for three back-to-back quarters.The chart below highlights the year-over-year Q3 earnings and revenue growth in the context of where growth has been in recent quarters and what is expected in the next few periods. Image Source: Zacks Investment ResearchThe earnings growth picture for the quarter improves further on an ex-Energy basis (+6.6% vs. +1.2%).The chart below shows the earnings and revenue growth picture on an annual basis.

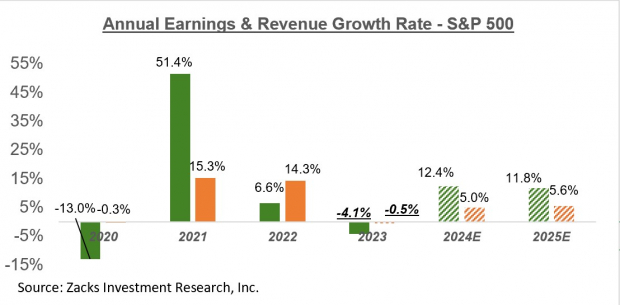

Image Source: Zacks Investment ResearchThe earnings growth picture for the quarter improves further on an ex-Energy basis (+6.6% vs. +1.2%).The chart below shows the earnings and revenue growth picture on an annual basis. Image Source: Zacks Investment ResearchLook at current expectations for next year and the year after to understand the disconnect between the reality of current bottom-up aggregate earnings estimates and the seemingly never-ending worries about an impending economic downturn. That said, most economic analysts have been steadily lowering their recessionary odds in recent months.More By This Author:How To Make The Most Of Today’s Market

Image Source: Zacks Investment ResearchLook at current expectations for next year and the year after to understand the disconnect between the reality of current bottom-up aggregate earnings estimates and the seemingly never-ending worries about an impending economic downturn. That said, most economic analysts have been steadily lowering their recessionary odds in recent months.More By This Author:How To Make The Most Of Today’s Market

Q3 Earnings Season Scorecard – Earnings Growth Turns Positive

Previewing Big Tech Earnings: What Can Investors Expect?

Leave A Comment