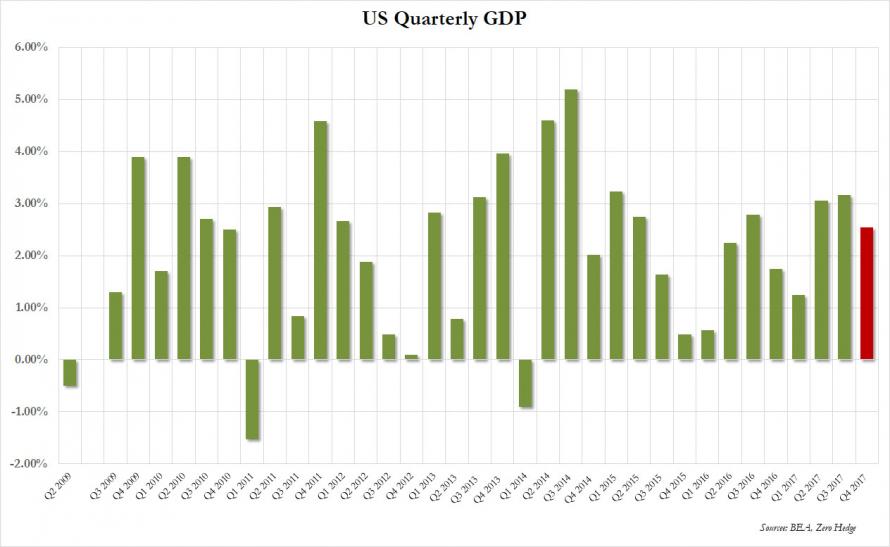

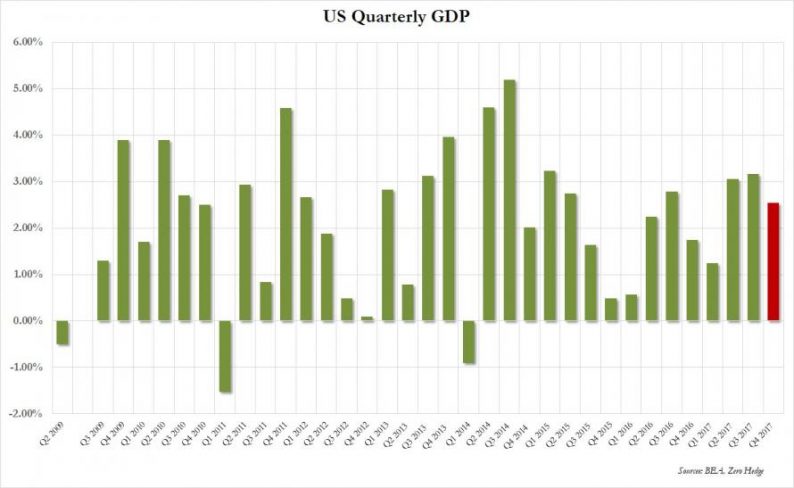

The consensus expected a 3.0% GDP print, with whisper numbers well above that and some expecting a print as high as 5%. However it was not meant to be, and as the BEA reported moments ago, the first estimate of Q4 GDP came in at 2.6%, missing expectations and below last quarter’s 3.2% GDP print, and the lowest since the first quarter of 2017, largely as a result of a surging trade deficit in the fourth quarter.

What happened?

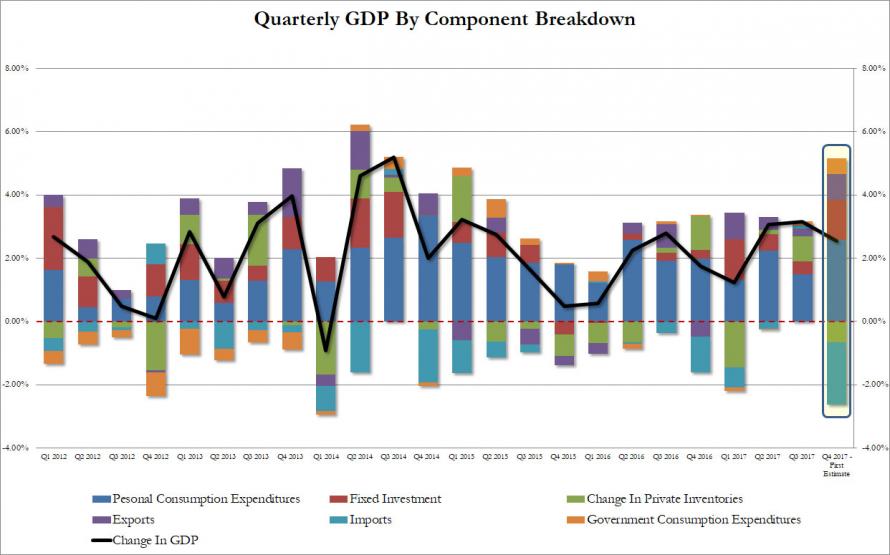

First the good news: Personal consumption rose 3.8% in 4Q after rising 2.2% the prior quarter. Final sales to private domestic purchasers q/q rose 4.6% in 4Q after rising 2.2% prior quarter; largest rise since Q3 2014. Spending contributed 2.58% to the bottom-line GDP print, the highest quarter since Q4 2014, however as we discussed previously, much of it was the result of a surge in credit card-funded spending while the personal savings rate dropped to levels last seen during the financial crisis.

Some more good news: nonresidential fixed investment – or spending on equipment, structures and intellectual property – rose 6.8% in 4Q after rising 4.7% the prior quarter. It contributed 0.84% to the annualized Q4 GDP’s bottom line.

However, both of these items were offset by a bigger than expected inventory destocking, as Inventories subtracted -0.67% from the final GDP number, the biggest drop since Q1.

But most notable was the sharp drop in GDP as a result of surging imports which subtracted -1.96% from the final GDP number. This was the biggest hit from imports to GDP going back all the way to Q3 2010. Net of exports, trade resulted in a -1.14% drag on GDP. Needless to say, for a president who is focused on boosting exports and reducing the US trade deficit, this number will only provoke more speculation about boosting US exports and thus, the possibility of a trade war.

All of the above broken down visually by component:

Some other observations: real disposable personal income—personal income adjusted for taxes and inflation —increased 1.1% in the fourth quarter after increasing 0.5% in the third quarter. Personal saving as a percentage of disposable personal income was 2.6% in the fourth quarter, compared with 3.3% in Q3,

Leave A Comment