While the Saudi-led campaign to starve Qatar’s citizens may end up short of the target, with both Turkey and Iran volunteering to provide needed staples to the isolated Gulf nation while local entrepreneurs have started a cow paradropping campaign to offset the decline in milk imports, a more pressing problem has emerged: Qatar’s financial system is running out of dollars. As Bloomberg reports, several Qatari banks have boosted interest rates on dollar deposits to shore up liquidity as the Saudi-led campaign to isolate the gas-rich Arab state intensifies.

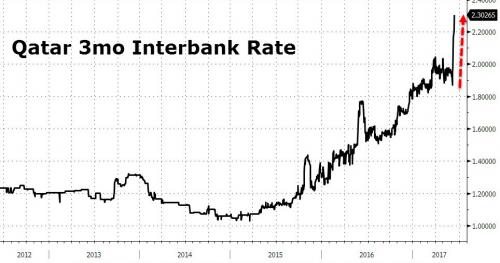

To boost their hard currency reserves, Qatar banks are now offering a premium of as much as 100 basis points over LIBOR to attract dollars from regional banks, some 80 bps higher compared to the rate they offered prior to last week’s crisis. A similar picture is visible on the 3-Month QIBOR, or Qatar Interbank Rate, which has surged to 2.3% as of Tuesday.

According to the central bank, at the end of April, Qatar’s banks held 21.4% of their customer deposits in foreign currency. Non-resident deposits made up 24% of the overall deposits of 781 billion riyals ($213 billion). A separate estimate from SICO Bahrain, Qatari banks have around 60 billion riyals ($16.5 billion) in funding in the form of customer and interbank deposits from other Gulf states. Most of this could eventually be withdrawn if the crisis continues.

Adding to concerns of a monetary blockade, Bloomberg also reports that some banks in neighboring countries have been cutting their exposure to Qatar amid concerns of a widening of the blockade.

In a Tuesday report, Capital Economics’ Jason Tuvey wrote that while banks are unlikely “to be thrust into a crisis,” borrowing costs “look set to rise and banks are likely to become more cautious with their lending,” “If local banks struggle to rollover their external debts, they could be forced to shrink their balance sheets and tighten credit conditions.” For now the local central bank has said that Qatar’s banking system is functioning without disruption, although market indicators suggest liquidity stress is rising. Likewise, Qatar National Bank, the biggest lender in the Middle East, said it didn’t see any “significant” rate increases since the standoff began, according to statement emailed to Bloomberg on Tuesday.

Leave A Comment