In case there are any questions about what is moving the stock market, yesterday’s rally should have cleared things up. Yes fans, expectations for the Trump Administration to effect changes to the tax code remains a primary driver of stock prices.

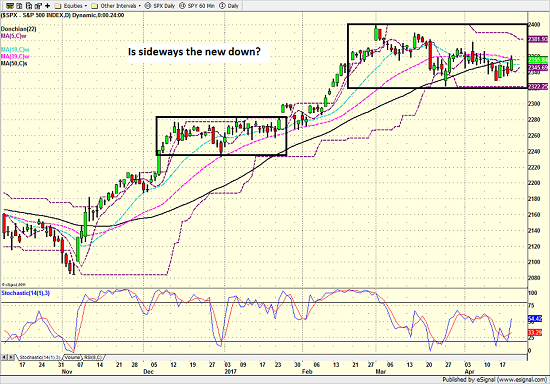

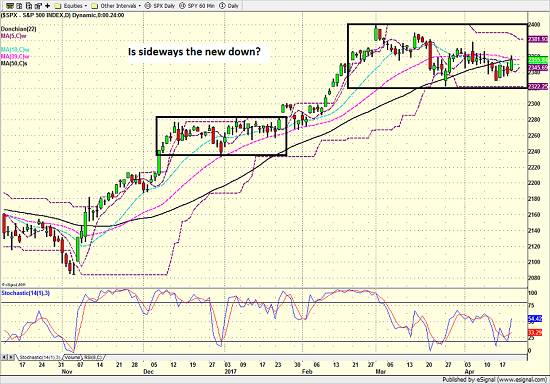

With the market teetering on the brink of an important technical breakdown (I’m of the mind that a sustained move below 2320 on the S&P 500 would embolden the bears), stocks suddenly rallied yesterday on comments from Steven Mnuchin regarding the outlook for the development of tax reform legislation.

Recall that up until just recently, Mnuchin had been saying he wanted a tax plan passed before August’s Congressional recess. But then on Monday, the Treasury Secretary told the Financial Times that getting a bill to the President’s desk before August was “not realistic at this point.”

However, yesterday, Mnuchin put hope back on the table saying that the administration is close to bringing forward “major tax reform” and that the White House will unveil a plan “very soon.” And despite the fact that the Trump administration has already missed several deadlines for developing its plan, traders took the Treasury Secretary’s words as a positive.

So, instead of the S&P chart looking sick and ready for some additional price exploration to the downside due to valuation issues, suddenly the key market index is back in the middle of its recent range.

S&P 500 – Daily

As such, the bulls argue that what we’re currently seeing isn’t the beginning of a meaningful correction, rather another sideways consolidation phase. And since sideways has become the new down during the current cyclical bull run, why would we expect anything different here?

So, with China admitting that they buy U.S. stocks every time the market pulls back 1% and hopes for tax reform still running high, the bulls just might have a point here.

Leave A Comment