Rates Remain Unchanged at 1.5%

In line with market expectations, the Reserve Bank of Australia kept their headline policy rate unchanged at record lows of 1.5% in February. The bank has now maintained this rate for six months.

One of the notable changes made to the statement was in comments aligned to the global economy. The bank judged that conditions have improved over recent months, seeing a pickup in both business and consumer confidence. The bank also noted a pickup in headline inflation rates in many economies. However, despite this, the bank still noted that “uncertainties remain” in the global outlook.

Growth & Inflation

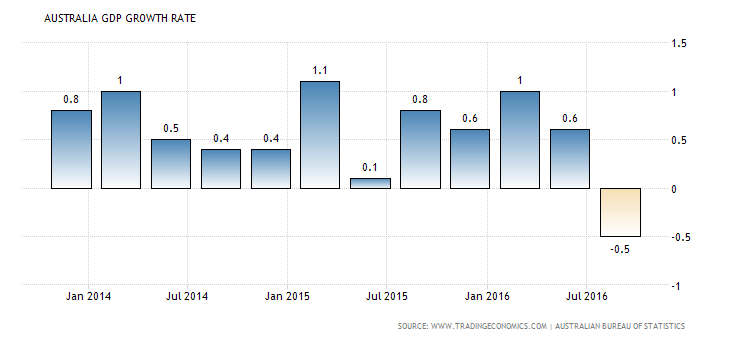

Regarding the domestic outlook, the bank’s view was mostly unchanged. The RBA still anticipated GDP growth returning to “around 3% over the next couple of years” with Q3 GDP weakness “largely reflecting temporary factors”.

Regarding inflation, the next forecasts, which will be released on Friday, are “little changed”. Headline inflation is forecast to pick up above 2% in 2017 though the rebound in underlying inflation is expected to be more gradual.

Labour Market

Regarding the labour market, the RBA noted that concerns remain as recent data continues to be mixed. The RBA is encouraged by the pickup in full-time employment but left disappointed by the increase in the unemployment rate. Overall though the bank still expected employment to increase over the coming period.

Housing

On housing, the bank’s comments were slightly more wary. The RBA reiterated their comments around house prices, noting that prices were still rising quickly due to “stronger demand by investors” and increasing leverage. The bank also continues to show concern for the impact that the large increases in apartment buildings will have on rents and on overall inflation, noting that rental growth is “the slowest for a couple of decades”.

RBA Outlook

Leave A Comment