Extreme market action continues. What began earlier this week as a rout in the Turkish Lira has quickly spread throughout all markets and now it seems to be affecting the cryptos as well.

All the major cryptos fell over the last 24 hours. Bitcoin managed to hold the most steady and Ethereum bore the brunt of the selling.

This article on Bloomberg indicates that the reason for this could be that some ICO’s are cashing out.

However, there is a need for further analysis backed up by more in-depth intel before a final conclusion can be drawn.

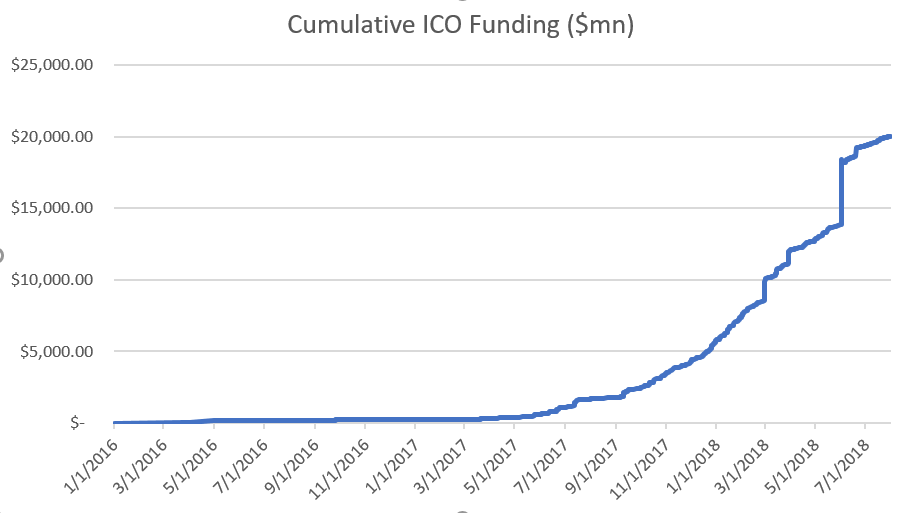

The reality is that more money is flowing into ICOs than out of them. According to data collected from CoinDesk, $14.3 Billion has been raised so far in 2018. Nearly triple the $5.7 billion raised in 2016 and 2017.

On the ground, we continue to see positive headlines that show a clearly developing crypto industry. So the fact that token prices are falling could very well be a reaction to external factors like the rapidly rising US Dollar, as we’ll explore below.

Today’s Highlights

Traditional Markets

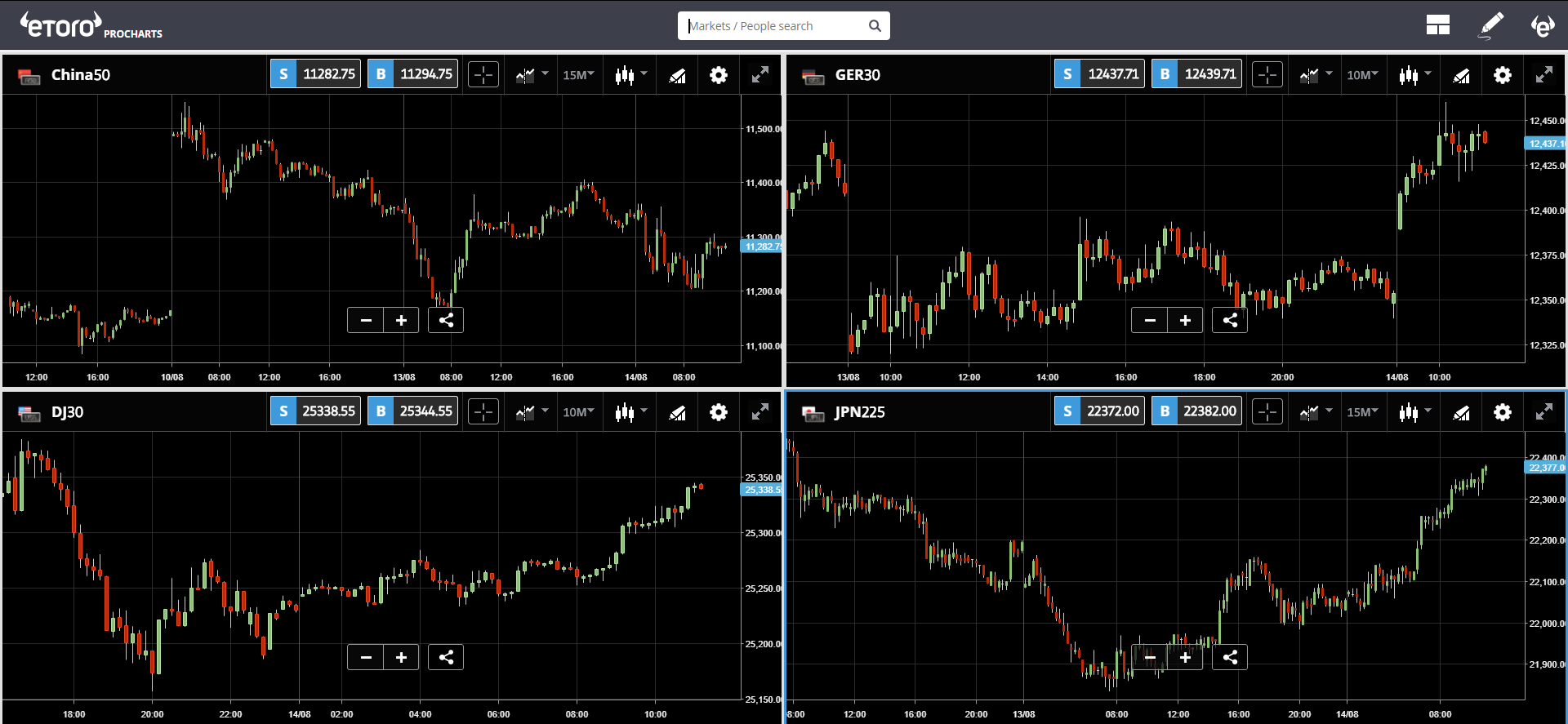

Looks like we’re getting a bit of a rebound in the markets today as the markets are mostly reversing many of yesterday’s moves.

Looking at the Lira, it seems we’ve backed slowly away from resistance at 7 Lira to the Dollar (USDTRY). We should be hearing from Turkish officials including Erdogan later today.

Stocks are up across Asia and Europe. All except China who is processing some sour economic data.

No Safety

Perhaps the strangest thing about the current market action is the lack of safe haven sentiment.

We can see clearly that volatility is rising…

Yet, gold and other precious metals continue to fall. Yesterday, Gold dropped below the important level of $1,200 for the first time since January 2017.

Leave A Comment