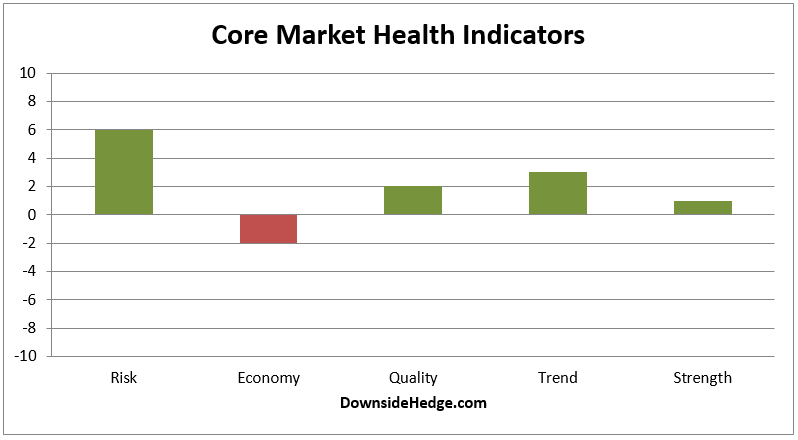

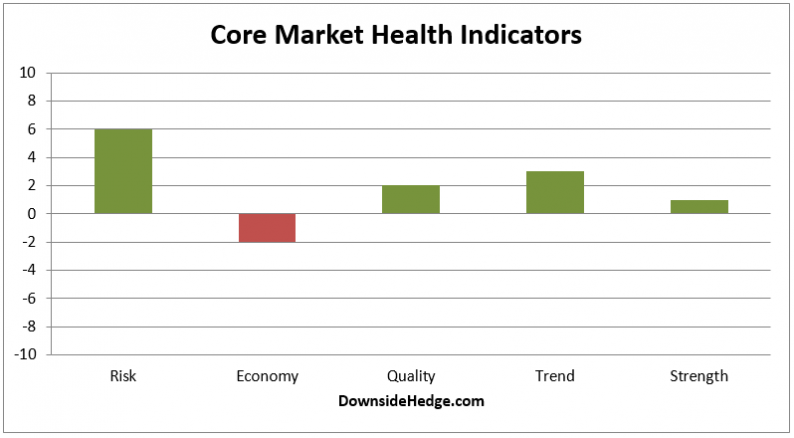

Over the past week, most of my core market health indicators rose dramatically. It appears that market internals are preparing for a move higher. As I mentioned last week, it looks like the current dip is merely rotation before a move to all time highs rather than the making of a long term top.

The measures of market quality and strength moved into positive territory this week. That changes the core portfolio allocations as follows:

Long / Short hedged portfolio: 90% long high beta stocks and 10% short the S&P 500 Index (or use the ETF with symbol SH)

Long / Cash portfolio: 80% long and 20% short

Volatility Hedged portfolio: 100% long since 11/11/2016

Leave A Comment