The data docket this week is on the light side, with the Q4 earnings season now effectively behind us and not much on the economic calendar either. The earnings season isn’t technically over yet as this week brings in results from more than 250 companies, including three S&P 500 members. But with results from 496 S&P 500 already on the books, the Q4 earnings picture is effectively carved in stone.

Most of the recent reports have been from the Retail sector and they have been no better than what we have been seeing from other sectors. This is somewhat puzzling given the widespread earlier expectation that improved household buying power, as a result of the energy savings, would show up in Retail sector results. Part of the explanation is the secular shift in spending trends from the brick-and-mortar operators to online merchants. The hyper competitive retail environment, in place for some time now, has also been a factor as are temporary seasonality factors. The bottom line is that the all-around growth challenges on display in other sectors this earnings season are very much present in the Retail sector’s earnings performance as well.

Total Q4 earnings for the Retail sector in the S&P 500 are up only +0.2% from the period last year, on +5.3% higher revenues, with 54.1% beating EPS estimates and only 35.1% coming ahead of top-line expectations. This is a weaker performance than we have seen from the same group of retailers in other recent periods, as the side-by-side comparison charts show.

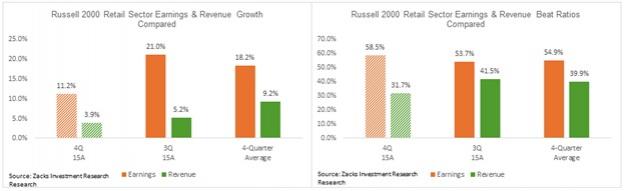

Please note that the sector’s Q4 earnings performance isn’t any better when we look at the retailers in the small-cap Russell 2000 index. The charts below compare the sector’s Q4 performance for the small-cap index.

The growth challenges beyond the Retail sector are well known by now, reflecting a slowing global economy, the strong U.S. dollar, and weakness in the oil and other commodity sectors. This isn’t a new problem, we have been discussing these headwinds the last few reporting cycles and they are very much in place in the current period as well. We will give you the final scorecard for 2015 Q4 a little later, but let’s discuss the weakening growth picture for 2016 Q1 first.

Leave A Comment