As loyal readers are already aware, I live in Houston. Normally, during the month of August, temperatures tend to compete with the surface of the sun while rain tends to be a more random occurrence. In other words, there is little difference between Houston and the Sahara Desert, generally speaking.

This year, however, is a different story as we are preparing to deal with the impact of the first major hurricane (category-3) since Bret made landfall in 1999 and Alicia in 1983. (Ike, which hit the Texas coast in 2008 was only a category-2 storm.)

It is currently estimated that we will experience between 18 and 30-inches of rain which will also likely result in the loss of power. Therefore, this week’s newsletter is going to be a little brief so I can make sure and get it out to you beforehand.

Quick Review

As noted last week:

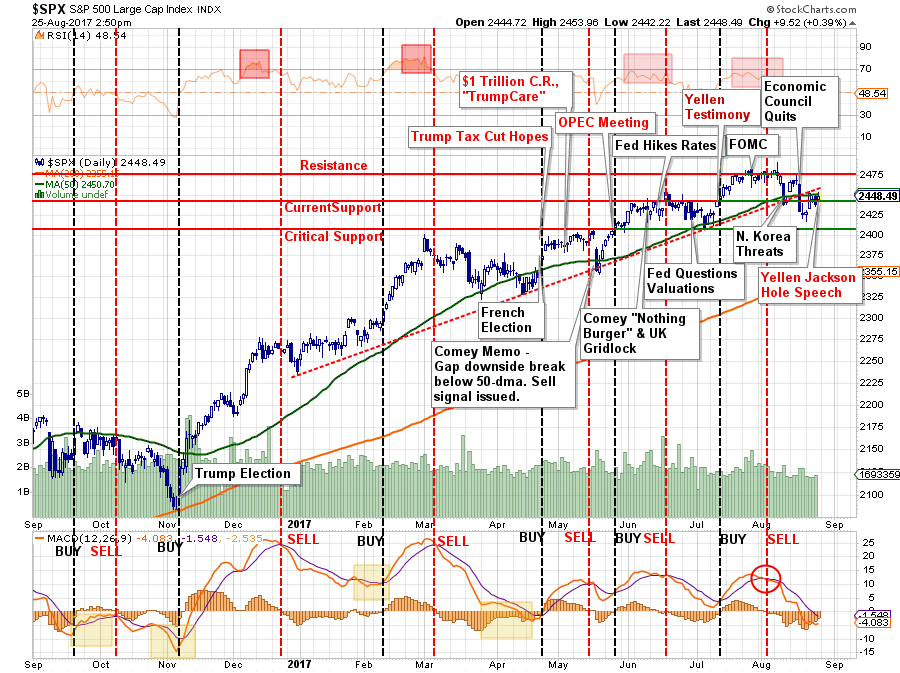

“Exactly one week after last week’s sell off, the market dumped again. This time it was the news of the complete dismemberment of President Trump’s ‘economic council’ of CEO’s along with the rumor that Gary Cohn would be exiting his position at the White House as well. While the latter turned out to be #FakeNews, the damage had already been done as market participants began to question the ability of the Administration to get its promised legislative action advanced.

Given the run up in the markets since the election, which was based on tax cuts/reform, infrastructure spending, repatriation and repeal of the Affordable Care Act, the lack of progress on that agenda has left the markets pushing higher on ‘hope’ and ‘promises.’ The disbanding of the economic council has led to some disruption of that confidence.”

For the second week in a row, the market staged a strong comeback rally which again failed at resistance, keeping further additions to equities on hold once again this week. With the market remaining on a short-term “sell signal,”we will remain patient to allow the market to regain a firmer footing within the confines of the current bullish trend.

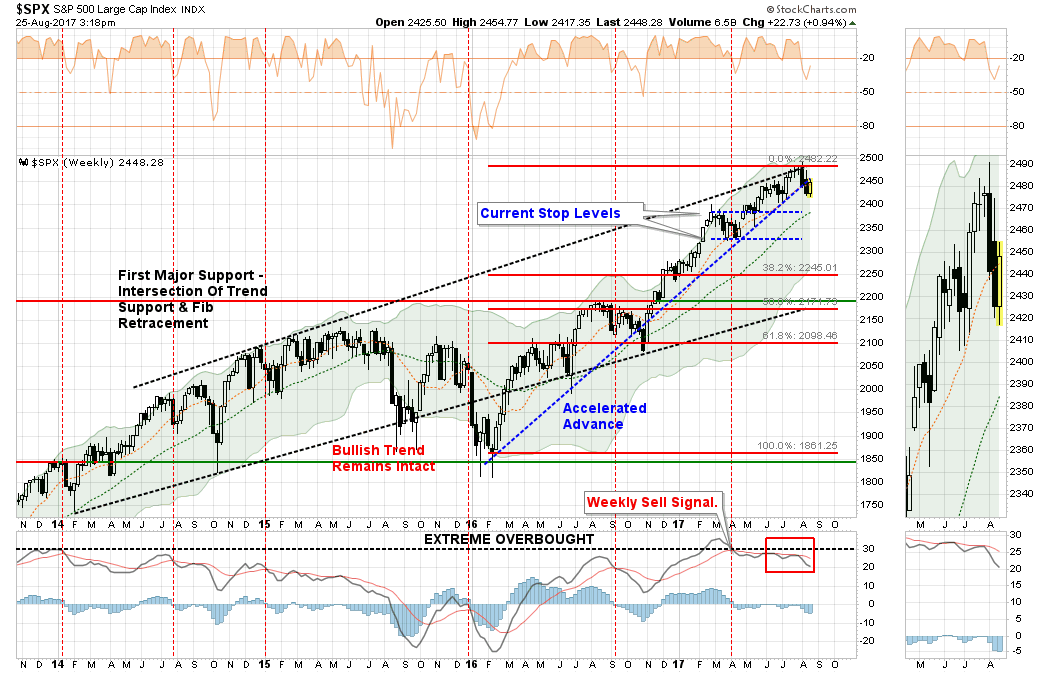

On a weekly basis, the “bullish trend” remains at risk as well. With the markets on a weekly “sell signal” at fairly high levels, it does suggest that “stock slop” could be with us for a while particularly as we head into the month of September. This potentially set investors up for a bigger correction in the weeks ahead.

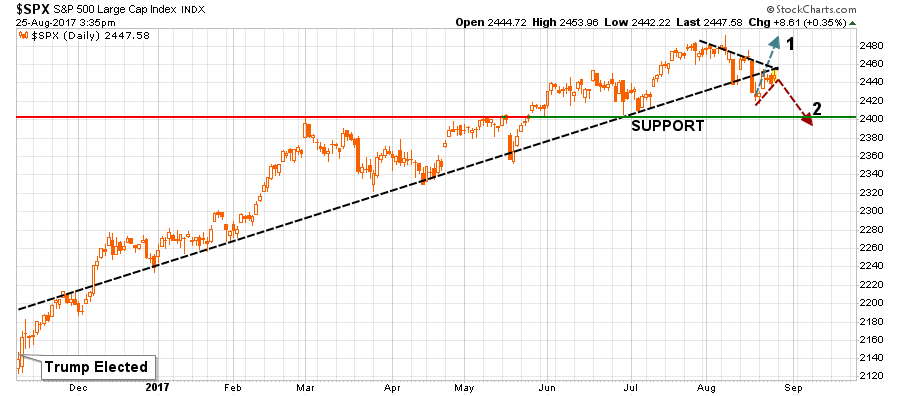

In case you missed last week’s missive, I laid out two scenarios we were watching while we “wait for confirmation the current sell-off has abated before adding additional risk exposure to portfolios.”

Scenario 1:

The market regains its footing next week and rallies strongly enough to break above the downward trending levels of previous rally attempts. Such action would confirm the bullish trend remains intact and would provide the opportunity to rebalance equity exposure to model weights accordingly.

Scenario 2:

The market rallies to the upwardly sloping “bullish trend line” that began with the election of President Trump. The rally fails at resistance and turns lower. Such a failure would confirm the current short-term bullish trend has likely concluded leading to a reduction of equity exposure, increases in cash positions and fixed income, and a reduction in overall portfolio equity risk.

Currently, it is “Scenario 2” which continues to play itself out currently.

The Case For “Scenario 2”

From an analytical viewpoint, there are several factors that continue to support “scenario 2,” as detailed above, playing out.

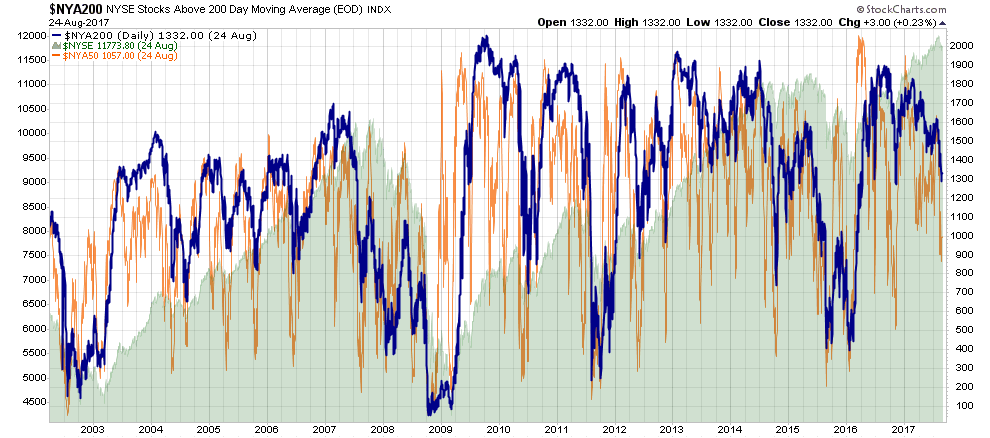

As noted the internal deterioration of the market has continued unabated over the last several weeks the number of stocks trading above their respective 50- and 200-day moving averages dropping to levels that have more normally equated to a deeper market correction.

The internal deterioration in the market shouldn’t be surprising given the large outflows from equities over the last few weeks as noted recently by Joe Ciolli:

Leave A Comment