I’ve recently argued that the success of passive investing potentially sows the seeds of its own demise. Patrick O’Shaughnessy also made a similar point recently and probably a bit more eloquently. But, to dig deeper into the push towards passive, there’s one big problem I have with virtually every one of the major robo-advisors that very few folks seem to be talking about. That is they all seem to advocate a heavily overweight position in equities, and for the most part this is skewed towards U.S. equities.

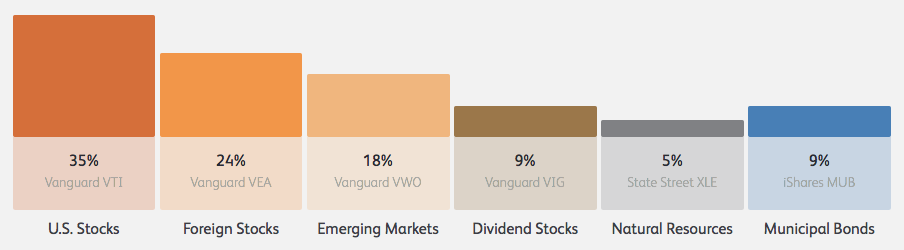

For example, below is the allocation WealthFront would put me in. It’s 91% in stocks, 49% U.S. stocks and 42% foreign, and 9% muni bonds. (This is their taxable allocation but the retirement allocation is very, very similar.)

I assume this massive equity overweight is simply based on the, “stocks for the long run,” dogma that everyone has bought into in recent years. The trouble with this is that it fails to take into account the simple fact that, in recent years and across a wide variety of time frames, bonds have outperformed stocks and with far less volatility, or what some might call, “risk.” As The Economist points out, “there was a point in 2011 when equities had lagged Treasury bonds over the previous 30 years.” 30 years!

Intrigued, I decided to run some of the numbers myself. The chart below tracks the difference in performance between Vanguard’s S&P 500 index fund versus their long-term treasury fund. It dates back to the start of 1999; that’s as far as StockCharts.com will let me go. Notice that since then, bonds have nearly doubled up on the performance of stocks and this includes some of the greatest years in stock market history! This time frame is especially compelling to me because stocks are currently valued, according to the Buffett yardstick and a few other valuable measures, just as highly today as they were back in 1999-2000.

Leave A Comment