With the BLS’s release of Q4 productivity figures, we get to check the BLS’s estimates just in time for tomorrow’s increasingly irrelevant payroll report. That much has become thoroughly apparent especially since the middle of last year as the Establishment Survey and unemployment rate only diverge with the overall breadth of economic indications. With GDP no longer corroborative, the labor reports have been in a world all their own. Far too many economists still rely upon them as their sole window for economic interpretation and these productivity numbers show further why they should not.

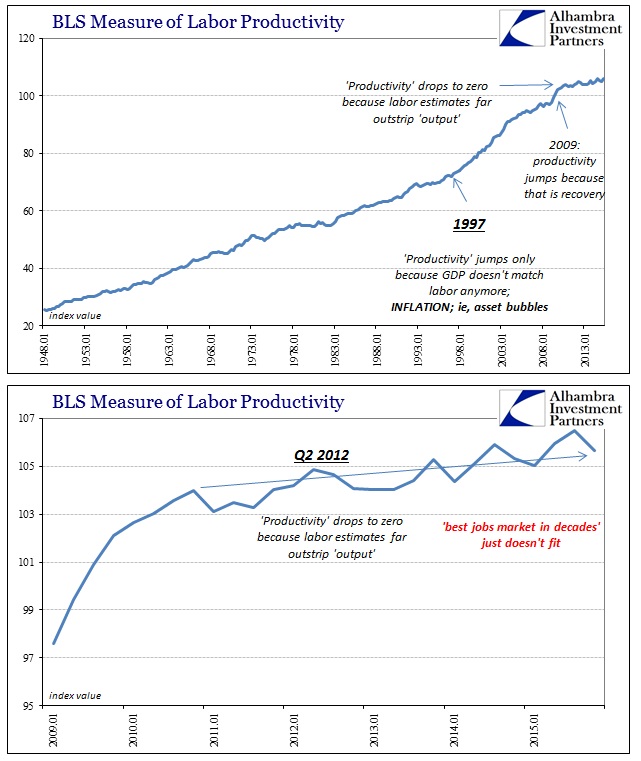

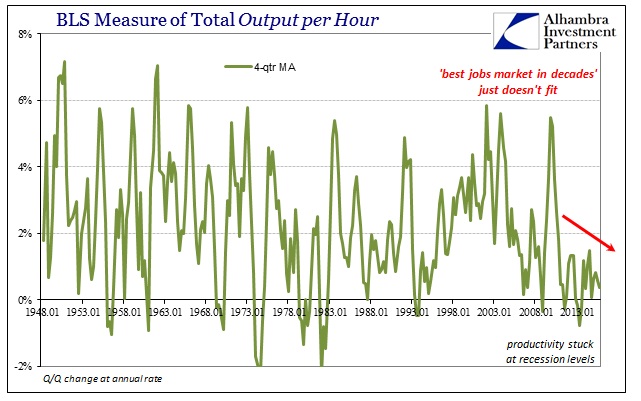

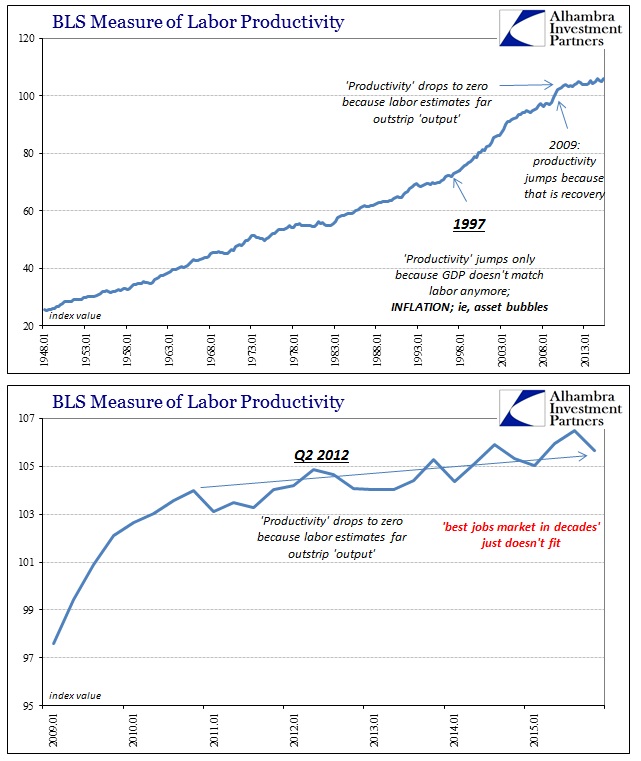

You have to understand what productivity means as both an economic concept and the statistic as it is constructed and presented. No economy will grow with low or even zero productivity; it’s plain common sense. Yet, the BLS’s numbers say that productivity growth has been zero or near it for five years. It has puzzled economists only because they take the calculations at face value. The fact that productivity is and remains so confusing already suggests that further investigation on all those accounts within the figure is warranted, and even demanded.

Any way you want to present the productivity estimates, clearly “something” is amiss starting around the beginning of 2011, flowing into and out of the 2012 slowdown. It has persisted at an alarmingly low state for years now, meaning that this is not simple statistical variation that will converge on its own to the mean. I have chosen to focus on the latter two years because that encompasses the “best jobs market in decades”, which serves really to highlight the major discrepancy here. In terms of economic common sense, why would businesses be hiring so robustly and getting so little out of their employees overall?

In the statistical sense, the BLS tells us that productivity since the start of 2011 is just slightly positive; during the “best jobs market in decades” it is even less so – essentially zero.

Leave A Comment