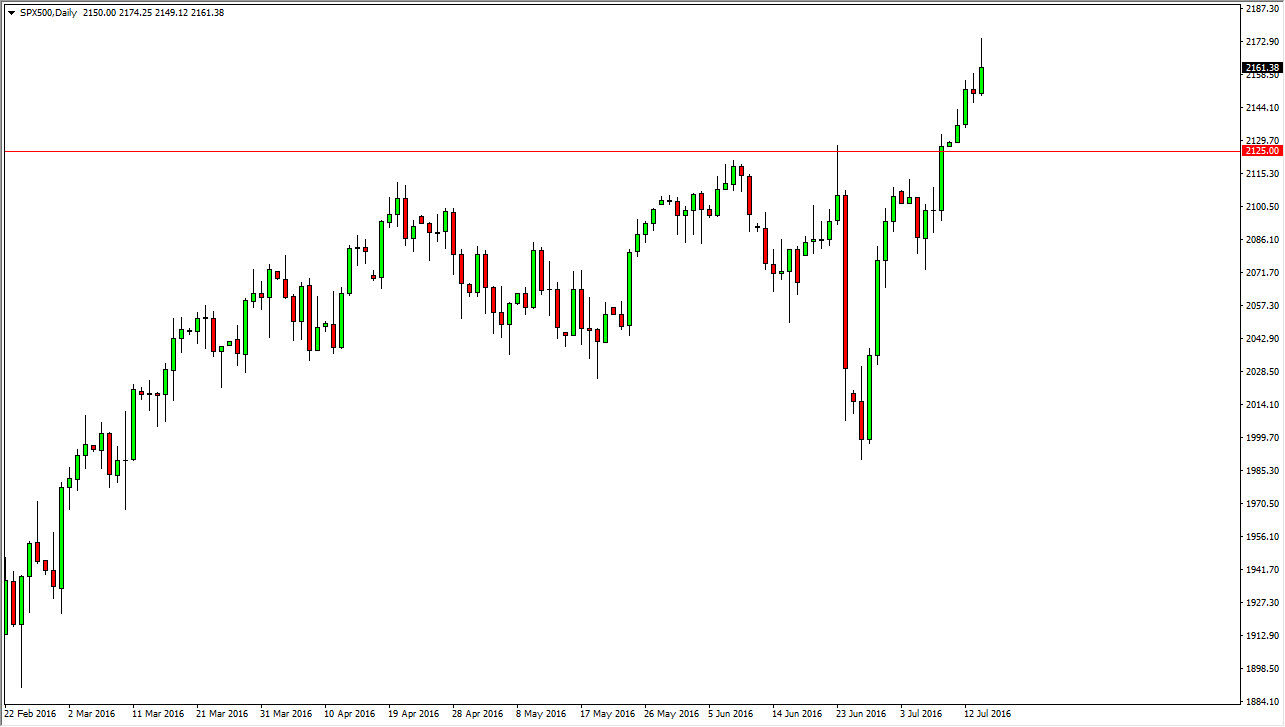

S&P 500

The S&P 500 continue higher during the day on Thursday, as we see quite a bit of bullish pressure. However, we did pullback a little bit during the latter part of the day so it could suggest a perhaps we are starting to run out of steam. At this point in time though, I feel this will only end up being a buying opportunity on the dips, as it should provide “value” in a market that is clearly broken out. Below here, the 2125 level should offer a significant amount of support as it was previously so resistive. I believe that pullbacks will be looked upon favorably by the bullish traders out there, and should be your opportunity to pick up the market “on the cheap.” Ultimately, if we break above the top of the range for the session on Thursday, that is also a buying opportunity as well, although I’d be the first person to admit that perhaps we would begin to be a bit overextended.

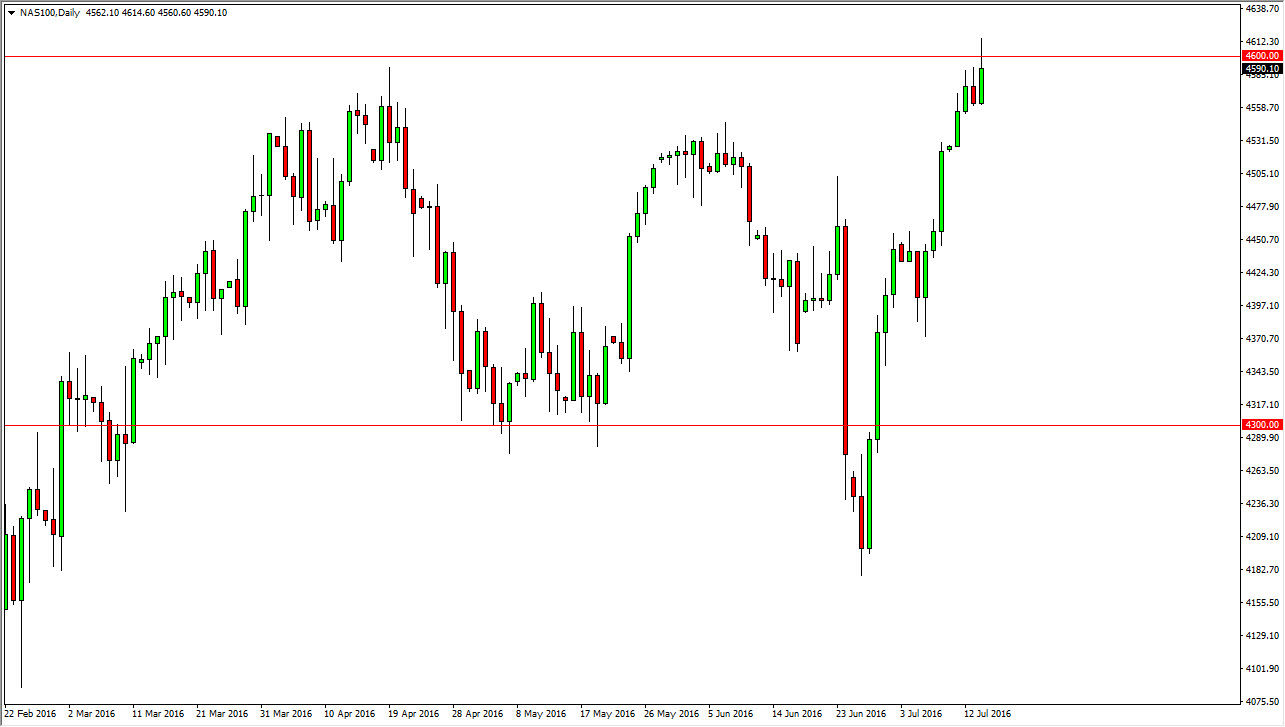

NASDAQ 100

The NASDAQ 100 broke out during the day on Thursday, but did pullback a little bit below the 4600 level. I think eventually we do continue to go higher though, because quite frankly out to the 3 major US indices that we follow, this is the only one that hasn’t broken out cleanly. It has been a bit of a laggard, but ultimately I think that it will follow the S&P 500 and the Dow Jones Industrial Average given enough time. A break above the top of the range during the Thursday session is reason enough for me to go long, and I believe the supportive candles on a pullback should also be thought of as buying opportunities as well. We are bit overextended at the moment, so it makes sense that perhaps we struggle little bit here, only to eventually show signs of massive strengthen later.

Leave A Comment