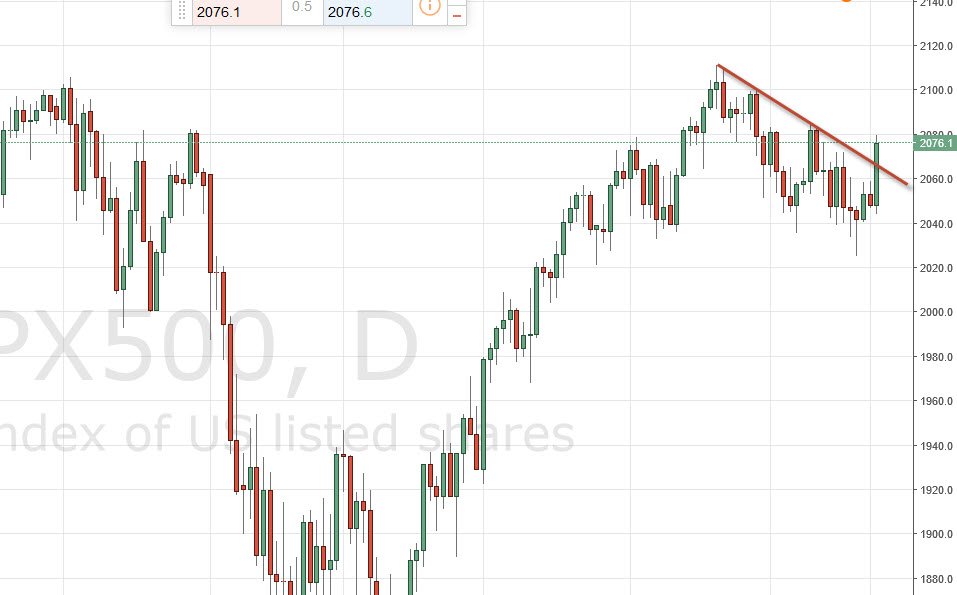

S&P 500

The S&P 500 rally during the course of the day on Tuesday, breaking above the vital 2060 handle. The Monday candle of course was a shooting star so the fact that we broke above it is a very strong sign and it now looks as if we broke above the top of a downtrend line, and as a result it’s likely that we will continue to grind higher, perhaps reaching towards the 2100 level. Pullbacks at this point in time should continue to be supported, and as a result we will more than likely continue to go higher given enough time. Ultimately, this market is trying to break out, but we need to continue to build up the momentum, so pullbacks should continue to be buying opportunities on signs of support and of course impulsive moves higher.

Nasdaq 100

The Nasdaq 100 broke higher during the course of the session on Tuesday, clearing the 4400 level. This of course is a very positive sign, and a break above the top of the candle should send this market reaching towards the 4500 level as well. Pullbacks should continue to show promise of moving higher, and supportive candles of course will be buying opportunities. I have no interest in selling this market and I believe that the 4400 level below should be a bit of a floor at this moment in time.

Quite frankly, I don’t have any interest in selling this market at all, least at this point in time in would need to see a longer-term signal to even act. There is a massive amount of noise below the 4280 level and as a result we should continue to see buyers enter this market again and again. With this, I really like going long of the Nasdaq 100, and it could very well outperform the rest of the US indices.

Leave A Comment