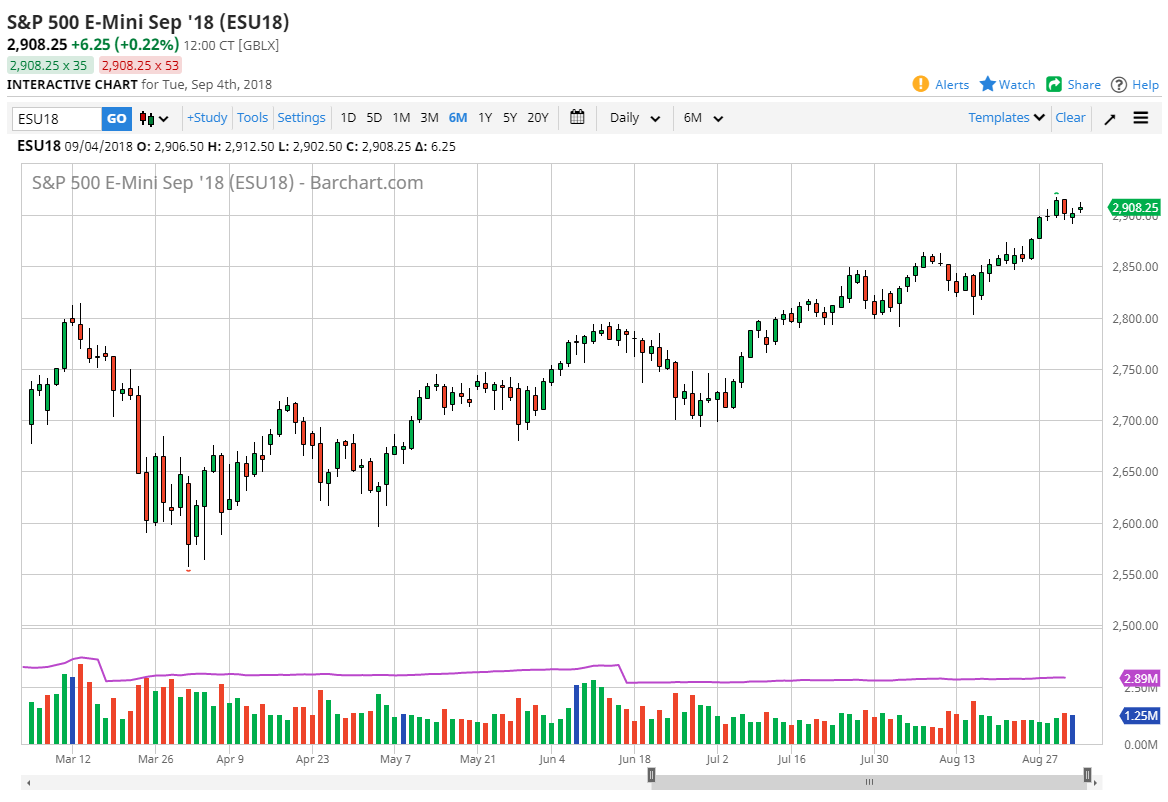

S&P 500

The S&P 500 futures markets rallied slightly during all electronic trading as the Americans were away for Labor Day. Overall, the markets are bullish, but we are a bit extended as well. I think that the 2900 level will continue to be a bit of a fulcrum for the price, as it is a large, round, psychologically significant number. This is the market that should continue to go higher over the longer-term but be aware of the fact that you are probably better served looking at the short-term pullbacks as buying opportunities. These buying opportunity should be taken in small positions, as the volatility certainly is a major problem. I think that the “floor” in the market is close to the 2850 handle though, so we could pull back significantly before the value hunters come back. If we break to a fresh, new high, then, of course, I think we go looking towards the 2950 level.

Nasdaq 100

The Nasdaq 100 futures market note also rallied during the day, as the underlying instrument was close. The market certainly looks bullish though, and the Nasdaq 100 has led the way out of most of the indices that I follow. I think that short-term pullbacks are buying opportunities over here as well, and I believe that the 7500 level underneath is massive support. The alternate scenario, of course, is that we can break above the 7700 level, and if we do then I think the market could go looking towards the 8000 level over the longer-term. The 7500 level underneath is essentially what I considered to be the “floor” in the uptrend. It’s a nice grind higher, and I think that will continue to be the case going forward.

Leave A Comment